(Three Differences, Classify Deferred Taxes) At December 31, 2010, Cascade Company had a net deferred tax liability...

Question:

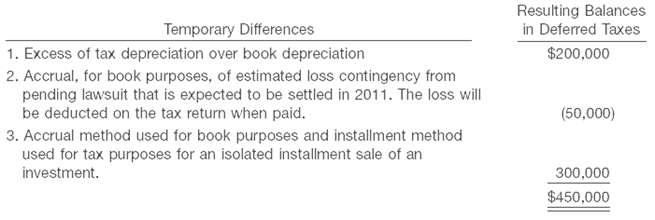

(Three Differences, Classify Deferred Taxes) At December 31, 2010, Cascade Company had a net deferred tax liability of $450,000. An explanation of the items that compose this balance is as follows. Indicate the manner in which deferred taxes should be presented on Cascade Company's December 31, 2010, balance sheet.

Depreciation is an important concept in accounting. By definition, depreciation is the wear and tear in the value of a noncurrent asset over its useful life. In simple words, depreciation is the cost of operating a noncurrent asset producing...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

Question Posted: