The options for each underlined sentence are as following in order. Please select one option for each underlined sentence.

The options for each underlined sentence are as following in order. Please select one option for each underlined sentence.

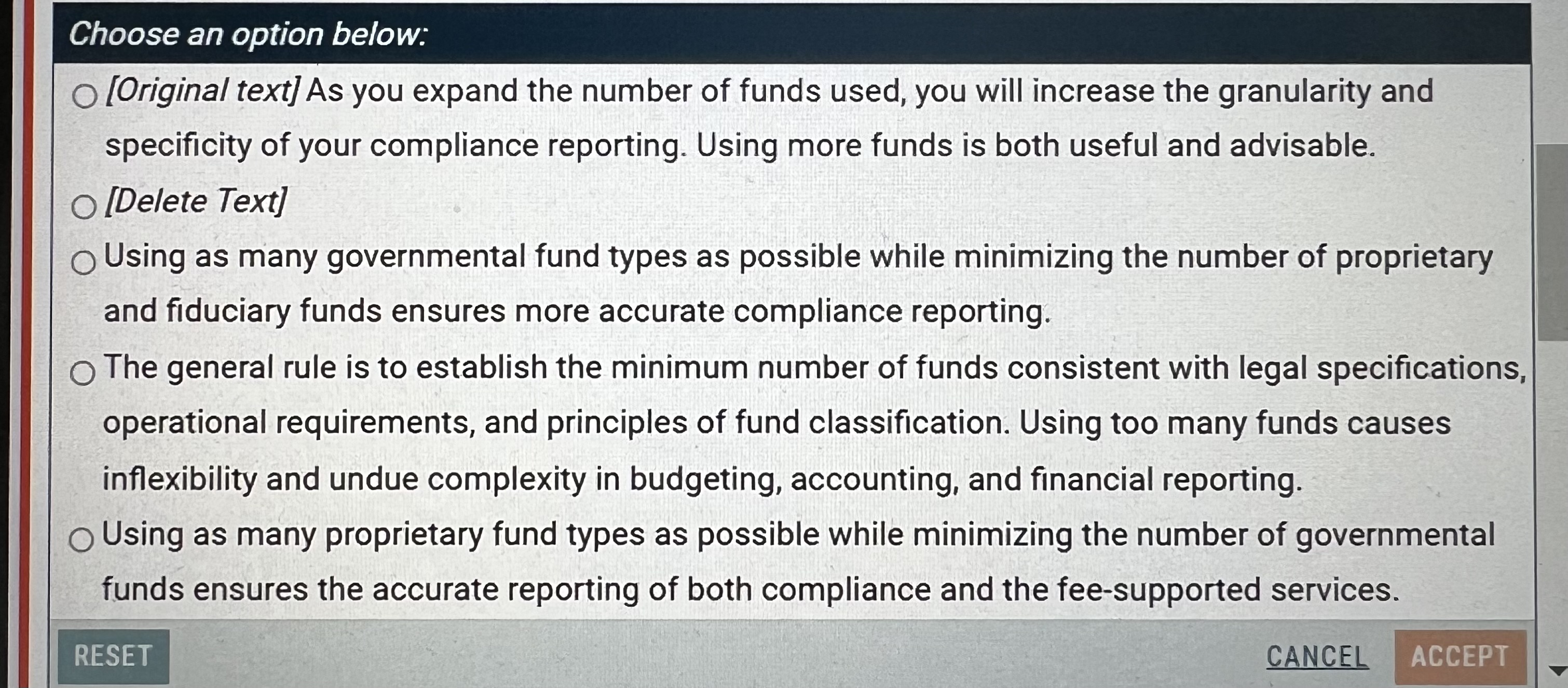

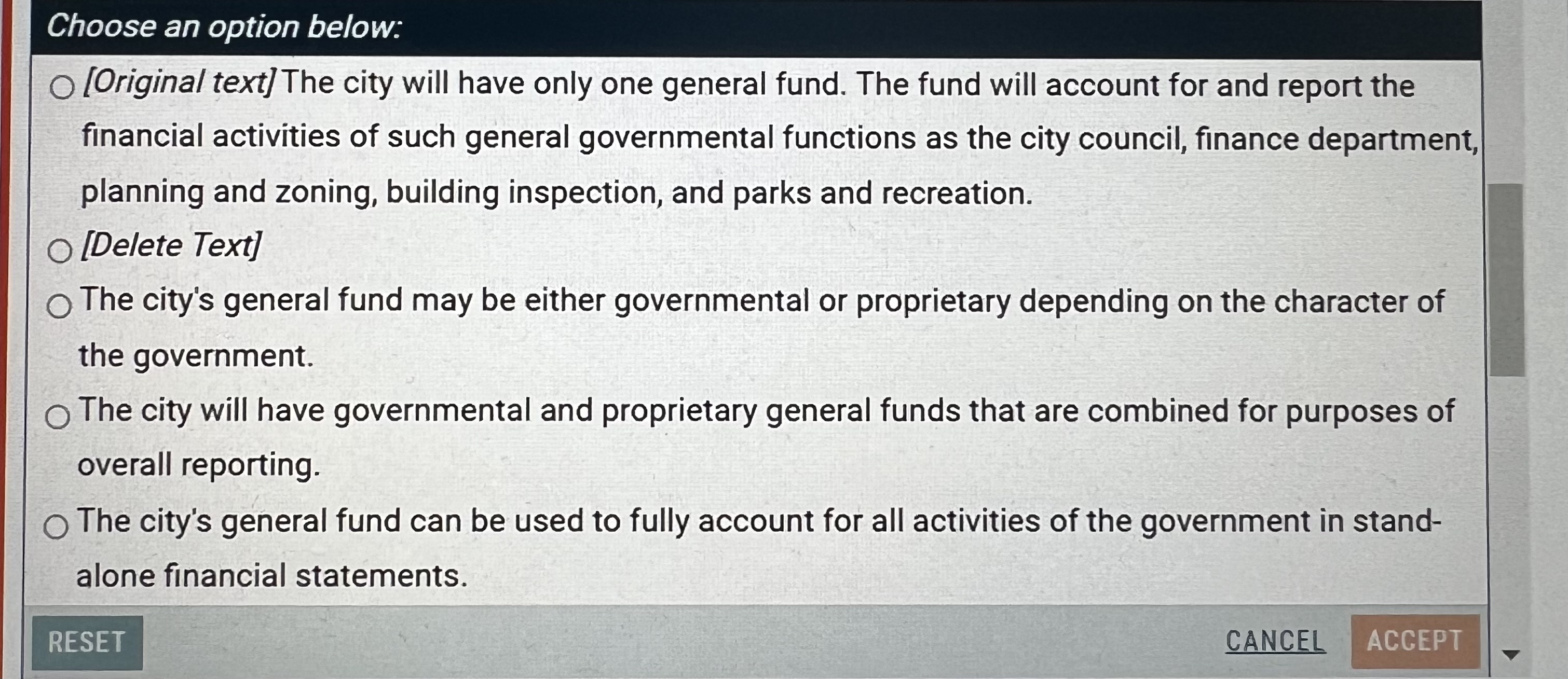

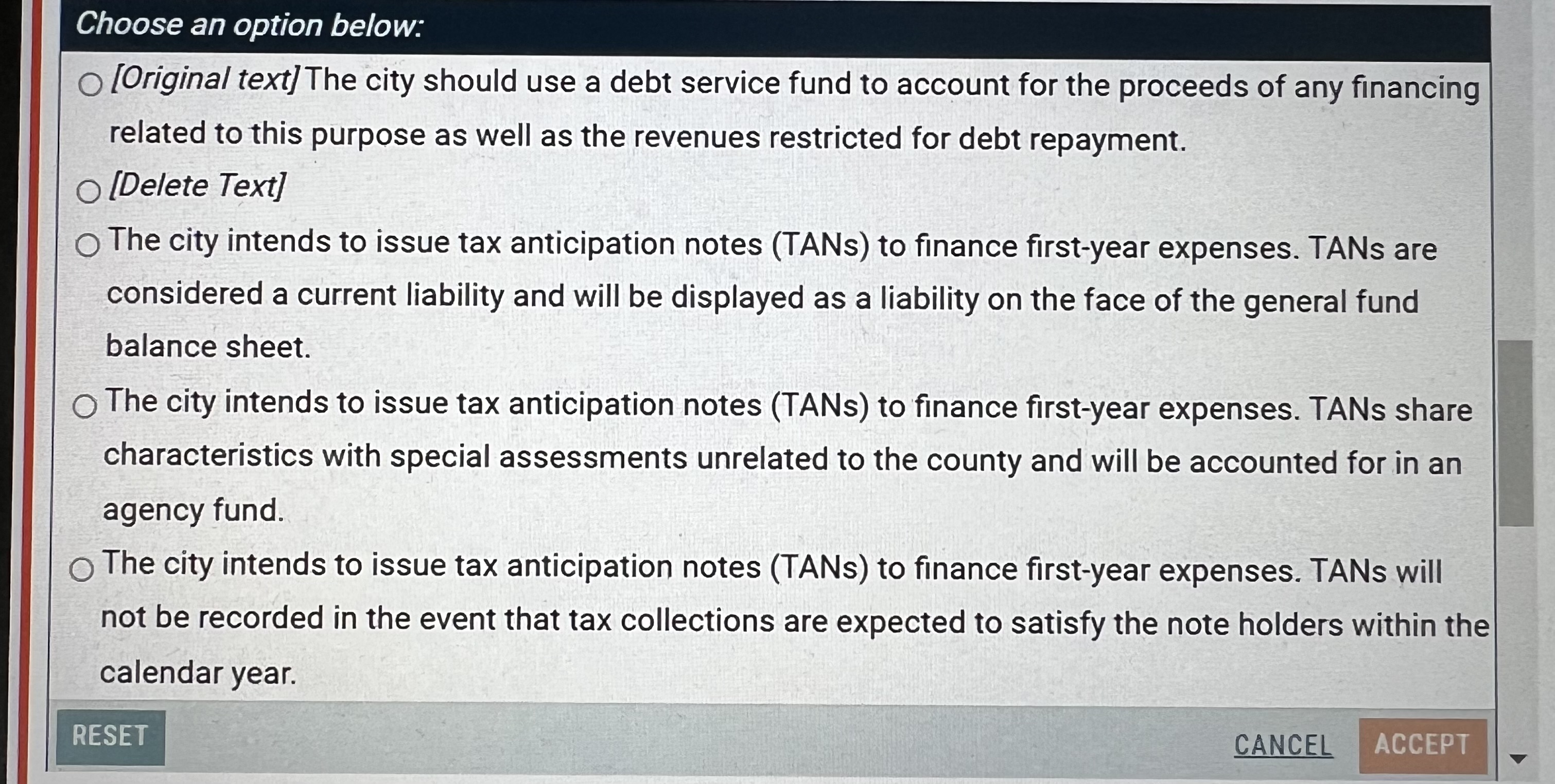

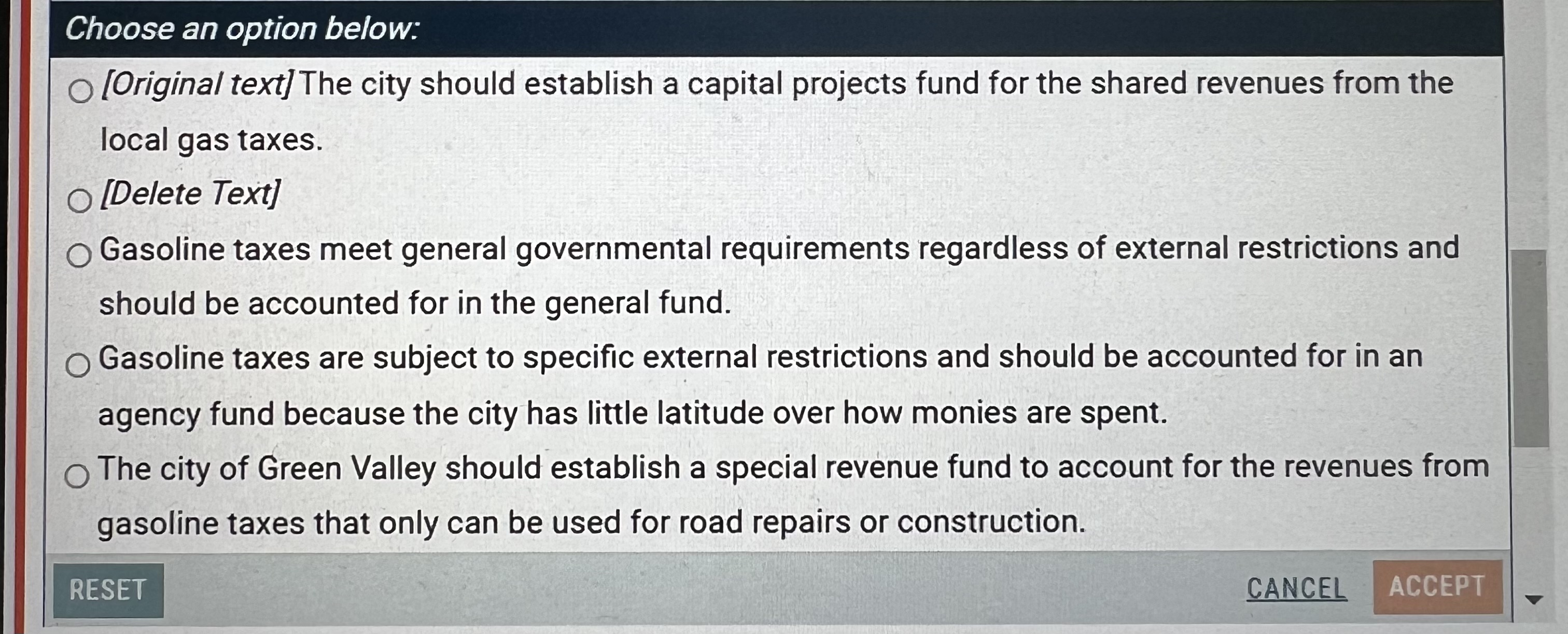

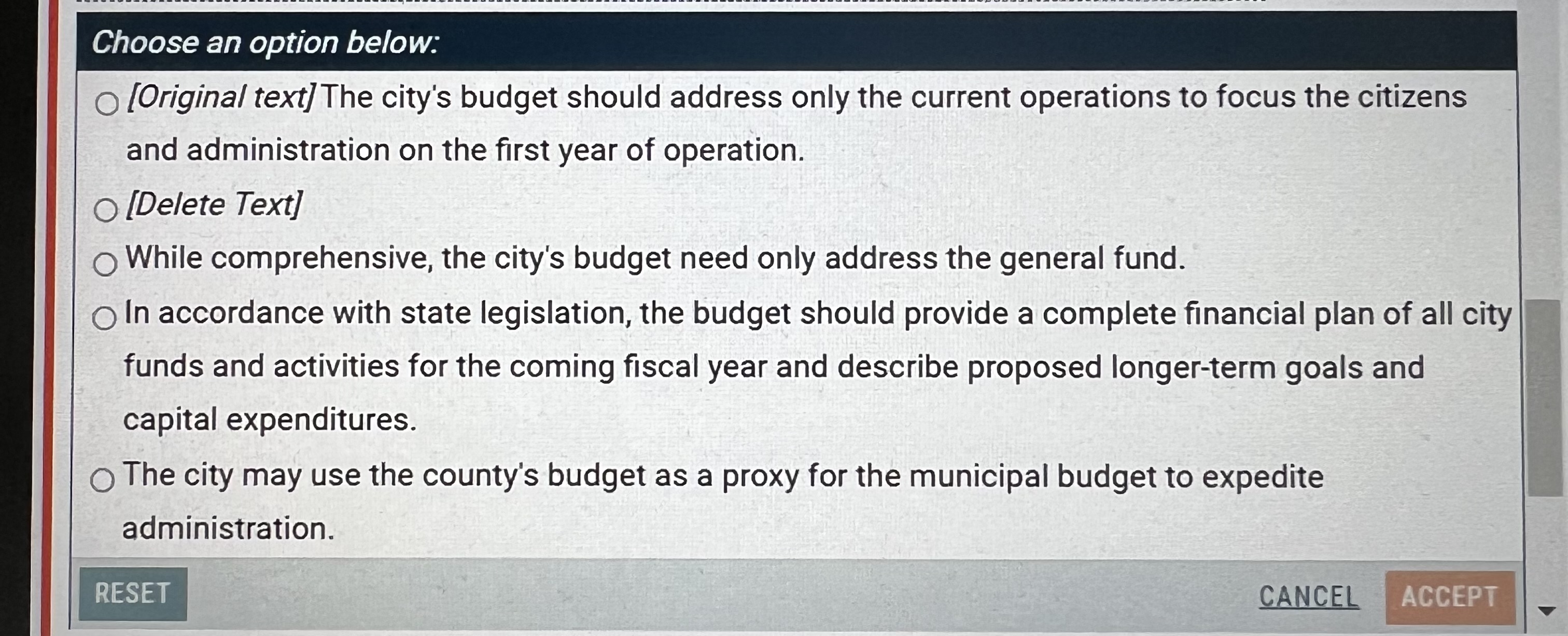

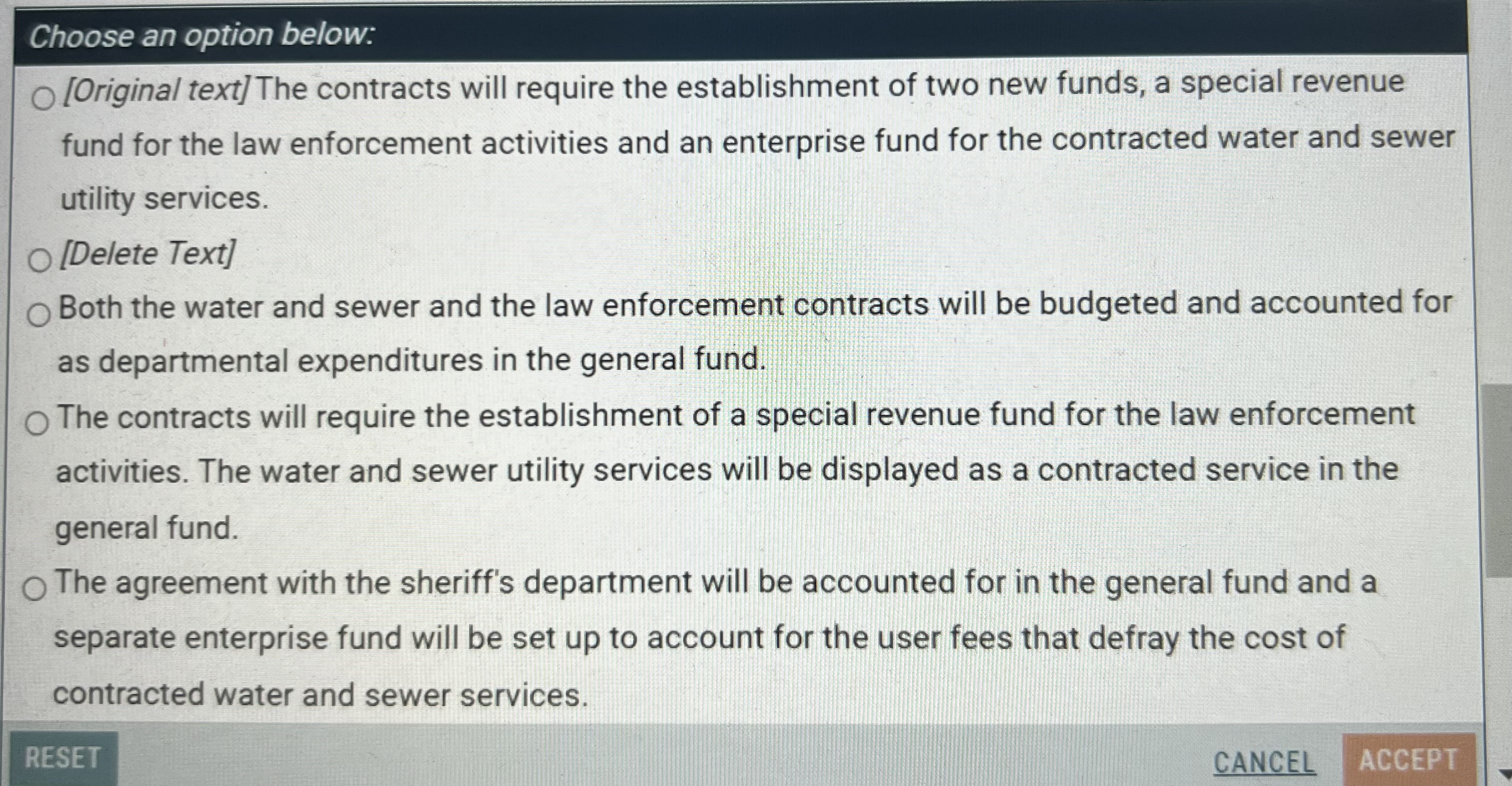

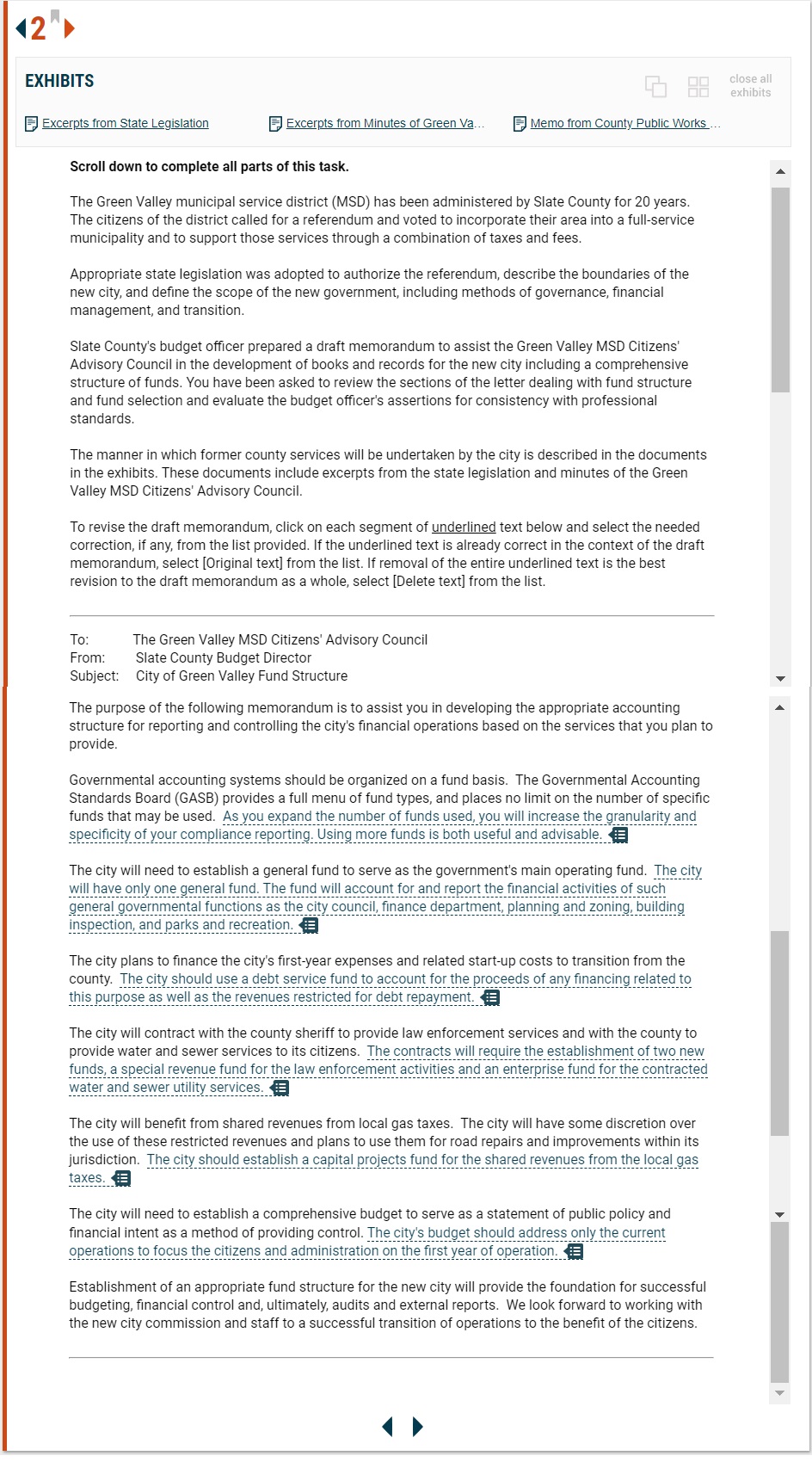

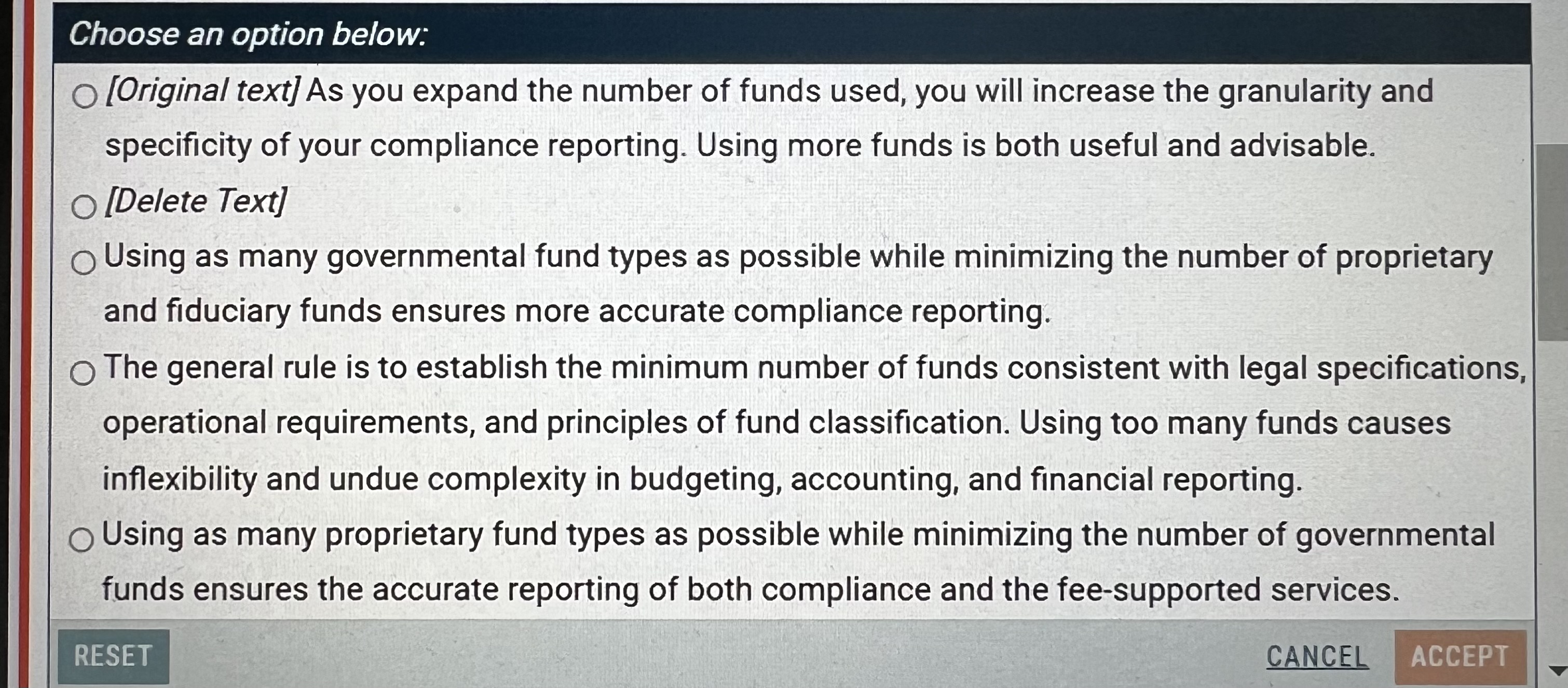

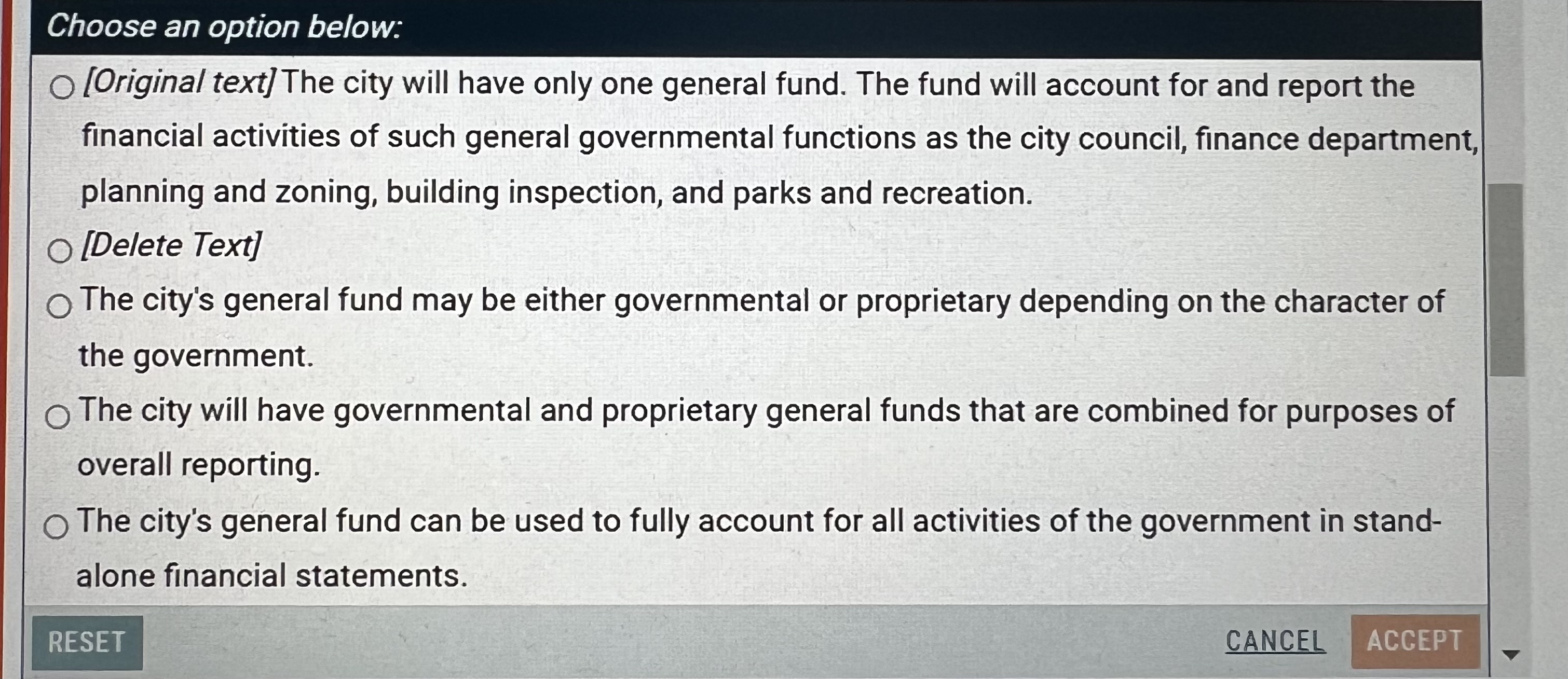

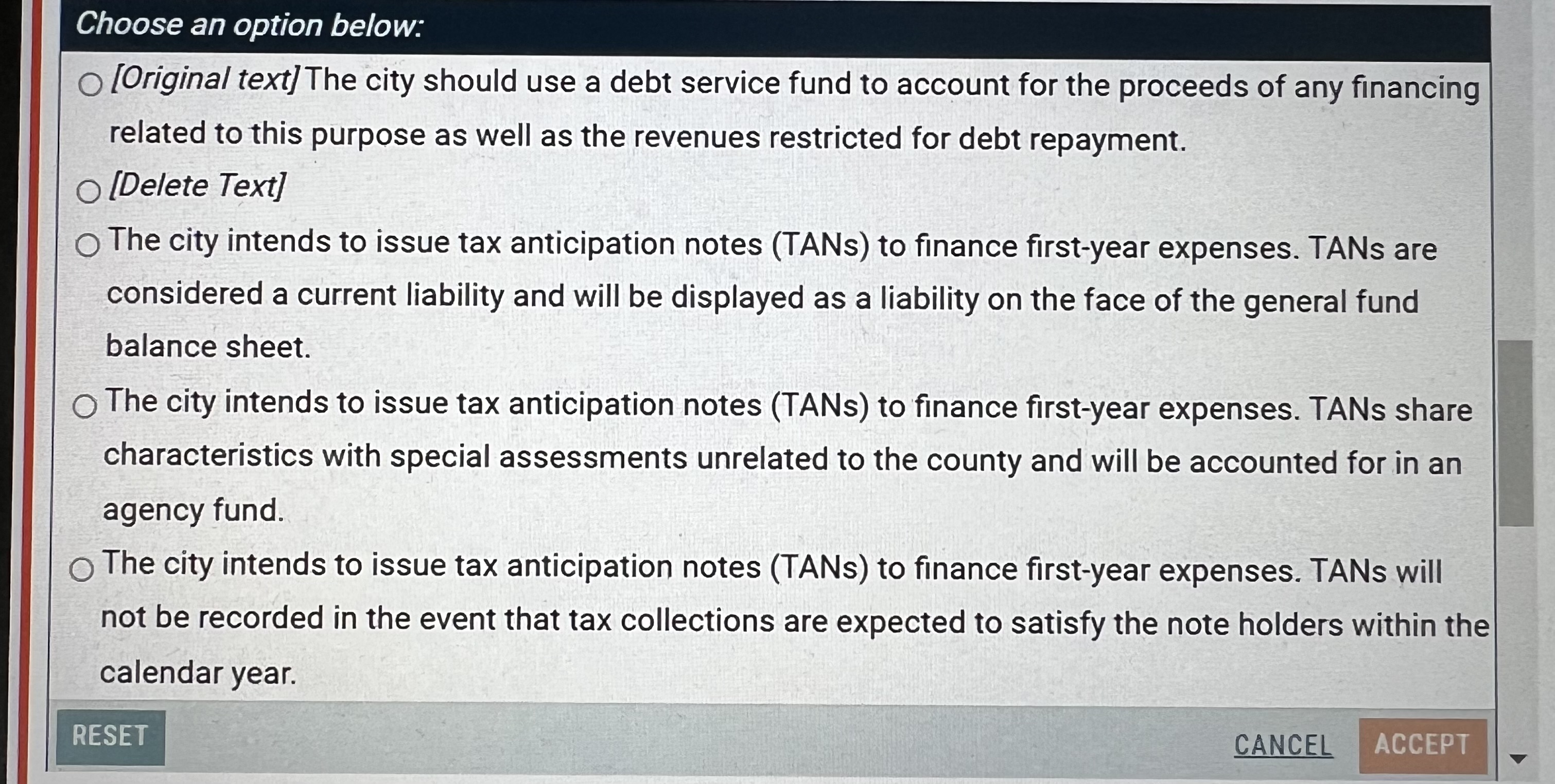

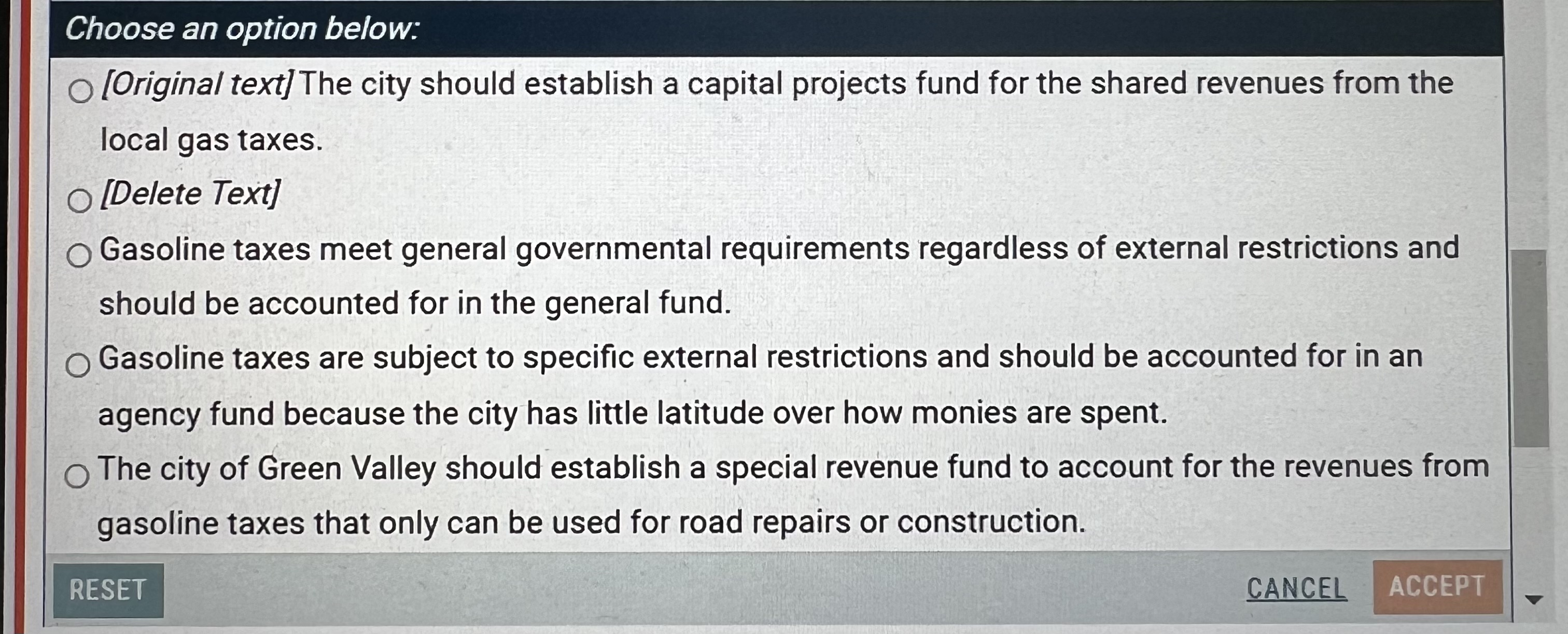

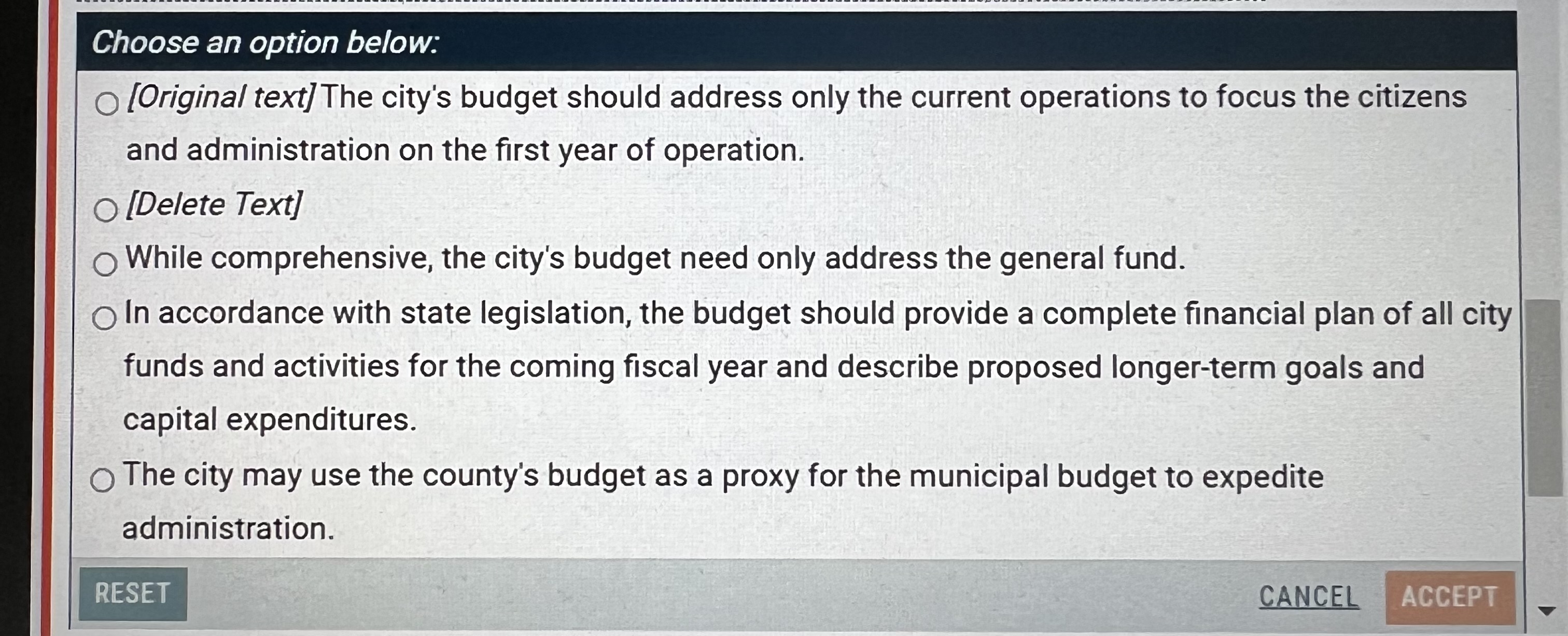

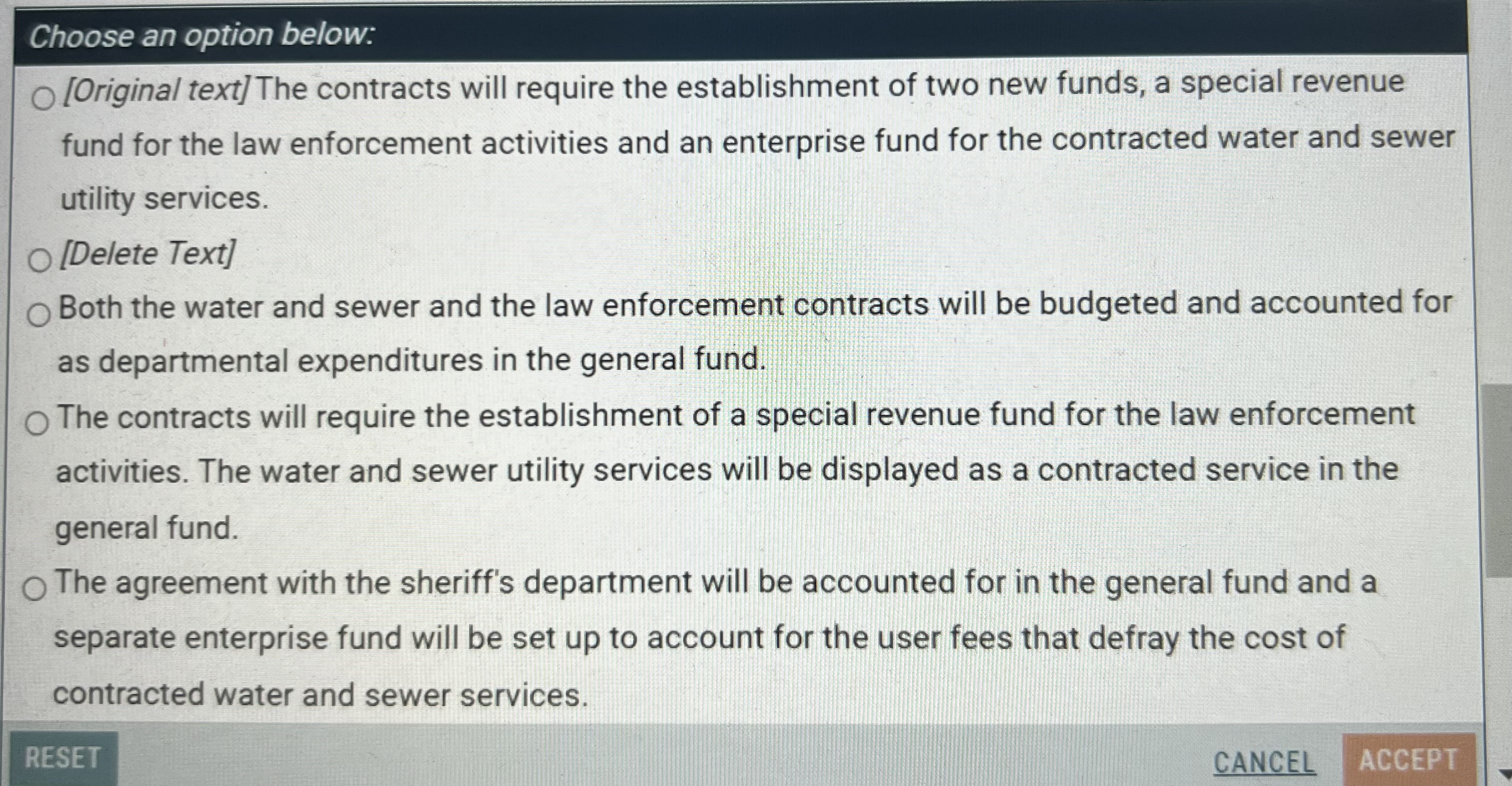

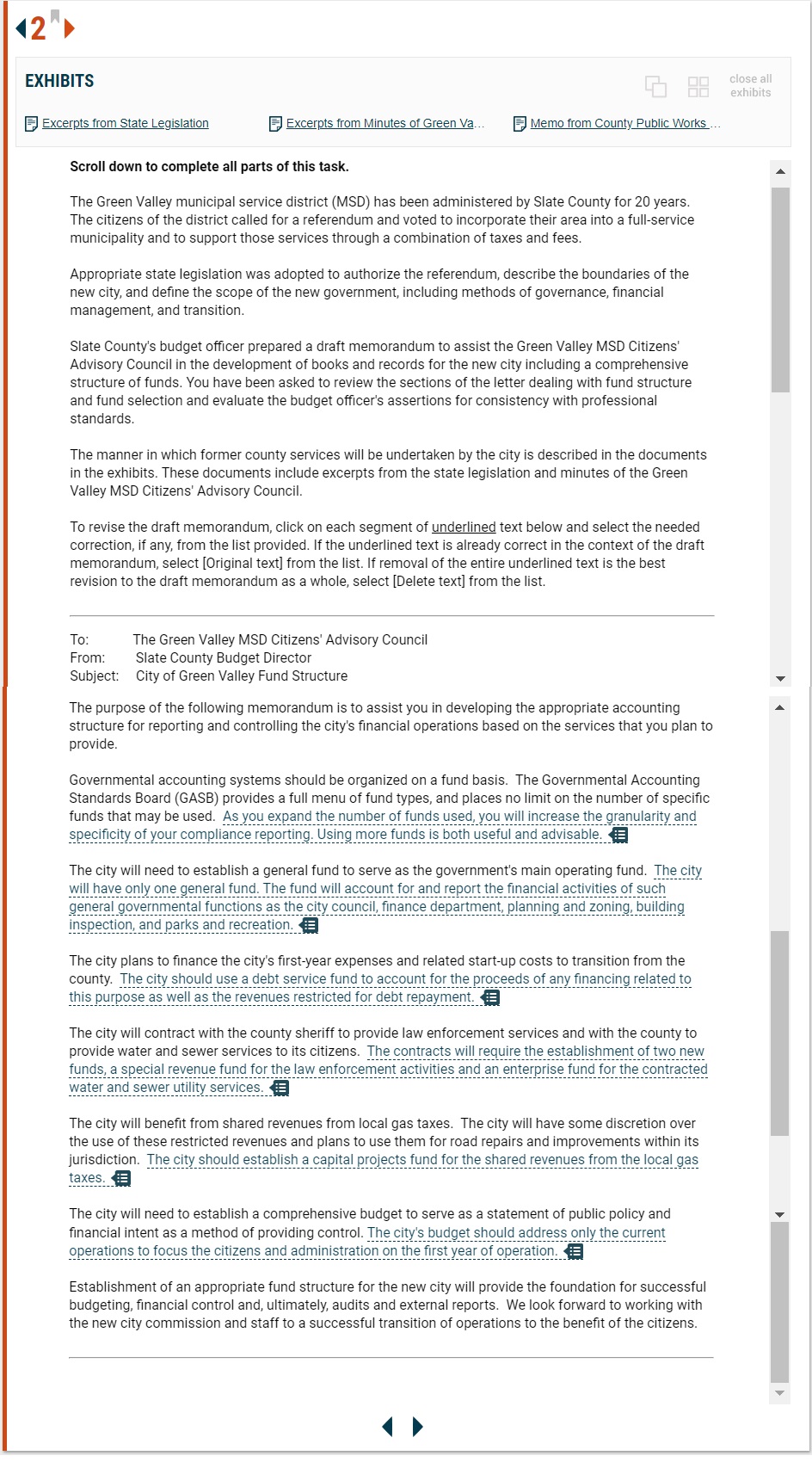

Scroll down to complete all parts of this task. The Green Valley municipal service district (MSD) has been administered by Slate County for 20 years. The citizens of the district called for a referendum and voted to incorporate their area into a full-service municipality and to support those services through a combination of taxes and fees. Appropriate state legislation was adopted to authorize the referendum, describe the boundaries of the new city, and define the scope of the new government, including methods of governance, financial management, and transition. Slate County's budget officer prepared a draft memorandum to assist the Green Valley MSD Citizens' Advisory Council in the development of books and records for the new city including a comprehensive structure of funds. You have been asked to review the sections of the letter dealing with fund structure and fund selection and evaluate the budget officer's assertions for consistency with professional standards. The manner in which former county services will be undertaken by the city is described in the documents in the exhibits. These documents include excerpts from the state legislation and minutes of the Green Valley MSD Citizens' Advisory Council. To revise the draft memorandum, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the draft memorandum, select [Original text] from the list. If removal of the entire underlined text is the best revision to the draft memorandum as a whole, select [Delete text] from the list. To: The Green Valley MSD Citizens' Advisory Council From: Slate County Budget Director Subject: City of Green Valley Fund Structure The purpose of the following memorandum is to assist you in developing the appropriate accounting structure for reporting and controlling the city's financial operations based on the services that you plan to provide. Governmental accounting systems should be organized on a fund basis. The Governmental Accounting Standards Board (GASB) provides a full menu of fund types, and places no limit on the number of specific funds that may be used. As you expand the number of funds used, you will increase the granularity and specificity of your compliance reporting. Using more funds is both useful and advisable. : The city will need to establish a general fund to serve as the government's main operating fund. The city will have only one general fund. The fund will account for and report the financial activities of such general governmental functions as the city council, finance department, planning and zoning, building inspection, and parks and recreation. : The city plans to finance the city's first-year expenses and related start-up costs to transition from the county. The city should use a debt service fund to account for the proceeds of any financing related to this purpose as well as the revenues restricted for debt repayment. := The city will contract with the county sheriff to provide law enforcement services and with the county to provide water and sewer services to its citizens. The contracts will require the establishment of two new funds, a special revenue fund for the law enforcement activities and an enterprise fund for the contracted water and sewer utility services. The city will benefit from shared revenues from local gas taxes. The city will have some discretion over the use of these restricted revenues and plans to use them for road repairs and improvements within its jurisdiction. The city should establish a capital projects fund for the shared revenues from the local gas taxes. The city will need to establish a comprehensive budget to serve as a statement of public policy and financial intent as a method of providing control. The city's budget should address only the current operations to focus the citizens and administration on the first year of operation. : Establishment of an appropriate fund structure for the new city will provide the foundation for successful budgeting, financial control and, ultimately, audits and external reports. We look forward to working with the new city commission and staff to a successful transition of operations to the benefit of the citizens. Choose an option below: [Original text] As you expand the number of funds used, you will increase the granularity and specificity of your compliance reporting. Using more funds is both useful and advisable. [Delete Text] Using as many governmental fund types as possible while minimizing the number of proprietary and fiduciary funds ensures more accurate compliance reporting. The general rule is to establish the minimum number of funds consistent with legal specifications operational requirements, and principles of fund classification. Using too many funds causes inflexibility and undue complexity in budgeting, accounting, and financial reporting. Using as many proprietary fund types as possible while minimizing the number of governmental funds ensures the accurate reporting of both compliance and the fee-supported services. [Original text] The city will have only one general fund. The fund will account for and report the financial activities of such general governmental functions as the city council, finance departmen planning and zoning, building inspection, and parks and recreation. [Delete Text] The city's general fund may be either governmental or proprietary depending on the character of the government. The city will have governmental and proprietary general funds that are combined for purposes of overall reporting. The city's general fund can be used to fully account for all activities of the government in standalone financial statements. Choose an option below: [Original text] The city should use a debt service fund to account for the proceeds of any financing related to this purpose as well as the revenues restricted for debt repayment. [Delete Text] The city intends to issue tax anticipation notes (TANs) to finance first-year expenses. TANs are considered a current liability and will be displayed as a liability on the face of the general fund balance sheet. The city intends to issue tax anticipation notes (TANs) to finance first-year expenses. TANs share characteristics with special assessments unrelated to the county and will be accounted for in an agency fund. The city intends to issue tax anticipation notes (TANs) to finance first-year expenses. TANs will not be recorded in the event that tax collections are expected to satisfy the note holders within the calendar year. Choose an option below: [Original text] The city should establish a capital projects fund for the shared revenues from the local gas taxes. [Delete Text] Gasoline taxes meet general governmental requirements regardless of external restrictions and should be accounted for in the general fund. Gasoline taxes are subject to specific external restrictions and should be accounted for in an agency fund because the city has little latitude over how monies are spent. The city of Green Valley should establish a special revenue fund to account for the revenues from gasoline taxes that only can be used for road repairs or construction. Choose an option below: [Original text] The city's budget should address only the current operations to focus the citizens and administration on the first year of operation. [Delete Text] While comprehensive, the city's budget need only address the general fund. In accordance with state legislation, the budget should provide a complete financial plan of all cit funds and activities for the coming fiscal year and describe proposed longer-term goals and capital expenditures. The city may use the county's budget as a proxy for the municipal budget to expedite administration. [Original text] The contracts will require the establishment of two new funds, a special revenue fund for the law enforcement activities and an enterprise fund for the contracted water and sewer utility services. [Delete Text] Both the water and sewer and the law enforcement contracts will be budgeted and accounted for as departmental expenditures in the general fund. The contracts will require the establishment of a special revenue fund for the law enforcement activities. The water and sewer utility services will be displayed as a contracted service in the general fund. The agreement with the sheriff's department will be accounted for in the general fund and a separate enterprise fund will be set up to account for the user fees that defray the cost of contracted water and sewer services. Scroll down to complete all parts of this task. The Green Valley municipal service district (MSD) has been administered by Slate County for 20 years. The citizens of the district called for a referendum and voted to incorporate their area into a full-service municipality and to support those services through a combination of taxes and fees. Appropriate state legislation was adopted to authorize the referendum, describe the boundaries of the new city, and define the scope of the new government, including methods of governance, financial management, and transition. Slate County's budget officer prepared a draft memorandum to assist the Green Valley MSD Citizens' Advisory Council in the development of books and records for the new city including a comprehensive structure of funds. You have been asked to review the sections of the letter dealing with fund structure and fund selection and evaluate the budget officer's assertions for consistency with professional standards. The manner in which former county services will be undertaken by the city is described in the documents in the exhibits. These documents include excerpts from the state legislation and minutes of the Green Valley MSD Citizens' Advisory Council. To revise the draft memorandum, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the draft memorandum, select [Original text] from the list. If removal of the entire underlined text is the best revision to the draft memorandum as a whole, select [Delete text] from the list. To: The Green Valley MSD Citizens' Advisory Council From: Slate County Budget Director Subject: City of Green Valley Fund Structure The purpose of the following memorandum is to assist you in developing the appropriate accounting structure for reporting and controlling the city's financial operations based on the services that you plan to provide. Governmental accounting systems should be organized on a fund basis. The Governmental Accounting Standards Board (GASB) provides a full menu of fund types, and places no limit on the number of specific funds that may be used. As you expand the number of funds used, you will increase the granularity and specificity of your compliance reporting. Using more funds is both useful and advisable. : The city will need to establish a general fund to serve as the government's main operating fund. The city will have only one general fund. The fund will account for and report the financial activities of such general governmental functions as the city council, finance department, planning and zoning, building inspection, and parks and recreation. : The city plans to finance the city's first-year expenses and related start-up costs to transition from the county. The city should use a debt service fund to account for the proceeds of any financing related to this purpose as well as the revenues restricted for debt repayment. := The city will contract with the county sheriff to provide law enforcement services and with the county to provide water and sewer services to its citizens. The contracts will require the establishment of two new funds, a special revenue fund for the law enforcement activities and an enterprise fund for the contracted water and sewer utility services. The city will benefit from shared revenues from local gas taxes. The city will have some discretion over the use of these restricted revenues and plans to use them for road repairs and improvements within its jurisdiction. The city should establish a capital projects fund for the shared revenues from the local gas taxes. The city will need to establish a comprehensive budget to serve as a statement of public policy and financial intent as a method of providing control. The city's budget should address only the current operations to focus the citizens and administration on the first year of operation. : Establishment of an appropriate fund structure for the new city will provide the foundation for successful budgeting, financial control and, ultimately, audits and external reports. We look forward to working with the new city commission and staff to a successful transition of operations to the benefit of the citizens. Choose an option below: [Original text] As you expand the number of funds used, you will increase the granularity and specificity of your compliance reporting. Using more funds is both useful and advisable. [Delete Text] Using as many governmental fund types as possible while minimizing the number of proprietary and fiduciary funds ensures more accurate compliance reporting. The general rule is to establish the minimum number of funds consistent with legal specifications operational requirements, and principles of fund classification. Using too many funds causes inflexibility and undue complexity in budgeting, accounting, and financial reporting. Using as many proprietary fund types as possible while minimizing the number of governmental funds ensures the accurate reporting of both compliance and the fee-supported services. [Original text] The city will have only one general fund. The fund will account for and report the financial activities of such general governmental functions as the city council, finance departmen planning and zoning, building inspection, and parks and recreation. [Delete Text] The city's general fund may be either governmental or proprietary depending on the character of the government. The city will have governmental and proprietary general funds that are combined for purposes of overall reporting. The city's general fund can be used to fully account for all activities of the government in standalone financial statements. Choose an option below: [Original text] The city should use a debt service fund to account for the proceeds of any financing related to this purpose as well as the revenues restricted for debt repayment. [Delete Text] The city intends to issue tax anticipation notes (TANs) to finance first-year expenses. TANs are considered a current liability and will be displayed as a liability on the face of the general fund balance sheet. The city intends to issue tax anticipation notes (TANs) to finance first-year expenses. TANs share characteristics with special assessments unrelated to the county and will be accounted for in an agency fund. The city intends to issue tax anticipation notes (TANs) to finance first-year expenses. TANs will not be recorded in the event that tax collections are expected to satisfy the note holders within the calendar