Multiple Choice Questions 1. What is the best source of income for a corporation? a. Discontinued operations

Question:

Multiple Choice Questions

1. What is the best source of income for a corporation?

a. Discontinued operations

b. Continuing operations

c. Extraordinary items

d. Prior-period adjustments

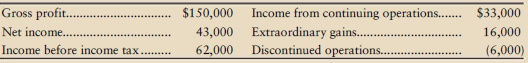

Michaels Lotion Company reports several earnings numbers on its current-year income statement (parentheses indicate a loss):

2. How much net income would most investment analysts predict for Michaels to earn next year?

a. $43,000

b. $16,000

c. $33,000

d. $49,000

3. Return to the preceding question. Suppose you are evaluating Michaels Lotion Company stock as an investment. You require an 8% rate of return on investments, so you capitalize Michael’s earnings at 8%. How much are you willing to pay for all of Michael’s stock?

a. $1,875,000

b. $412,500

c. $537,500

d. $775,000

4. Superior Value Corporation had the following items that were labeled extraordinary on its income statement:

Extraordinary flood loss.........................$100,000

Extraordinary gain on lawsuit................ 150,000

Net income from operations, before income tax and before these extraordinary items, totals $240,000, and the income tax rate is 30%. Superior Values bottom line net income after tax is

a. $273,000.

b. $203,000.

c. $290,000.

d. $168,000.

5. Superior Value Corporation in question 36 has 9,000 shares of 7%, $100 par preferred stock, and 200,000 shares of common stock outstanding. Earnings per share for net income is

a. $0.58.

b. $1.20.

c. $1.51.

d. $0.70.

6. Earnings per share is not reported for

a. Extraordinary items.

b. Discontinued operations.

c. Continuing operations.

d. Comprehensive income.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial accounting

ISBN: 978-0136108863

8th Edition

Authors: Walter T. Harrison, Charles T. Horngren, William Bill Thomas