Question: Multiple Choice Questions 1. Sales are $540,000 and cost of goods sold is $330,000. Beginning and ending inventories are $29,000 and $34,000, respectively. How many

Multiple Choice Questions

1. Sales are $540,000 and cost of goods sold is $330,000. Beginning and ending inventories are $29,000 and $34,000, respectively. How many times did the company turn its inventory over during this period?

a. 17.1 times

b. 6.7 times

c. 7.2 times

d. 10.5 times

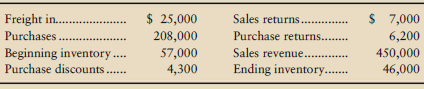

2. Trigger, Inc., reported the following data:

Trigger, Inc., gross profit percentage is

a. 46.3.

b. 52.7.

c. 47.3.

d. 57.4.

3. Shipley Tank Company had the following beginning inventory, net purchases, net sales, and gross profit percentage for the first quarter of 2010:

Beginning inventory, $52,000

Net sales revenue, $94,000

Net purchases, $73,000

Gross profit rate, 50%

By the gross profit method, the ending inventory should be

a. $80,000.

b. $78,000.

c. $81,000.

d. $79,000.

4. An error understated Regan Corporations December 31, 2010, ending inventory by $42,000. What effect will this error have on total assets and net income for 2010?

Assets Net income

a. Understate No effect

b. No effect No effect

c. Understate Understate

d. No effect Overstate

5. An error understated Regan Corporations December 31, 2010, ending inventory by $42,000. What effect will this error have on net income for 2011?

a. Overstate

b. Understate

c. No effect

$ 7,000 6,200 450,000 46,000 Sales returns. Purchase returns.... Sales revenue... Ending inventory... $ 25,000 Freight in. . Purchases. Beginning inventory. Purchase discounts .. 57,000 4,300

Step by Step Solution

3.58 Rating (173 Votes )

There are 3 Steps involved in it

1 d 330000 29000 34000 2 105 times 2 c 473 Net sales 443000 450000 7000 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

196-B-M-A-I (1539).docx

120 KBs Word File