You have been asked for your advice in selecting a portfolio of assets and have been supplied

Question:

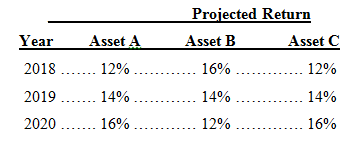

You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data.

You have been told that you can create two portfolios-one consisting of assets A and B and the other consisting of assets A and C-by investing equal proportions (50%) in each of the two component assets.

a. What is the average return, r̅, for each asset over the three-year period?

b. What is the standard deviation, s, for each asset's return?

c. What is the average return, r̅p, for each of the portfolios?

d. How would you characterize the correlations of returns of the two assets in each of the portfolios identified in part c?

e. What is the standard deviation of expected returns, sp, for each portfolio?

f. Which portfolio do you recommend? Why?

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780134083308

13th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk