Timberland Company is trying to decide on an allocation base to use to assign manufacturing overhead to

Question:

Timberland Company is trying to decide on an allocation base to use to assign manufacturing overhead to jobs. The company has always used direct labor hours to assign manufacturing over-head to products, but it is trying to decide whether it should use a different allocation base such as direct labor dollars or machine hours.

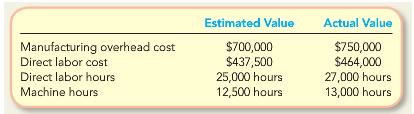

Actual and estimated results for manufacturing overhead, direct labor cost, direct labor hours, and machine hours for the most recent fiscal year are summarized here:

Required:

1. Based on the company’s current allocation base (direct labor hours), compute the following:

a. Predetermined overhead rate.

b. Applied manufacturing overhead.

c. Over- or underapplied manufacturing overhead.

2. If the company had used direct labor dollars (instead of direct labor hours) as its allocation base, compute the following:

a. Predetermined overhead rate.

b. Applied manufacturing overhead.

c. Over- or underapplied manufacturing overhead.

3. If the company had used machine hours (instead of direct labor hours) as its allocation base, compute the following:

a. Predetermined overhead rate.

b. Applied manufacturing overhead.

c. Over- or underapplied manufacturing overhead

4. Based on last year’s data alone, which allocation base would have provided the most accurate measure for applying manufacturing overhead costs to production?

5. How does a company decide on an allocation base to use in applying manufacturing over- head? What factors should be considered?

Step by Step Answer:

Managerial Accounting

ISBN: 978-0078025518

2nd edition

Authors: Stacey Whitecotton, Robert Libby, Fred Phillips