Grossfeld Company of Omaha, Nebraska, provides liquid fertilizer and herbicides to regional farmers. On July 31, 2012,

Question:

Grossfeld Company of Omaha, Nebraska, provides liquid fertilizer and herbicides to regional farmers. On July 31, 2012, the company's Cash account per its general ledger showed a balance of $5,876.70.

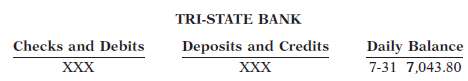

The bank statement from Tri-State Bank on that date showed the following balance.

A comparison of the details on the bank statement with the details in the Cash account revealed the following facts.1. The bank service charge for July was $32.2. The bank collected a note receivable of $900 for Grossfeld Company on July 15, plus $48 of interest. The bank made an $18 charge for the collection. Grossfeld has not accrued any interest on the note.3. The July 31 receipts of $1,339 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31.4. Company check No. 2480 issued to S. Tully, a creditor, for $471 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $417.5. Checks outstanding on July 31 totaled $2,480.10.6. On July 31, the bank statement showed an NSF charge of $818 for a check received by the company from L. Weare, a customer, on account.Instructions(a) Prepare the bank reconciliation as of July 31, 2012.(b) Prepare the necessary adjusting entries at July 31,2012.

Step by Step Answer:

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso