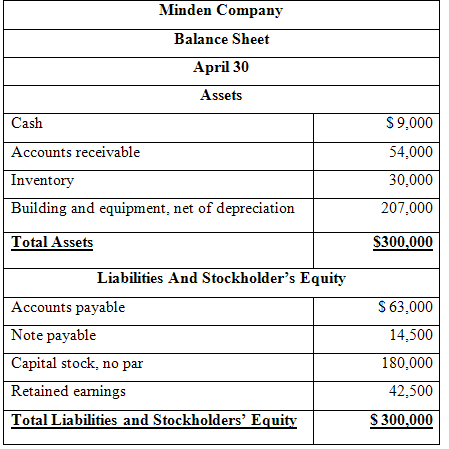

Minden Company is a wholesale distributor of premium European chocolates. The companys balance sheet as of April

Question:

Minden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below:

The company is in the process of preparing budget data for May. A number of budget items have already been prepared, as stated below:

(a) Sales are budgeted at $200,000 for May. Of these sales, $60,000 will be for cash; the remainder will be credit sales. One-half of a month’s credit sales are collected in the month the sales are made, and the reminder is collected in the following month. All of the April 30 accounts receivable will be collected in May.

(b) Purchase of inventory are expected to total $120,000 during May. These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchases; the remainder are paid in the following month. All of the April 30 accounts payable to suppliers will be paid during May.

(c) The May 31 inventory balance is budgeted at $40,000.

(d) Selling and administrative expenses for May are budget at $72,000, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $2,000 for the month.

(e) The note payable on the April 30 balance sheet will be paid during May, with $100 in interest, (All of the interest relates to May)

(f) New refrigerating equipment costing $6,500 will be purchased for cash during May.

(g) During May, the company will borrow $20,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year.

Required:

1. Prepare a cash budget for May. Suppose your budget with a schedule of expected cash collections from sales and a schedule of expected cash disbursements for merchandise purchase

2. Prepare a budgeted income statement for May. Use the absorption costing income statement formal as shown in Schedule 3.

3. Prepare a budgeted balance sheet as of May 31.

Cash BudgetA cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer