Question: Diana, a partner in the cash basis HDA Partnership, has a one-third interest in partnership profits and losses. The partnerships balance sheet at the end

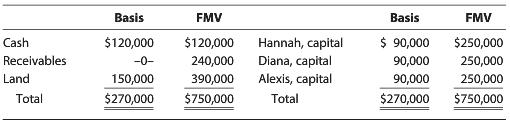

Diana, a partner in the cash basis HDA Partnership, has a one-third interest in partnership profits and losses. The partnership’s balance sheet at the end of the current year is as follows:

Diana sells her interest in the HDA Partnership to Kenneth at the end of the current year for cash of $250,000.

a. How much income must Diana report on her tax return for the current year from the sale? What is its nature?

b. If the partnership does not make an optional adjustment-to-basis election, what are the type and amount of income that Kenneth must report in the next year when the receivables are collected?

c. If the partnership did make an optional adjustment-to-basis election, what are the type and amount of income that Kenneth must report in the next year when the receivables are collected? When the land (which is used in the HDA Partnership’s business) is sold for $420,000? Assume that no other transactions occurred that year.

Basis FMV Basis FMV Cash Receivables Land $120,000 120,000 Hannah, capital 90,000 $250,000 90,000 250,000 90,000 250,000 $270,000 $750,000 -0- 240,000 Diana, capital 150,000 390,000 Alexis, capital $270,000 750,000 Total

Step by Step Solution

3.31 Rating (175 Votes )

There are 3 Steps involved in it

a 80000 of ordinary income and 80000 of capital gain Dianas total gain is 160000 250000 selling pri... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

527-L-B-L-T-L (558).docx

120 KBs Word File