During the year, cost of goods sold was $80,000; income from operations was $76,000; income tax expense

Question:

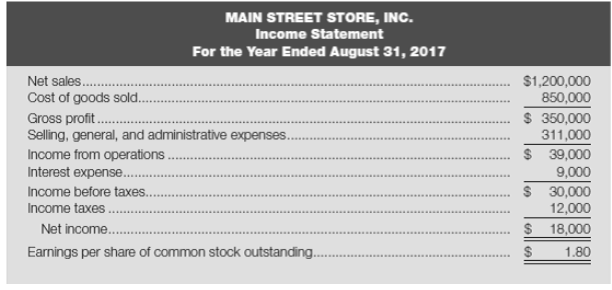

During the year, cost of goods sold was $80,000; income from operations was $76,000; income tax expense was $16,000; interest expense was $12,000; and selling, general, and administrative expenses were $44,000.

Required:

Calculate net sales, gross profit, income before taxes, and net income. (Exhibit 2-2 may he used as a solution model.)

Exhibit 2-2

Transcribed Image Text:

MAIN STREET STORE, INC. Income Statement For the Year Ended August 31, 2017 $1,200,000 850,000 Net sales. Cost of goods sold. $ 350,000 311,000 Gross profit. Selling, general, and administrative expenses. $ 39,000 9,000 Income from operations. Interest expense.. $ 30,000 12,000 Income before taxes... Income taxes. Net income... Earnings per share of common stock outstanding. $ 18,000 2$ 1.80

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 73% (15 reviews)

Set up an income statement using the structure and format as shown i...View the full answer

Answered By

Sinmon Warui Kamau

After moving up and down looking for a job, a friend introduced me to freelance writing. I started with content writing and later navigated to academic writing. I love writing because apart from making a living out of it, it is also a method of learning and helping others to learn.

5.00+

40+ Reviews

45+ Question Solved

Related Book For

Accounting What the Numbers Mean

ISBN: 978-1259535314

11th edition

Authors: David Marshall, Wayne McManus, Daniel Viele

Question Posted:

Students also viewed these Cost Accounting questions

-

During the year, cost of goods sold was $40,000; income from operations was $38,000; income tax expense was $8,000; interest expense was $6,000; and selling, general, and administrative expenses were...

-

During the year, net sales were $125,000; gross profit was $50,000; net income was $20,000; income tax expense was $5,000; and selling, general, and administrative expenses were $22,000. Required:...

-

Selling, general, and administrative expenses were $132,000; net sales were $600,000; interest expense was $14,200; research and development expenses were $63,000; net cash provided by operating...

-

Given: MIII; Prove: M Use the definitions and postulates given in Example 2 to prove the theorems in Problems 914. Give both statements and reasons.

-

On January 1, 2002, the Key West Company acquired a pie-making machine for $50,000. The machine was expected to have a useful life of 10 years with no residual value. Key West uses the straight-line...

-

The Day Company and the Knight Company are identical in every respect except that Day is not levered. Financial information for the two firms appears in the following table. All earnings streams are...

-

You have decided to undertake a project and have defined the main research question as What are the opinions of consumers to a 10% reduction in weight, with the price remaining the same, of Snackers...

-

BONDS ISSUED AT A PREMIUM, REDEEMED AT A LOSS Blackwell Company issued the following bonds at a premium: Date of issue and sale: .....March 1, 20-1 Principal amount: .......$500,000 Sale price of...

-

The December 31, 2020 statement of financial position of Leon Company showed Accounts receivable balance of P500,000 and Allowance for Bad Debts of P48,000. Following is a summary of accounts...

-

Tankmaster Manufacturing Company is a large manufacturer of domestic oil tanks. Since it came into existence in 1980, the company has enjoyed steady growth in both sales and profits. Davina...

-

During the year, net sales were $250,000; gross profit was $100,000; net income was $40,000; income tax expense was $10,000; and selling, general, and administrative expenses were $44,000. Required:...

-

The information presented here represents selected data from the December 31, 2016, balance sheets and income statements for the year then ended for three firms: Required: Calculate the missing...

-

Why do you think asking whether money is an asset or a liability is a trick question in economics?

-

Write a java program that contain two overloaded methods that accepts two numbers or two characters representing a range example (11, 37) or (c, w) inputted by the user. The method generates a random...

-

Maggie could not conceive a child using natural means, so she sought out a woman who would donate an egg to be surgically implanted in Maggie. Which of the following items are deductible by Maggie in...

-

M corporation is subject to tax only in state b state b law provides for the use of federal taxable income before net operating loss and special deductions as the starting point for computing state...

-

Use Routh Criteria to determine the values of K needed for the system represented by the Characteristic Equation to be stable. (1 + K)s + (2K + 3)s + 2 3K = 0 Obtain the root locus plot for the...

-

Q7 a) Two forces equal to 2P and P act on a particle. If the first be doubled and second is increased by 12N, the direction of resultant remains unaltered. Find the value of P (5)

-

Indicate which tests should be used. n=1 n - 1 2n + 1

-

What is EBIT/eps analysis? What information does it provide managers?

-

Assume that you own 14,000 shares of Briant Inc.s common stock and that you currently receive cash dividends of $1.68 per share per year. Required: a. If Briant Inc. declared a 5% stock dividend, how...

-

Dedrick Inc. did not pay dividends in 2018 or 2019, even though 60,000 shares of its 7.5%, $50 par value cumulative preferred stock were outstanding during those years. The company has 900,000 shares...

-

Rosie Inc. did not pay dividends on its $4.50, $50 par value, cumulative preferred stock during 2018 or 2019, but had met its preferred dividend requirement in all prior years. Since 2014, 42,000...

-

Al preparar el estado de resultados pro forma, cules de las siguientes partidas se deducen de las utilidades brutas para llegar a las ganancias despus de impuestos? Pregunta de seleccin mltiple....

-

Lawson Inc. is expanding its manufacturing plant, which requires an investment of $4 million in new equipment and plant modifications. Lawson's sales are expected to increase by $3 million per year...

-

20 On January 1, Year 1, X Company purchased equipment for $80,000. The company estimates that the equipment will have a useful life of 10 years and a residual value of $5,000. X Company depreciates...

Study smarter with the SolutionInn App