Assume you are considering a portfolio containing two assets, L and M. Asset L will represent 40%

Question:

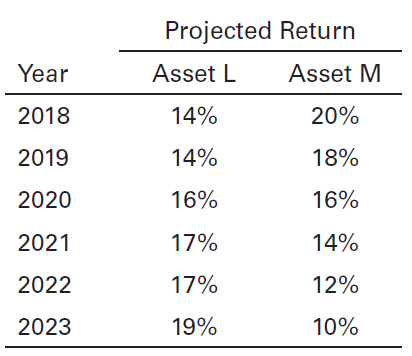

Assume you are considering a portfolio containing two assets, L and M. Asset L will represent 40% of the dollar value of the portfolio, and asset M will account for the other 60%. The projected returns over the next six years, 2018-2023, for each of these assets are summarized in the following table.

a. Use an Excel spreadsheet to calculate the projected portfolio return,![]() , for each of the six years.

, for each of the six years.

b. Use an Excel spreadsheet to calculate the average portfolio return,![]() , over the six-year period.

, over the six-year period.

c. Use an Excel spreadsheet to calculate the standard deviation of expected portfolio returns, sp, over the six-year period.

d. How would you characterize the correlation of returns of the assets L and M?

e. Discuss any benefits of diversification achieved through creation of the portfolio.

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780134083308

13th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk