Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the U.S. dollar

Question:

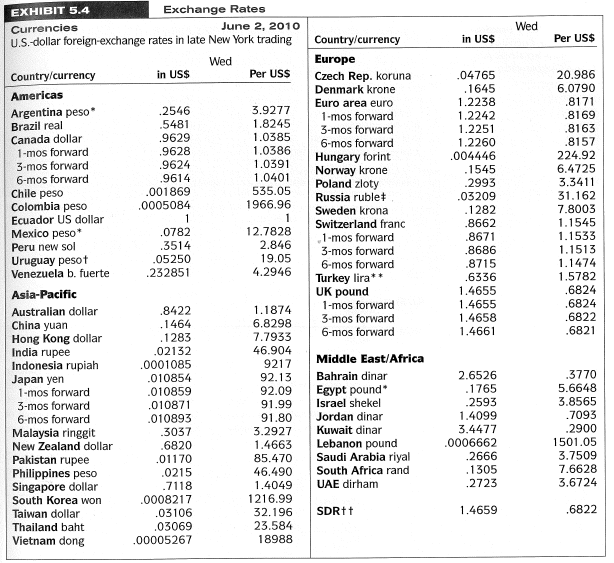

Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the U.S. dollar versus the British pound using European term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?

Exhibit 5.4

Transcribed Image Text:

Exchange Rates EXHIBIT 5.4 Currencies U.S.-dollar foreign-exchange rates in late New York trading June 2, 2010 Wed Per US$ Country/currency in US$ Europe Wed Per USS 20.986 in US$ Czech Rep. koruna Denmark krone Country/currency .04765 .1645 1.2238 6.0790 .8171 Americas Euro area euro Argentina peso* Brazil real Canada dollar 1-mos forward 3-mos forward 6-mos forward Chile peso Colombia peso Ecuador US dollar Mexico peso* .2546 .5481 .9629 3.9277 .8169 .8163 .8157 1.2242 1-mos forward 3-mos forward 1.8245 1.2251 1.0385 1.2260 .004446 6-mos forward 1.0386 .9628 Hungary forint Norway krone Poland zloty Russia ruble Sweden krona 224.92 .9624 .9614 .001869 1.0391 .1545 .2993 6.4725 3.3411 1.0401 535.05 1966.96 31.162 .03209 .0005084 7.8003 1.1545 .1282 Switzerland franc ,1-mos forward 3-mos forward .8662 .0782 .3514 .05250 12.7828 2.846 1.1533 1.1513 1.1474 .8671 Peru new sol .8686 .8715 .6336 1.4655 Uruguay pesot Venezuela b. fuerte 19.05 4.2946 6-mos forward .232851 Turkey lira** UK pound 1-mos forward 3-mos forward 6-mos forward 1.5782 .6824 .6824 .6822 Asia-Pacific 1.4655 1.4658 1.1874 6.8298 7.7933 .8422 Australian dollar China yuan Hong Kong dollar India rupee .1464 .6821 1.4661 .1283 .02132 46.904 9217 Middle East/Africa .0001085 Indonesia rupiah Japan yen 1-mos forward 3-mos forward 6-mos forward .3770 2.6526 .1765 Bahrain dinar 92.13 .010854 5.6648 3.8565 Egypt pound* Israel shekel 92.09 .010859 .2593 91.99 .010871 .7093 .2900 1501.05 1.4099 Jordan dinar Kuwait dinar .010893 .3037 .6820 .01170 91.80 3.4477 3.2927 Malaysia ringgit New Zealand dollar Pakistan rupee Philippines peso Singapore dollar South Korea won Taiwan dollar .0006662 .2666 Lebanon pound Saudi Arabia riyal South Africa rand UAE dirham 1.4663 3.7509 85.470 7.6628 3.6724 .1305 46.490 .0215 .2723 .7118 .0008217 1.4049 1216.99 1.4659 .6822 SDRTT 32.196 .03106 .03069 .00005267 23.584 Thailand baht Vietnam dong 18988

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (20 reviews)

The formula we want to use is f N F N SS x 360N f 1 6824 68246824 x 36030 0000 f 3 ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

International Financial Management

ISBN: 978-0078034657

6th Edition

Authors: Cheol S. Eun, Bruce G.Resnick

Question Posted:

Students also viewed these Finance questions

-

What is one interpretation of a high P/E ratio?

