A firm with a 14% WACC is evaluating two projects for this years capital budget. After-tax cash

Question:

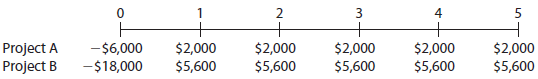

A firm with a 14% WACC is evaluating two projects for this year’s capital budget. After-tax cash flows, including depreciation, are as follows:

a. Calculate NPV, IRR, MIRR, payback, and discounted payback for each project.

b. Assuming the projects are independent, which one(s) would you recommend?

c. If the projects are mutually exclusive, which would you recommend?

d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR?

2 Project A Project B $2,000 $2,000 $5,600 $2,000 $5,600 -$6,000 -$18,000 $2,000 $5,600 $2,000 $5,600 $5,600

Step by Step Answer:

a Project A CF 0 6000 CF 15 2000 IYR 14 Solve for NPV A 86616 IRR A 1986 MIRR calculation Using a fi...View the full answer

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

A firm with 14 percent WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: A) Calculate NPV, IRR, MIRR, payback, and...

-

The Sanders Electric Company is evaluating two projects for possible inclusion in the firms capital budget. Project M will require a $37,000 investment while project Os investment will be $46,000....

-

The management of Gawain plc is evaluating two projects whose returns depend on the future state of the economy as shown below: Probability __________ IRRA(%) ___________ IRRB(%)...

-

Problem Set 3 b. zero. c. negative. d. smaller than the variance. 22. Growth factors for the population of Atlanta in the past five years have been 1, 2, 3, 4, and 5. The geometric mean is a. 15. b....

-

Which financial statement presents information related to changes in retained earnings and share repurchase?

-

You have recently been hired by Piepkorn Manufacturing to work in the newly established treasury department. Piepkorn Manufacturing is a small company that produces cardboard boxes in a variety of...

-

Do you need to be good at maths? LO.1

-

The Bucks Grande exhibition baseball team plays 50 weeks each year and uses an average of 350 baseballs per week. The team orders baseballs from Coopers-Town, Inc., a ball manufacturer noted for...

-

5. Casper Hospital bases its budgets on patient-visits. The hospital's static planning budget for May appears below: The budgeted number of patient-visits 5,100 $ 13,770 15,300 Budgeted variable...

-

As an investment advisor for MREAF (Momentum Real Estate Advisory Fund), you are about to make a presentation to the portfolio manager of the ET&T pension fund. You would like to show what would have...

-

Your division is considering two projects with the following net cash flows (in millions): a. What are the projects? NPVs assuming the WACC is 5%? 10%? 15%? b. What are the projects? IRRs at each of...

-

A mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an...

-

How is infrastructure protection (assuring the security of utility services) related to information security?

-

Photon Technologies, Inc., a manufacturer of batteries for mobile phones, signed a contract with a large electronics manufacturer to produce three models of lithium-ion battery packs for a new line...

-

Mastery Problem: Capital Investment Analysis HomeGrown Company HomeGrown Company is a chain of grocery stores that are similar to indoor farmer's markets, providing fresh, local produce, meats, and...

-

McDonald's and CSR There more than 32,000 restaurants around the world (www.aboutmcdonalds.com/etc/medialib/csr/docs. that carry the McDonald's label and logo. As such, they...

-

Smartwatch Based on a survey by Consumer Technology Association, smartwatches are used in 18% of U.S. households. Find the probability that a randomly selected U.S. household has no smartwatches.

-

Suppose you wanted to purchase a commercial real estate property thats valued at $ 1 , 0 0 0 , 0 0 0 . You could secure financing from a traditional bank, which provides you with $ 7 5 0 , 0 0 0 ....

-

Define power and describe the determinants of an individuals power within an organization. LO8

-

SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Sanchez Welding and Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended...

-

A chemical dictionary gives the following descriptions of the production of some compounds. Write plausible chemical equations based on these descriptions. (a) Lead(II) carbonate: adding a solution...

-

SKI tries to match the maturity of its assets and liabilities. Describe how SKI could adopt a more aggressive or a more conservative financing policy.

-

Assume that SKIs payables deferral period is 30 days. Now calculate the firms cash conversion cycle .

-

What might SKI do to reduce its cash and securities without harming operations?

-

20 On January 1, Year 1, X Company purchased equipment for $80,000. The company estimates that the equipment will have a useful life of 10 years and a residual value of $5,000. X Company depreciates...

-

Discuss why it is important for company managers to understand and use social capital knowledge to help build social ties among their skilled knowledge workers so they can build employee loyalty...

-

Kate lives in a house close to a local university, and she traditionally has rented a garage apartment in the back of her property to students for $750 per month. Kate wants to transfer the title to...

Study smarter with the SolutionInn App