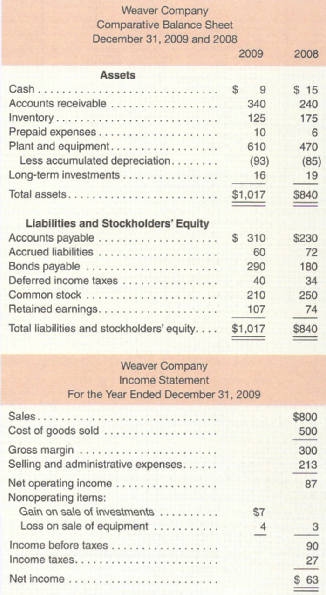

Comparative financial statements for Weaver Company follow: During 2009, the company sold some equipment for $20 that

Question:

Comparative financial statements for Weaver Company follow:

During 2009, the company sold some equipment for $20 that had cost $40 and on which there was accumulated depreciation of $16. In addition, the company sold long-term investments for $10 that had cost $3 when purchased several years ago. Cash dividends totaling $30 were paid during 2009.

Required:

1. Using the indirect method, determine the net cash provided by operating activities for 2009.

2. Using the information in (1) above, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for 2009.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Question Posted: