Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tankmaster Manufacturing Company is a large manufacturer of domestic oil tanks. Since it came into existence in 1980, the company has enjoyed steady growth

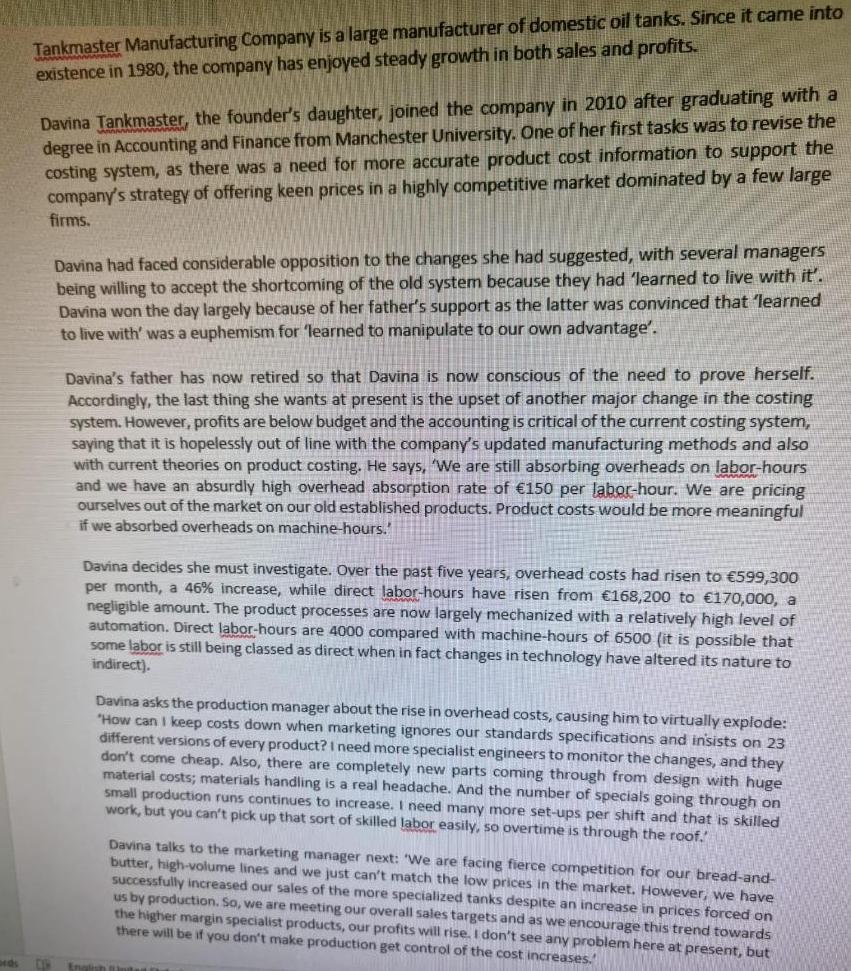

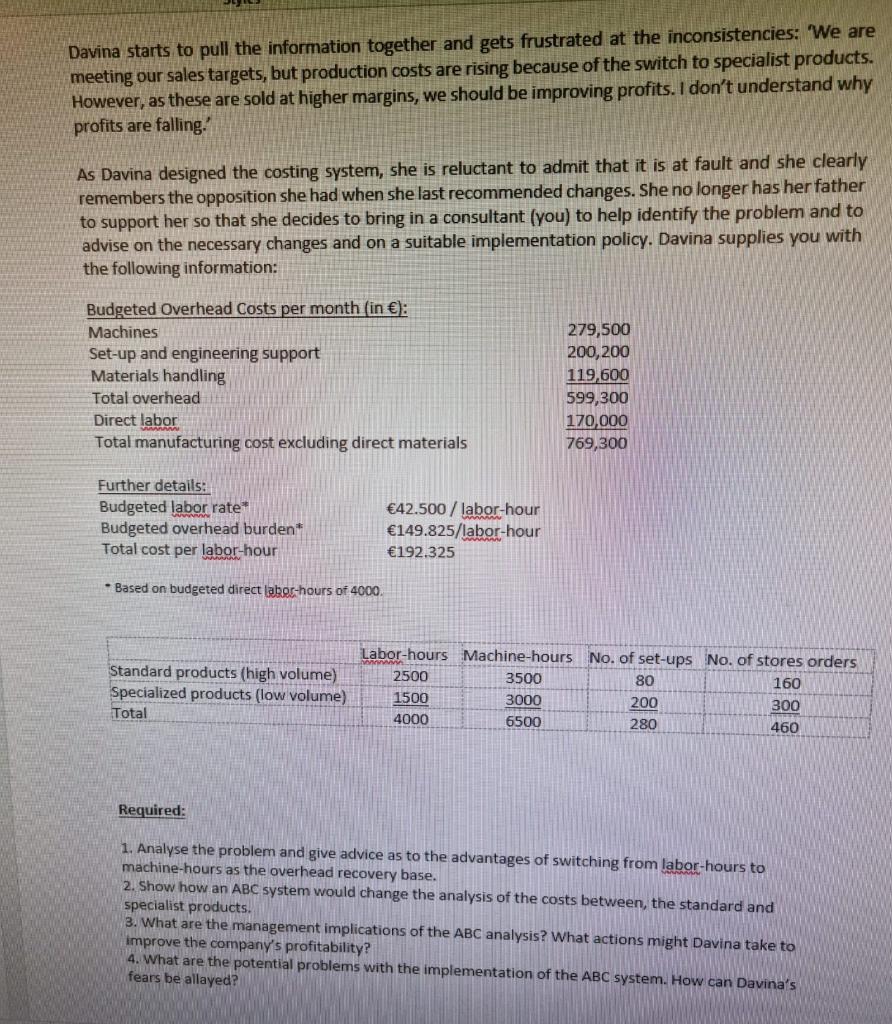

Tankmaster Manufacturing Company is a large manufacturer of domestic oil tanks. Since it came into existence in 1980, the company has enjoyed steady growth in both sales and profits. Davina Tankmaster, the founder's daughter, joined the company in 2010 after graduating with a degree in Accounting and Finance from Manchester University. One of her first tasks was to revise the costing system, as there was a need for more accurate product cost information to support the company's strategy of offering keen prices in a highly competitive market dominated by a few large firms. Davina had faced considerable opposition to the changes she had suggested, with several managers being willing to accept the shortcoming of the old system because they had learned to live with it. Davina won the day largely because of her father's support as the latter was convinced that learned to live with' was a euphemism for 'learned to manipulate to our own advantage'. Davina's father has now retired so that Davina is now conscious of the need to prove herself. Accordingly, the last thing she wants at present is the upset of another major change in the costing system. However, profits are below budget and the accounting is critical of the current costing system, saying that it is hopelessly out of line with the company's updated manufacturing methods and also with current theories on product costing. He says, 'We are still absorbing overheads on labor-hours and we have an absurdly high overhead absorption rate of 150 per labor-hour. We are pricing ourselves out of the market on our old established products. Product costs would be more meaningful if we absorbed overheads on machine-hours. Davina decides she must investigate. Over the past five years, overhead costs had risen to 599,300 per month, a 46% increase, while direct labor-hours have risen from 168,200 to 170,000, a negligible amount. The product processes are now largely mechanized with a relatively high level of automation. Direct labor-hours are 4000 compared with machine-hours of 6500 (it is possible that some labor is still being classed as direct when in fact changes in technology have altered its nature to indirect). Davina asks the production manager about the rise in overhead costs, causing him to virtually explode: "How can I keep costs down when marketing ignores our standards specifications and insists on 23 different versions of every product? I need more specialist engineers to monitor the changes, and they don't come cheap. Also, there are completely new parts coming through from design with huge material costs; materials handling is a real headache. And the number of specials going through on small production runs continues to increase. I need many more set-ups per shift and that is skilled work, but you can't pick up that sort of skilled labor easily, so overtime is through the roof. Davina talks to the marketing manager next: "We are facing fierce competition for our bread-and- butter, high-volume lines and we just can't match the low prices in the market. However, we have successfully increased our sales of the more specialized tanks despite an increase in prices forced on us by production. So, we are meeting our overall sales targets and as we encourage this trend towards the higher margin specialist products, our profits will rise. I don't see any problem here at present, but there will be if you don't make production get control of the cost increases. English Blte Davina starts to pull the information together and gets frustrated at the inconsistencies: "We are meeting our sales targets, but production costs are rising because of the switch to specialist products. However, as these are sold at higher margins, we should be improving profits. I don't understand why profits are falling. As Davina designed the costing system, she is reluctant to admit that it is at fault and she clearly remembers the opposition she had when she last recommended changes. She no longer has her father to support her so that she decides to bring in a consultant (you) to help identify the problem and to advise on the necessary changes and on a suitable implementation policy. Davina supplies you with the following information: Budgeted Overhead Costs per month (in ): Machines 279,500 200,200 Set-up and engineering support Materials handling 119,600 Total overhead Direct labor Total manufacturing cost excluding direct materials 599,300 170,000 769,300 Further details: Budgeted Jabor rate Budgeted overhead burden* Total cost per labor-hour 42.500/ labor-hour 149.825/labor-hour 192.325 * Based on budgeted direct labor-hours of 4000. Labor-hours Machine-hours No. of set-ups No. of stores orders Standard products (high volume) Specialized products (low volume) 2500 3500 80 160 1500 3000 200 300 Total 4000 6500 280 460 Required: 1. Analyse the problem and give advice as to the advantages of switching from labor-hours to machine-hours as the overhead recovery base. 2. Show how an ABC system would change the analysis of the costs between, the standard and specialist products. 3. What are the management implications of the ABC analysis? What actions might Davina take to improve the company's profitability? 4. What are the potential problems with the implementation of the ABC system. How can Davina's fears be allayed?

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Required 1 Analy se the problem and give advice as to the advantages of switching from labor hours to machine hours as the overhead recovery base ANS WER The main advantage of switching from labor hou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started