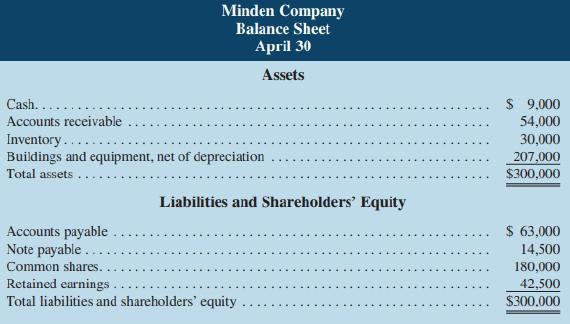

Minden Company is a wholesale distributor of premium European chocolates. The company's balance sheet as of April

Question:

Minden Company is a wholesale distributor of premium European chocolates. The company's balance sheet as of April 30 is given below:

The company is in the process of preparing a budget for May and has assembled the following data:

a. Sales are budgeted at $200,000 for May. Of these sales, $60,000 will be for cash; die remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May.

b. Purchases of inventory are expected to total $120,000 during May. These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the April 30 accounts payable to suppliers will be paid during May.

c. The May 31 inventory balance is budgeted at $40,000.

d. Selling and administrative expenses for May are budgeted at $72,000, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $2,000 for the month.

e. The note payable on the April 30 balance sheet will be paid during May, with $100 in interest. (All of the interest relates to May.)

f. New refrigerating equipment costing $6,500 will be purchased for cash during May.

g. During May, the company will borrow $20,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year.

Required:

1. Prepare a cash budget for May. Support your budget with a schedule of expected cash collections from sales and a schedule of expected cash disbursements for merchandise purchases.

2. Prepare a budgeted income statement for May.

3. Prepare a budgeted balance sheet as of May 31.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby