An analysis of the transactions made by Mark Kotsay & Co., a certified public accounting firm, for

Question:

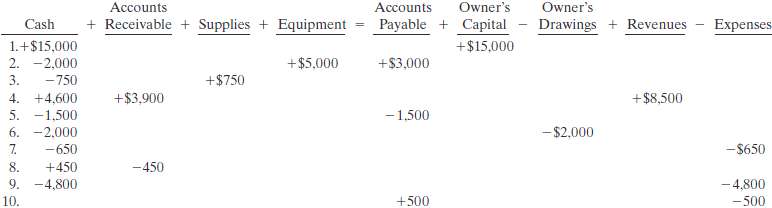

An analysis of the transactions made by Mark Kotsay & Co., a certified public accounting firm, for the month of August is shown below. The expenses were $650 for rent, $4,800 for salaries and wages, and $500 for utilities

Instructions(a) Describe each transaction that occurred for the month.

(b) Determine how much owner?s equity increased for the month.

(c) Compute the amount of net income for themonth.

Transcribed Image Text:

Accounts + Receivable + Supplies + Equipment = Payable + Capital Drawings + Revenues Owner's Owner's Accounts Cash Expenses 1.+$15,000 +$15,000 +$5,000 2. -2,000 3. +$3,000 +$750 - 750 4. +4,600 5. -1.500 +$3,900 +$8,500 -1,500 - $2,000 6. -2.000 7. -$650 -650 -450 8. 9. +450 -4,800 10. -4,800 -500 +500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (16 reviews)

a 1 Owner invested 15000 cash in the business 2 Purchased equipment for 5000 ...View the full answer

Answered By

OTIENO OBADO

I have a vast experience in teaching, mentoring and tutoring. I handle student concerns diligently and my academic background is undeniably aesthetic

4.30+

3+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted:

Students also viewed these Cost Accounting questions

-

An analysis of the transactions made by Rodriguez & Co., a certified public accounting firm, for the month of August is shown below. Each increase and decrease in owner's equity is explained....

-

An analysis of the transactions made by S. Moses & Co., a certified public accounting firm, for the month of August is shown below. The expenses were $650 for rent, $4,900 for salaries, and $500 for...

-

An analysis of the transactions made by S. Moses & Co., a certified public accounting firm, for the month of August is shown below. Each increase and decrease in equity is explained. Instructions (a)...

-

If possible, completely factor the expressions in Problems 336. 9-x-2x

-

A summary of cash flows for Sentinel Travel Service for the year ended August 31, 2019, follows: Cash receipts: Cash received from customers ....................................... $734,000 Cash...

-

What are vocabularies in IR systems? What role do they play in the indexing of documents?

-

What problems not generally found in manufacturing systems do service systems present in terms of scheduling the use of resources? LO.1

-

Does Monsanto maintain an ethical culture that can effectively respond to various stakeholders ? The original Monsanto was very different from the current company. It was started by John F. Queeny in...

-

1. An investment will generate annual CFAT (cash flows after taxes) of $315,000. It would cost $840,000 to acquire and should last five years with no salvage value expected. The payback period for...

-

1. Explain the accounting issues involved in each of the seven items in the consent decree between the SEC and Microsoft. As part of your explanation, explain why it was or was not valid to record an...

-

Thornton Computer Timeshare Company entered into the following transactions during May 2012. 1. Purchased computer terminals for $20,000 from Digital Equipment on account. 2. Paid $4,000 cash for May...

-

An analysis of transactions for Mark Kotsay & Co. was presented in E18. Instructions Prepare an income statement and an owners equity statement for August and a balance sheet at August 31, 2012.

-

Which of the following would not change the receivables turnover ratio for a retai a. increases in the retail prices of inventory b. a change in credit policy c. increases in the cost incurred to...

-

Fineas Co. use the Job Order Costing system to determine product costs. Before entering 2020, the company has created a production budget, with an estimated total manufacturing overhead of $...

-

Define what a market value is? What are three major principles of investing funds? How does the federal government control the money supply? An investor purchases a 10-year U.S. Treasury note and...

-

1. Suppose we have two alternative designs, each of which yields a different present value of the total lifetime cost: the first is $1604 and the second is $1595. Verify that the present value of the...

-

Sometimes when we are asked for a linear model, the information that we are given is data about a scenario. In these cases we have to use Excel to generate a trendline. There is a video in this...

-

1. Purpose Explain 3 points from the Introduction section as to why this study is important. How did this study build on the existing literature in this area? 2. Participants Outline at least 2...

-

What kind oflegol hllrnge "ould each o( th ... itua1lon, give ,1.., to! R.,rc:h, Find ou1 "h.i hp~nI 1n

-

1. As a general strategy, would you recommend that Carl take an aggressive approach to capacity expansion or more of a wait-and-see approach? 2. Should Carl go with the option for one facility that...

-

Construct the average fixed cost, average variable cost, and average total cost schedules and the marginal cost schedule. Lens body board factory pays $60 a day for equipment and $200 a day to each...

-

Chen Company manufactures basketballs. Materials are added at the beginning of the production process and conversion costs are incurred uniformly. Production and cost data for the month of July 2010...

-

Luther Processing Company uses a weighted-average process costing system and manufactures a single product??a premium rug shampoo and cleaner. The manufacturing activity for the month of October has...

-

Luther Processing Company uses a weighted-average process costing system and manufactures a single product??a premium rug shampoo and cleaner. The manufacturing activity for the month of October has...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App