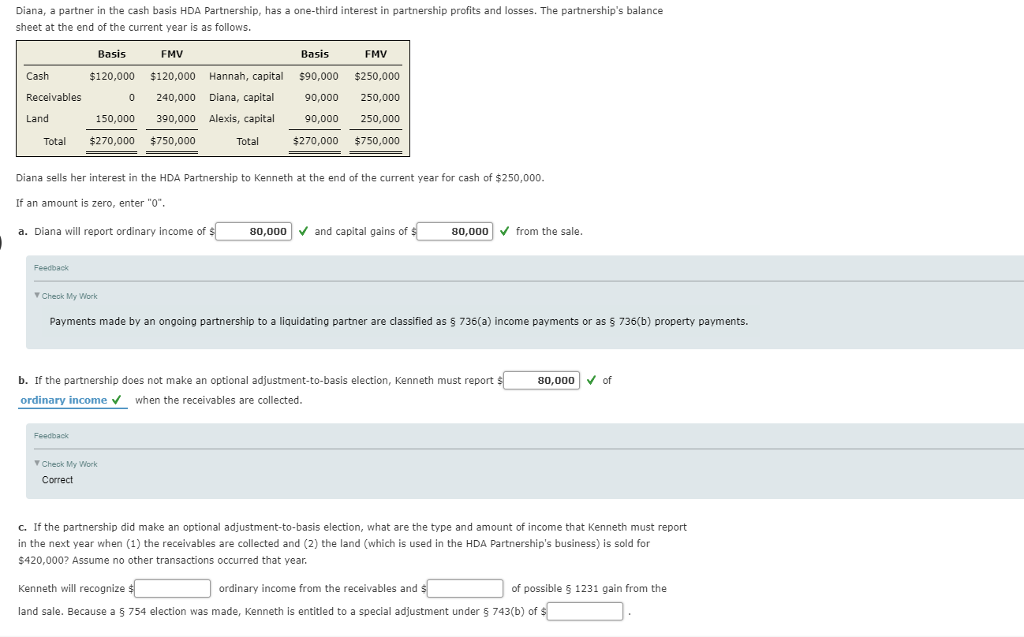

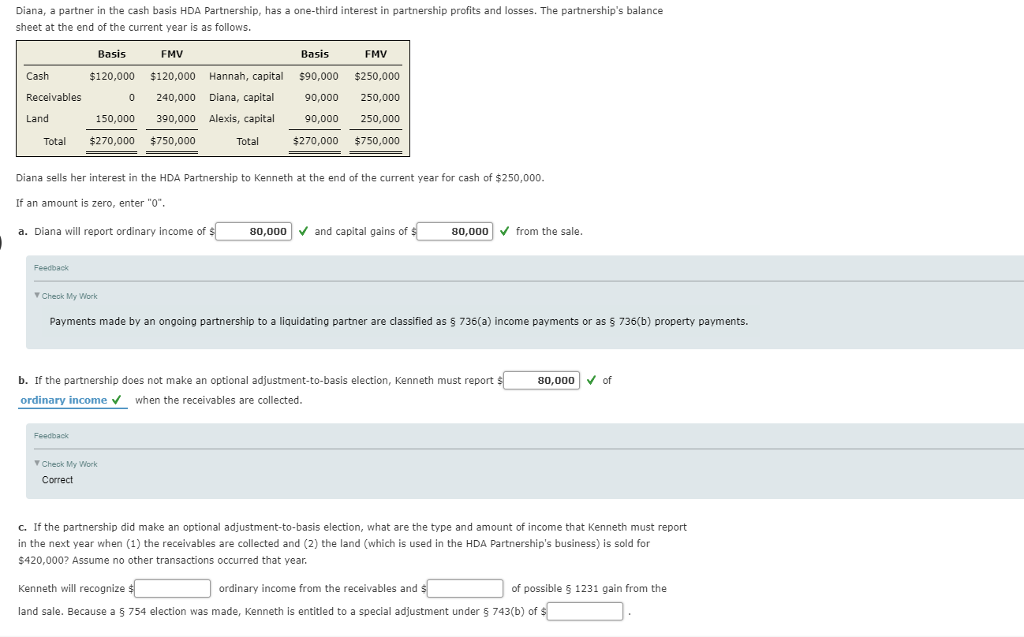

Diana, a partner in the cash basis HDA Partnership, has a one-third interest in partnership profits and losses. The partnership's balance sheet at the end of the current year is as follows. Basis FMV Basis FMV Cash Receivables Land $120,000 $120,000 Hannah, capital $90,000 $250,000 90,000 250,000 150,000 390,000 Alexis, capital 90,000 250,000 $270,000 $750,000 0 240,000 Diana, capital Total $270,000 $750,000 Total Diana sells her interest in the HDA Partnership to Kenneth at the end of the current year for cash of $250,000 If an amount is zero, enter "O a. Diana will report ordinary income of 80,000 and capital gains of 80,000 V from the sale Feedback Cheak My Work Payments made by an ongoing partnership to a liquidating partner are classified as 736(a) income payments or as 736(b) property payments. b. If the partnership does not make an optional adjustment-to-basis election, Kenneth must report ordinary incomewhen the receivables are collected 80,000of Feedback Check My Work Correct c. If the partnership did make an optional adjustment-to-basis election, what are the type and amount of income that Kenneth must report in the next year when (1) the receivables are collected and (2) the land (which is used in the HDA Partnership's business) is sold for $420,000? Assume no other transactions occurred that year Kenneth will recognize ordinary income from the receivables and of possible 5 1231 gain from the land sale. Because a 5 754 election was made, Kenneth is entitled to a special adjustment under 5 743(b) of Diana, a partner in the cash basis HDA Partnership, has a one-third interest in partnership profits and losses. The partnership's balance sheet at the end of the current year is as follows. Basis FMV Basis FMV Cash Receivables Land $120,000 $120,000 Hannah, capital $90,000 $250,000 90,000 250,000 150,000 390,000 Alexis, capital 90,000 250,000 $270,000 $750,000 0 240,000 Diana, capital Total $270,000 $750,000 Total Diana sells her interest in the HDA Partnership to Kenneth at the end of the current year for cash of $250,000 If an amount is zero, enter "O a. Diana will report ordinary income of 80,000 and capital gains of 80,000 V from the sale Feedback Cheak My Work Payments made by an ongoing partnership to a liquidating partner are classified as 736(a) income payments or as 736(b) property payments. b. If the partnership does not make an optional adjustment-to-basis election, Kenneth must report ordinary incomewhen the receivables are collected 80,000of Feedback Check My Work Correct c. If the partnership did make an optional adjustment-to-basis election, what are the type and amount of income that Kenneth must report in the next year when (1) the receivables are collected and (2) the land (which is used in the HDA Partnership's business) is sold for $420,000? Assume no other transactions occurred that year Kenneth will recognize ordinary income from the receivables and of possible 5 1231 gain from the land sale. Because a 5 754 election was made, Kenneth is entitled to a special adjustment under 5 743(b) of