Kathys Mats produces and sells artistic placemats for dining room tables. These placemats are manufactured out of

Question:

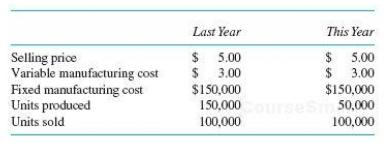

Kathy’s Mats produces and sells artistic placemats for dining room tables. These placemats are manufactured out of recycled plastics. For last year and this year each mat has a variable manufacturing cost of $ 3, and fixed manufacturing overhead is $ 150,000 per year ( both Last Year and This Year). Kathy’s Mats incurs no other costs. The following table summarizes the selling price and the number of mats produced and sold Last Year and This Year:

Kathy’s Mats uses FIFO (First- in First Out) to value its ending inventory. Last Year Kathy’s Mats had no beginning inventory.

Required:

a. Prepare income statements for Last Year and This Year using absorption costing.

b. Prepare income statements for Last Year and This Year using variable costing.

c. Write a short memo explaining why the net income amounts for Last Year and This Year are the same or different in parts ( a ) and ( b ).

d. Assume all the same facts ( and data) as given in the problem EXCEPT that This Year Kathy’s Mats produced 60,000 mats rather than 50,000 mats. Compute net income for Last Year and This Year using (i) absorption costing and (ii) variable costing.

e. Write a short memo explaining why the net income amounts for Last Year and This Year are the same or different in (i) and ( ii) of part ( d ).

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Accounting for Decision Making and Control

ISBN: 978-0078025747

8th edition

Authors: Jerold Zimmerman