A corporation has $7 million in equity. During the tax year it takes in $4 million in

Question:

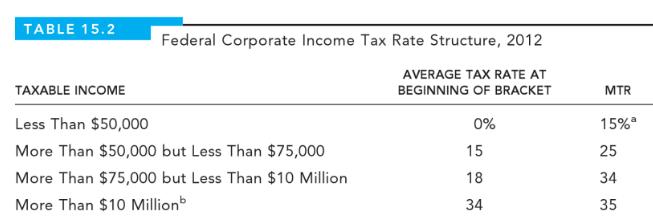

A corporation has $7 million in equity. During the tax year it takes in $4 million in receipts and earns $2 million in capital gains from sale of a subsidiary. It incurs labor costs of $1 million, interest costs of $250,000, material costs of $500,000, and pays rent for structures of $250,000. Calculate the corporation's total accounting profit and, assuming that the profit is fully taxable, calculate its tax liability using the tax rates in Table 15.2. Calculate the ATR of the corporation as a percentage of its economic profit, assuming that the opportunity cost of capital is 8 percent.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Public Finance A Contemporary Application of Theory to Policy

ISBN: 978-1285173955

11th edition

Authors: David N Hyman

Question Posted: