Answered step by step

Verified Expert Solution

Question

1 Approved Answer

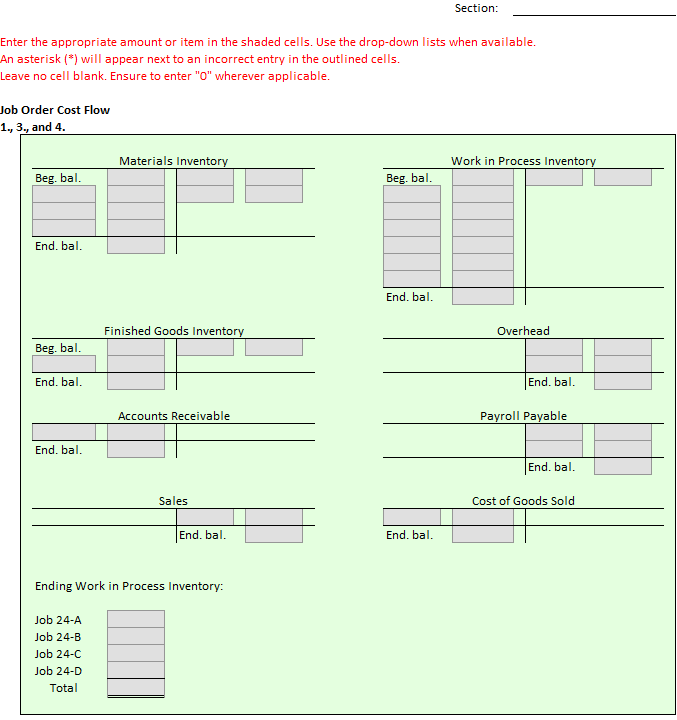

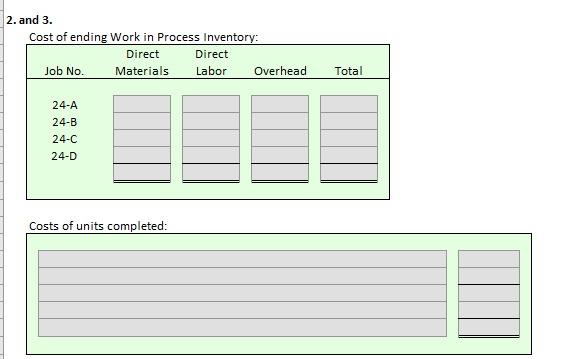

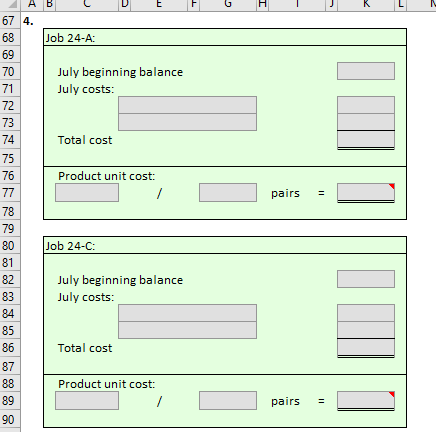

Using the information given above, the following tables need to be filled out. It is an excel template so I can only edit the cells

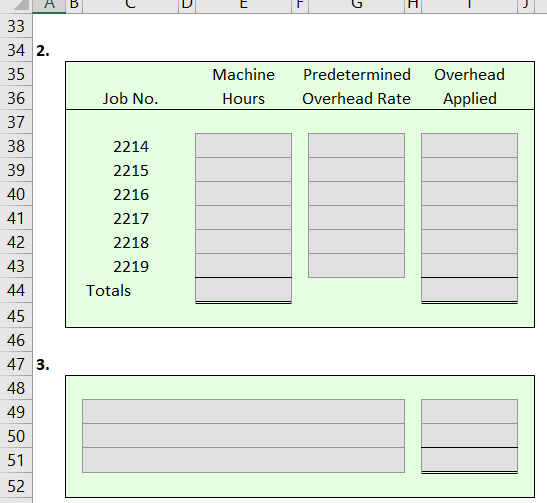

Using the information given above, the following tables need to be filled out. It is an excel template so I can only edit the cells and not change anything else so I have included screenshots of what is required.

Please do provide an explanation of for any calculations as I would want to know how everything was calculated, thank you so much!

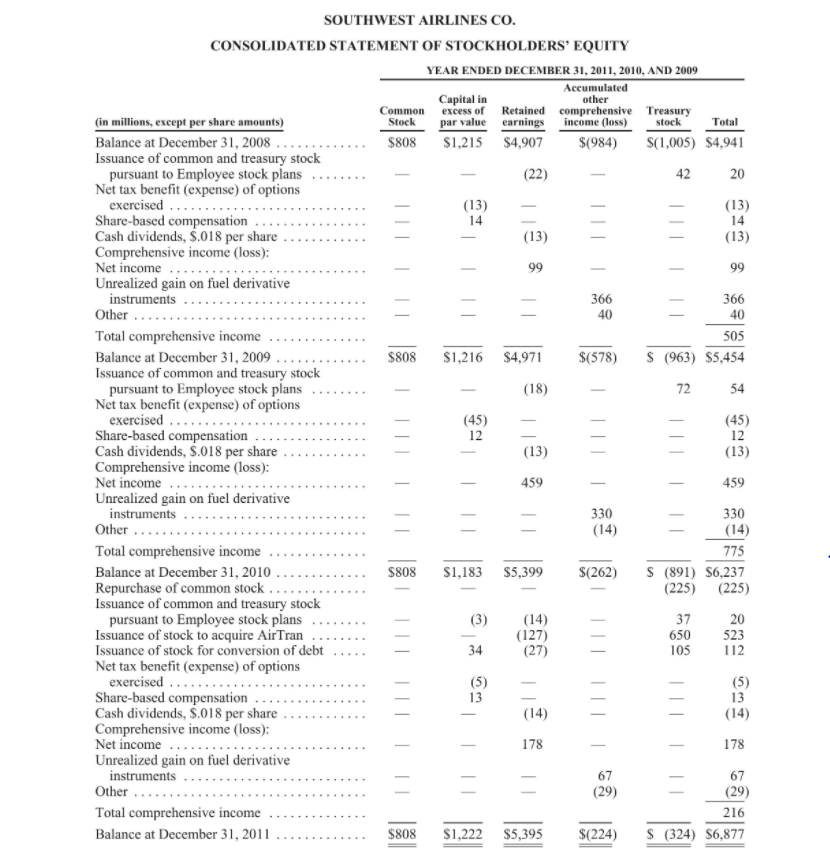

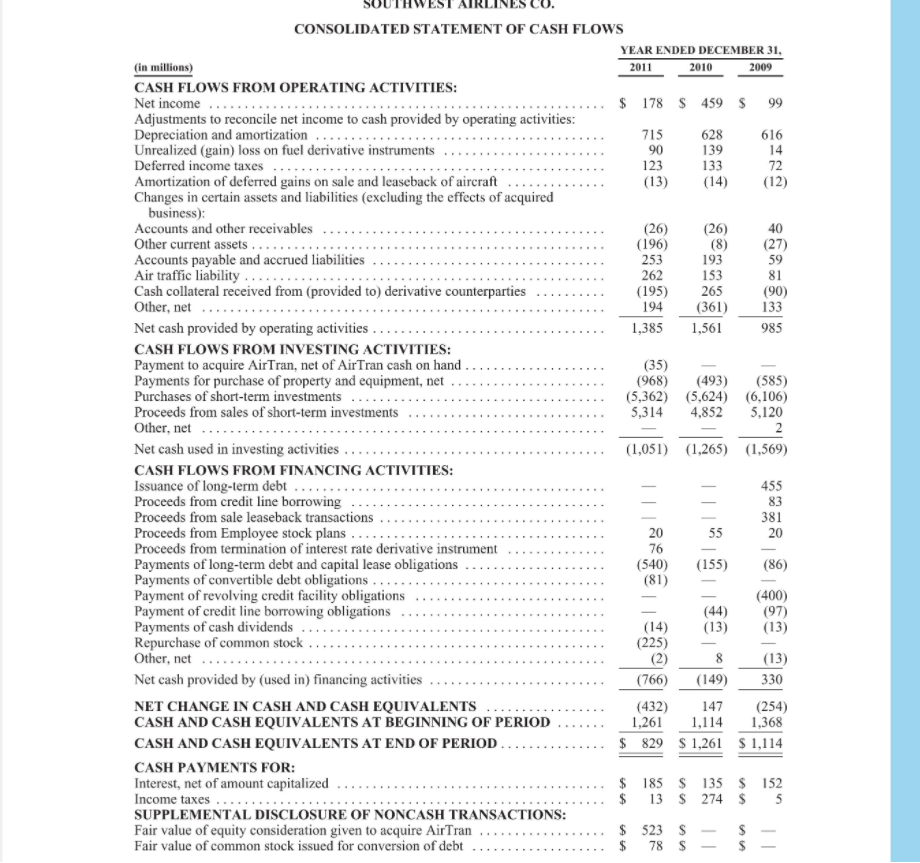

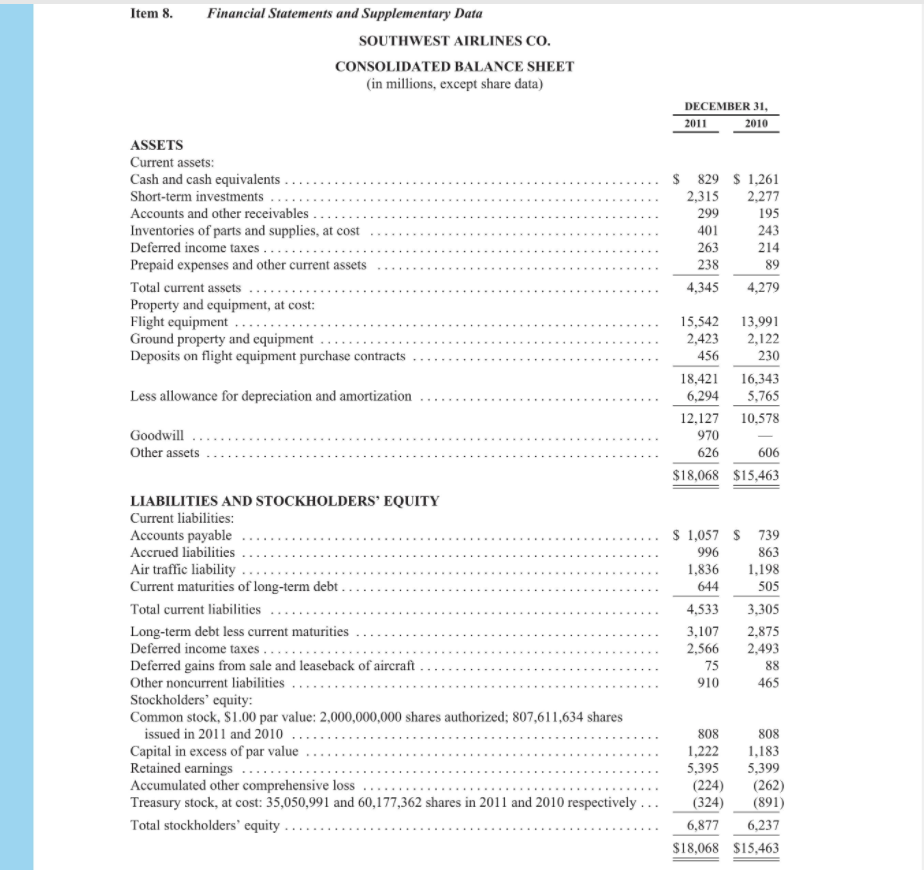

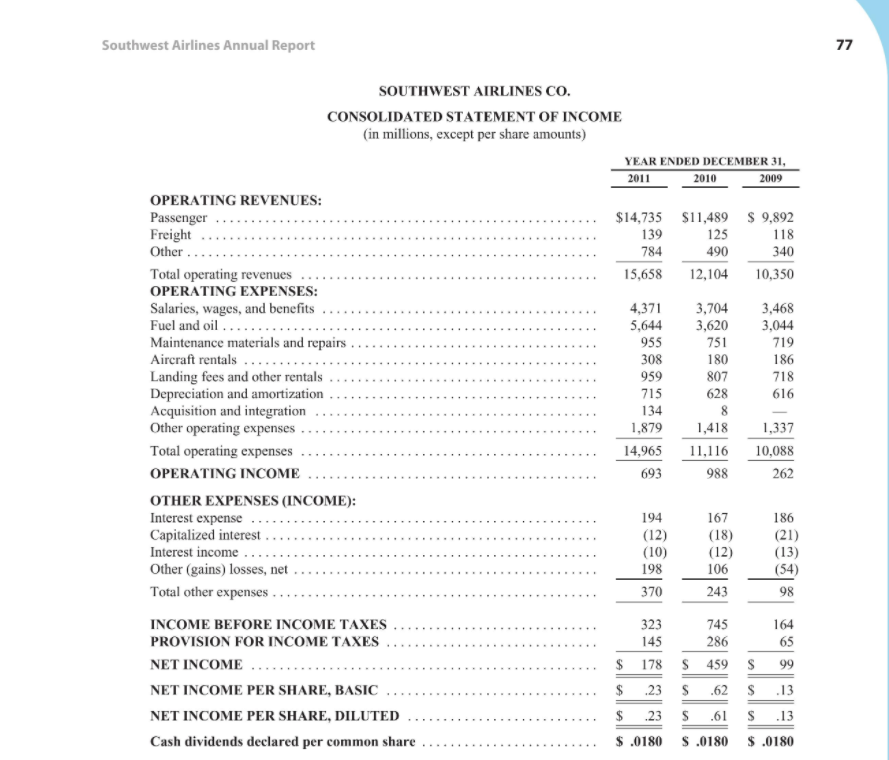

other - 366 SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY YEAR ENDED DECEMBER 31, 2011, 2010, AND 2009 Accumulated Capital in Common excess of Retained comprehensive Treasury (in millions, except per share amounts) Stock par value earnings income (loss) stock Total Balance at December 31, 2008.... $808 $1,215 $4,907 $(984) $(1,005) $4,941 Issuance of common and treasury stock pursuant to Employee stock plans (22) 42 20 Net tax benefit (expense) of options exercised ..... (13) (13) Share-based compensation 14 14 Cash dividends, $.018 per share (13) (13) Comprehensive income (loss): Net income... 99 99 Unrealized gain on fuel derivative instruments 366 Other .... 40 40 Total comprehensive income 505 Balance at December 31, 2009 $808 $1,216 $4,971 $(578) $ (963) $5,454 Issuance of common and treasury stock pursuant to Employee stock plans (18) 72 54 Net tax benefit (expense) of options exercised ........ (45) (45) Share-based compensation 12 12 Cash dividends, S.018 per share (13) (13) Comprehensive income (loss): Net income 459 459 Unrealized gain on fuel derivative instruments 330 Other ..... (14) Total comprehensive income 775 Balance at December 31, 2010 $808 $1,183 $5,399 $(262) $ (891) $6,237 Repurchase of common stock (225) (225) Issuance of common and treasury stock pursuant to Employee stock plans (14) 37 20 Issuance of stock to acquire AirTran (127) 650 523 Issuance of stock for conversion of debt 34 (27) 105 112 Net tax benefit (expense) of options exercised (5) Share-based compensation 13 13 Cash dividends, $.018 per share (14) (14) Comprehensive income (loss): Net income 178 178 Unrealized gain on fuel derivative instruments 67 67 Other .... (29) (29) Total comprehensive income 216 Balance at December 31, 2011 $808 $1,222 $5,395 $(224) $ (324) $6,877 - 1 1 330 (3) | S ||| (5) E - 1 1 2011 2010 2009 8:| 153 265 CONSOLIDATED STATEMENT OF CASH FLOWS YEAR ENDED DECEMBER 31, (in millions) CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 178 $ 459 $ 99 Adjustments to reconcile net income to cash provided by operating activities: Depreciation and amortization 715 628 616 Unrealized (gain) loss on fuel derivative instruments 90 139 14 Deferred income taxes 123 133 72 Amortization of deferred gains on sale and leaseback of aircraft (13) (14) (12) Changes in certain assets and liabilities (excluding the effects of acquired business): Accounts and other receivables (26) (26) 40 Other current assets .... (196) (8) (27) Accounts payable and accrued liabilities 253 193 59 Air traffic liability ..... 262 81 Cash collateral received from (provided to) derivative counterparties (195) (90) Other, net .... 194 (361) 133 Net cash provided by operating activities. 1,385 1,561 985 CASH FLOWS FROM INVESTING ACTIVITIES: Payment to acquire AirTran, net of AirTran cash on hand (35) Payments for purchase of property and equipment, net (968) (493) (585) Purchases of short-term investments (5,362) (5,624) (6,106) Proceeds from sales of short-term investments 5,314 4,852 5,120 Other, net 2 Net cash used in investing activities (1,051) (1,265) (1,569) CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of long-term debt 455 Proceeds from credit line borrowing 83 Proceeds from sale leaseback transactions Proceeds from Employee stock plans. 20 55 20 Proceeds from termination of interest rate derivative instrument 76 Payments of long-term debt and capital lease obligations (540) (155) (86) Payments of convertible debt obligations .... (81) Payment of revolving credit facility obligations (400) Payment of credit line borrowing obligations (44) (97) Payments of cash dividends (14) (13) (13) Repurchase of common stock (225) Other, net (2) 8 (13) Net cash provided by (used in) financing activities (766) (149) 330 NET CHANGE IN CASH AND CASH EQUIVALENTS (432) 147 (254) CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 1,261 1,114 1,368 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 829 $ 1,261 $ 1,114 CASH PAYMENTS FOR: Interest, net of amount capitalized $ 185 $ 135 $ 152 Income taxes $ 13 $ 274 $ 5 SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Fair value of equity consideration given to acquire AirTran ... $ 523S Fair value of common stock issued for conversion of debt $ 78 $ $ 381 _ 11 AA Item 8. Financial Statements and Supplementary Data SOUTHWEST AIRLINES CO. CONSOLIDATED BALANCE SHEET (in millions, except share data) DECEMBER 31, 2011 2010 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables. Inventories of parts and supplies, at cost Deferred income taxes .. Prepaid expenses and other current assets Total current assets Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts $ 829 $ 1,261 2,315 2,277 299 195 401 243 263 214 238 89 4,345 4,279 16,343 Less allowance for depreciation and amortization 15,542 13,991 2,423 2,122 456 230 18,421 6,294 5,765 12.127 10,578 970 626 606 $18,068 $15,463 Goodwill Other assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Air traffic liability Current maturities of long-term debt. Total current liabilities Long-term debt less current maturities Deferred income taxes... Deferred gains from sale and leaseback of aircraft Other noncurrent liabilities Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 807,611,634 shares issued in 2011 and 2010 Capital in excess of par value Retained earnings .... Accumulated other comprehensive loss .... Treasury stock, at cost: 35,050,991 and 60,177,362 shares in 2011 and 2010 respectively. Total stockholders' equity .... $ 1,057 $ 739 996 863 1,836 1,198 644 505 4,533 3,305 3,107 2,875 2,566 2,493 75 88 910 465 808 808 1,222 1,183 5,395 5,399 (224) (262) (324) (891) 6,877 6,237 $18,068 $15,463 Southwest Airlines Annual Report 77 715 SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF INCOME (in millions, except per share amounts) YEAR ENDED DECEMBER 31, 2011 2010 2009 OPERATING REVENUES: Passenger $14,735 $11,489 $ 9,892 Freight 139 125 118 Other 784 490 340 Total operating revenues 15,658 12,104 10,350 OPERATING EXPENSES: Salaries, wages, and benefits 4,371 3,704 3,468 Fuel and oil ..... 5,644 3,620 3,044 Maintenance materials and repairs 955 751 719 Aircraft rentals 308 180 186 Landing fees and other rentals 959 807 718 Depreciation and amortization 628 616 Acquisition and integration 134 8 Other operating expenses 1,879 1,418 1,337 Total operating expenses 14,965 11,116 10,088 OPERATING INCOME 693 988 262 OTHER EXPENSES (INCOME): Interest expense 194 167 186 Capitalized interest (12) (18) (21) Interest income (10) (12) (13) Other (gains) losses, net 198 106 (54) Total other expenses 370 98 INCOME BEFORE INCOME TAXES 323 745 164 PROVISION FOR INCOME TAXES 145 286 65 NET INCOME 178 S459 S 99 NET INCOME PER SHARE, BASIC $ .23 $ .62 S NET INCOME PER SHARE, DILUTED $ .23 S .61 $.13 Cash dividends declared per common share $.0180 S .0180 $.0180 243 .13 Section: Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available. An asterisk (*) will appear next to an incorrect entry in the outlined cells. Leave no cell blank. Ensure to enter "0" wherever applicable. Job Order Cost Flow 1., 3., and 4. Materials Inventory Work in Process Inventory Beg. bal. Beg. bal. End, bal. End, bal. Finished Goods Inventory Overhead Beg. bal. End, bal. End. bal. Accounts Receivable Payroll Payable End. bal. End. bal. Sales Cost of Goods Sold End. bal. End. bal. Ending Work in Process Inventory: Job 24-A Job 24-B Job 24-C Job 24-D Total 2. and 3. Cost of ending Work in Process Inventory: Direct Direct Job No. Materials Labor Overhead Total 24-A 24-B 24-C 24-D Costs of units completed: A B E G I K 67 4. 68 69 70 Job 24-A: July beginning balance July costs: 71 72 73 74 Total cost Product unit cost: / pairs 11 Job 24-C: 75 76 77 78 79 80 81 82 83 84 85 86 July beginning balance July costs: II Total cost 87 88 89 Product unit cost: / pairs 11 90 Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available. An asterisk (*) will appear next to an incorrect entry in the outlined cells. Leave no cell blank. Ensure to enter "0" wherever applicable. Allocation of Overhead 1. Nature Cosmetics Company Overhead Rate Computation Schedule For This Year (1) (2) Projected Percentage Overhead Cost Item Last Year Increase (3) Projection This Year (12) Total overhead Predetermined overhead rate for this year: / MH Per MH Machine Hours Predetermined Overhead Rate Overhead Applied Job No. 33 34 2. 35 36 37 38 39 40 41 2214 2215 2216 2217 2218 2219 Totals 42 43 44 45 46 47 3. 48 49 50 51 52 other - 366 SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY YEAR ENDED DECEMBER 31, 2011, 2010, AND 2009 Accumulated Capital in Common excess of Retained comprehensive Treasury (in millions, except per share amounts) Stock par value earnings income (loss) stock Total Balance at December 31, 2008.... $808 $1,215 $4,907 $(984) $(1,005) $4,941 Issuance of common and treasury stock pursuant to Employee stock plans (22) 42 20 Net tax benefit (expense) of options exercised ..... (13) (13) Share-based compensation 14 14 Cash dividends, $.018 per share (13) (13) Comprehensive income (loss): Net income... 99 99 Unrealized gain on fuel derivative instruments 366 Other .... 40 40 Total comprehensive income 505 Balance at December 31, 2009 $808 $1,216 $4,971 $(578) $ (963) $5,454 Issuance of common and treasury stock pursuant to Employee stock plans (18) 72 54 Net tax benefit (expense) of options exercised ........ (45) (45) Share-based compensation 12 12 Cash dividends, S.018 per share (13) (13) Comprehensive income (loss): Net income 459 459 Unrealized gain on fuel derivative instruments 330 Other ..... (14) Total comprehensive income 775 Balance at December 31, 2010 $808 $1,183 $5,399 $(262) $ (891) $6,237 Repurchase of common stock (225) (225) Issuance of common and treasury stock pursuant to Employee stock plans (14) 37 20 Issuance of stock to acquire AirTran (127) 650 523 Issuance of stock for conversion of debt 34 (27) 105 112 Net tax benefit (expense) of options exercised (5) Share-based compensation 13 13 Cash dividends, $.018 per share (14) (14) Comprehensive income (loss): Net income 178 178 Unrealized gain on fuel derivative instruments 67 67 Other .... (29) (29) Total comprehensive income 216 Balance at December 31, 2011 $808 $1,222 $5,395 $(224) $ (324) $6,877 - 1 1 330 (3) | S ||| (5) E - 1 1 2011 2010 2009 8:| 153 265 CONSOLIDATED STATEMENT OF CASH FLOWS YEAR ENDED DECEMBER 31, (in millions) CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 178 $ 459 $ 99 Adjustments to reconcile net income to cash provided by operating activities: Depreciation and amortization 715 628 616 Unrealized (gain) loss on fuel derivative instruments 90 139 14 Deferred income taxes 123 133 72 Amortization of deferred gains on sale and leaseback of aircraft (13) (14) (12) Changes in certain assets and liabilities (excluding the effects of acquired business): Accounts and other receivables (26) (26) 40 Other current assets .... (196) (8) (27) Accounts payable and accrued liabilities 253 193 59 Air traffic liability ..... 262 81 Cash collateral received from (provided to) derivative counterparties (195) (90) Other, net .... 194 (361) 133 Net cash provided by operating activities. 1,385 1,561 985 CASH FLOWS FROM INVESTING ACTIVITIES: Payment to acquire AirTran, net of AirTran cash on hand (35) Payments for purchase of property and equipment, net (968) (493) (585) Purchases of short-term investments (5,362) (5,624) (6,106) Proceeds from sales of short-term investments 5,314 4,852 5,120 Other, net 2 Net cash used in investing activities (1,051) (1,265) (1,569) CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of long-term debt 455 Proceeds from credit line borrowing 83 Proceeds from sale leaseback transactions Proceeds from Employee stock plans. 20 55 20 Proceeds from termination of interest rate derivative instrument 76 Payments of long-term debt and capital lease obligations (540) (155) (86) Payments of convertible debt obligations .... (81) Payment of revolving credit facility obligations (400) Payment of credit line borrowing obligations (44) (97) Payments of cash dividends (14) (13) (13) Repurchase of common stock (225) Other, net (2) 8 (13) Net cash provided by (used in) financing activities (766) (149) 330 NET CHANGE IN CASH AND CASH EQUIVALENTS (432) 147 (254) CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 1,261 1,114 1,368 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 829 $ 1,261 $ 1,114 CASH PAYMENTS FOR: Interest, net of amount capitalized $ 185 $ 135 $ 152 Income taxes $ 13 $ 274 $ 5 SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Fair value of equity consideration given to acquire AirTran ... $ 523S Fair value of common stock issued for conversion of debt $ 78 $ $ 381 _ 11 AA Item 8. Financial Statements and Supplementary Data SOUTHWEST AIRLINES CO. CONSOLIDATED BALANCE SHEET (in millions, except share data) DECEMBER 31, 2011 2010 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables. Inventories of parts and supplies, at cost Deferred income taxes .. Prepaid expenses and other current assets Total current assets Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts $ 829 $ 1,261 2,315 2,277 299 195 401 243 263 214 238 89 4,345 4,279 16,343 Less allowance for depreciation and amortization 15,542 13,991 2,423 2,122 456 230 18,421 6,294 5,765 12.127 10,578 970 626 606 $18,068 $15,463 Goodwill Other assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Air traffic liability Current maturities of long-term debt. Total current liabilities Long-term debt less current maturities Deferred income taxes... Deferred gains from sale and leaseback of aircraft Other noncurrent liabilities Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 807,611,634 shares issued in 2011 and 2010 Capital in excess of par value Retained earnings .... Accumulated other comprehensive loss .... Treasury stock, at cost: 35,050,991 and 60,177,362 shares in 2011 and 2010 respectively. Total stockholders' equity .... $ 1,057 $ 739 996 863 1,836 1,198 644 505 4,533 3,305 3,107 2,875 2,566 2,493 75 88 910 465 808 808 1,222 1,183 5,395 5,399 (224) (262) (324) (891) 6,877 6,237 $18,068 $15,463 Southwest Airlines Annual Report 77 715 SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF INCOME (in millions, except per share amounts) YEAR ENDED DECEMBER 31, 2011 2010 2009 OPERATING REVENUES: Passenger $14,735 $11,489 $ 9,892 Freight 139 125 118 Other 784 490 340 Total operating revenues 15,658 12,104 10,350 OPERATING EXPENSES: Salaries, wages, and benefits 4,371 3,704 3,468 Fuel and oil ..... 5,644 3,620 3,044 Maintenance materials and repairs 955 751 719 Aircraft rentals 308 180 186 Landing fees and other rentals 959 807 718 Depreciation and amortization 628 616 Acquisition and integration 134 8 Other operating expenses 1,879 1,418 1,337 Total operating expenses 14,965 11,116 10,088 OPERATING INCOME 693 988 262 OTHER EXPENSES (INCOME): Interest expense 194 167 186 Capitalized interest (12) (18) (21) Interest income (10) (12) (13) Other (gains) losses, net 198 106 (54) Total other expenses 370 98 INCOME BEFORE INCOME TAXES 323 745 164 PROVISION FOR INCOME TAXES 145 286 65 NET INCOME 178 S459 S 99 NET INCOME PER SHARE, BASIC $ .23 $ .62 S NET INCOME PER SHARE, DILUTED $ .23 S .61 $.13 Cash dividends declared per common share $.0180 S .0180 $.0180 243 .13 Section: Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available. An asterisk (*) will appear next to an incorrect entry in the outlined cells. Leave no cell blank. Ensure to enter "0" wherever applicable. Job Order Cost Flow 1., 3., and 4. Materials Inventory Work in Process Inventory Beg. bal. Beg. bal. End, bal. End, bal. Finished Goods Inventory Overhead Beg. bal. End, bal. End. bal. Accounts Receivable Payroll Payable End. bal. End. bal. Sales Cost of Goods Sold End. bal. End. bal. Ending Work in Process Inventory: Job 24-A Job 24-B Job 24-C Job 24-D Total 2. and 3. Cost of ending Work in Process Inventory: Direct Direct Job No. Materials Labor Overhead Total 24-A 24-B 24-C 24-D Costs of units completed: A B E G I K 67 4. 68 69 70 Job 24-A: July beginning balance July costs: 71 72 73 74 Total cost Product unit cost: / pairs 11 Job 24-C: 75 76 77 78 79 80 81 82 83 84 85 86 July beginning balance July costs: II Total cost 87 88 89 Product unit cost: / pairs 11 90 Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available. An asterisk (*) will appear next to an incorrect entry in the outlined cells. Leave no cell blank. Ensure to enter "0" wherever applicable. Allocation of Overhead 1. Nature Cosmetics Company Overhead Rate Computation Schedule For This Year (1) (2) Projected Percentage Overhead Cost Item Last Year Increase (3) Projection This Year (12) Total overhead Predetermined overhead rate for this year: / MH Per MH Machine Hours Predetermined Overhead Rate Overhead Applied Job No. 33 34 2. 35 36 37 38 39 40 41 2214 2215 2216 2217 2218 2219 Totals 42 43 44 45 46 47 3. 48 49 50 51 52Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started