year. Choose an option below: [Original text] The city should establish a capital projects fund for the shared revenues from the local gas taxes. [Delete Text] Gasoline taxes meet general governmental requirements regardless of external restrictions and should be accounted for in the general fund. Gasoline taxes are subject to specific external restrictions and should be accounted for in an agency fund because the city has little latitude over how monies are spent. The city of Green Valley should establish a special revenue fund to account for the revenues from gasoline taxes that only can be used for road repairs or construction. Choose an option below: [Original text] The city's budget should address only the current operations to focus the citizens and administration on the first year of operation. [Delete Text] While comprehensive, the city's budget need only address the general fund. In accordance with state legislation, the budget should provide a complete financial plan of all cit funds and activities for the coming fiscal year and describe proposed longer-term goals and capital expenditures. The city may use the county's budget as a proxy for the municipal budget to expedite administration. [Original text] The contracts will require the establishment of two new funds, a special revenue fund for the law enforcement activities and an enterprise fund for the contracted water and sewer utility services. [Delete Text] Both the water and sewer and the law enforcement contracts will be budgeted and accounted for as departmental expenditures in the general fund. The contracts will require the establishment of a special revenue fund for the law enforcement activities. The water and sewer utility services will be displayed as a contracted service in the general fund. The agreement with the sheriff's department will be accounted for in the general fund and a separate enterprise fund will be set up to account for the user fees that defray the cost of contracted water and sewer services

The options for each underlined sentence are as following in order. Please select one option for each underlined sentence.

The options for each underlined sentence are as following in order. Please select one option for each underlined sentence.