-

What is the interpretation of the direct-labor rate variance? What are some possible causes?

-

What is the interpretation of the direct-labor efficiency variance?

-

an unadjusted trial balance as of December 31, 2020. (6points)Account TitleBalanceDebitCreditCash36,910Accounts Receivable5,750Office Supplies1,400 PART1: The following transactions occurred for...

-

Presented here are selected data from the 10-K reports of four companies for their 2015 fiscal years. The four companies, in alphabetical order, are: Caterpillar, Inc., a company that manufactures...

-

How do budgets partition decision rights within a firm?

-

Describe the steps one must take to become a great leader. (p. 56)

-

Chaffee Company is considering an investment that will return a lump sum of $750,000 six years from now. What amount should Chaffee Company pay for this investment to earn an 8% return?

-

Hold up Bank has an issue of preferred stock with a $6 stated dividend that just sold for $50 per share. What is the banks cost of preferred stock?

-

An importer has a payment of 8 million due in 90 days. a. If the 90 day pound forward rate is $1.4201, what is the hedged cost of making that payment? b. If the spot rate expected in 90 days is...

-

Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the Canadian dollar versus the U.S. dollar using American term quotations. For simplicity, assume each...

-

A bank is quoting the following exchange rates against the dollar for the Swiss franc and the Australian dollar: SFr/$ = 1.5960-70 A$/$ = 1.7225-35 An Australian firm asks the bank for an A$/SFr...

-

Explain the various types of pivots an entrepreneur may need to consider for a business model.

-

What is the logical ending point of a sequential game that starts at position (2,8) with player 1 moving first? Show your work. Player 1 Strategy B Strategy A Strategy A Player 2 Strategy B (3,4)...

-

Problem A-6 Income and Retained Earnings Statements Peanut Corporation is a private corporation using ASPE. At December 31, 2017, an analysis of the accounts and discussions with company officials...

-

8.5 Area Between Curves (dy) Calculus-Calculator Allowed Mastery Check #2 Name: Date: Period: For 1-2, find the area of the region bounded by the following curves. Show the integral set up with...

-

Your company has a travel policy that reimburses employees for the "ordinary and necessary" costs of business travel. Employees often mix a business trip with pleasure by either extending the time at...

-

Simulation A: 1 Diameter 600 mm 2 Focal Length 1800 mm 3 F/D Ratio 3 4 Eyepieces 30 m 5 Barlow? N 6 Celestial Sights M42 - M31 - M51 Simulation B: 1 Diameter 150 mm 2 Focal Length 1800 mm 3 F/D Ratio...

-

How has the evolution of computer technology enhanced the feasibility of using the algebraic method of service department cost allocation? LO1

-

Find the intercepts and then graph the line. (a) 2x - 3y = 6 (b) 10 - 5x = 2y

-

Find the molarity of a 7.85% aqueous ammonia solution that has a density of 0.965 g/mL.

-

Explain and compare forward versus backward internalization.

-

What could be the reason for the negative synergistic gains for British acquisitions of U.S. firms?

-

What are the advantages and disadvantages of FDI as compared to a licensing agreement with a foreign partner?

-

What is Apple Companys strategy for success in the marketplace? Does the company rely primarily on customer intimacy, operational excellence, or product leadership? What evidence supports your...

-

Exercise 1 1 - 7 ( Algo ) Net present value and unequal cash flows LO P 3 Gomez is considering a $ 2 1 0 , 0 0 0 investment with the following net cash flows. Gomez requires a 1 2 % return on its...

-

a Campbell Inc. produces and sells outdoor equipment. On July 1, 2011. Campbell issued $40,000,000 a 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving Cash of 548,601,480....

Study smarter with the SolutionInn App