Elite Livery, Inc., was organized to provide limousine service between the airport and various suburban locations. It

Question:

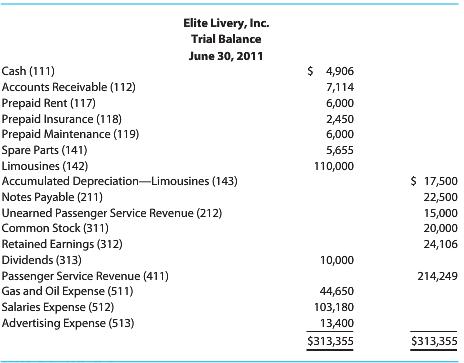

Elite Livery, Inc., was organized to provide limousine service between the airport and various suburban locations. It has just completed its second year of business. Its trial balance appears below.

The following information is also available:

a. To obtain space at the airport, Elite Livery paid two years’ rent in advance when it began the business.

b. An examination of insurance policies reveals that $900 expired during the year.

c. To provide regular maintenance for its vehicles, Elite Livery deposited $6,000 with a local garage. An examination of maintenance invoices reveals charges of $5,472 against the deposit.

d. An inventory of spare parts shows $1,008 on hand.

e. Elite Livery depreciates all of its limousines at the rate of 12.5 percent per year. No limousines were purchased during the year.

f. A payment of $5,650 for one full year’s interest on notes payable is now due.

g. Unearned Passenger Service Revenue on June 30 includes $8,908 for tickets that employers purchased for use by their executives but that have not yet been redeemed.

h. Federal income taxes for the year are estimated to be $6,625.

REQUIRED

1. Determine adjusting entries and enter them in the general journal (Page 14).

2. Open ledger accounts for the accounts in the trial balance plus the following: Interest Payable (213), Income Taxes Payable (214), Rent Expense (514), Insurance Expense (515), Spare Parts Expense (516), Depreciation Expense—Limousines (517), Maintenance Expense (518), Interest Expense (519), and Income Taxes Expense (520). Record the balances shown in the trial balance.

3. Post the adjusting entries from the general journal to the ledger accounts, showing proper references.

4. Prepare an adjusted trial balance, an income statement, a statement of retained earnings, and a balance sheet.

5. Do adjustments affect the cash flow yield? After the adjustments, is the cash flow yield for the year more or less than it would have been if the adjustments had not been made?

Step by Step Answer: