On January 1, 2011, Violet purchased 30% of the shares of Demster for $60,050. At this date,

Question:

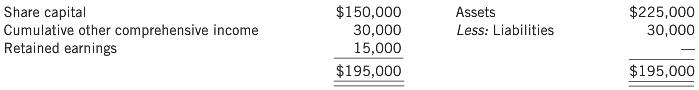

On January 1, 2011, Violet purchased 30% of the shares of Demster for $60,050. At this date, the account balances of Demster were:

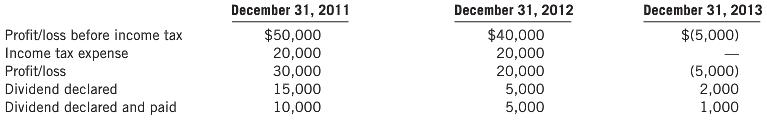

At January 1, 2011, all the identifiable assets and liabilities of Demster were recorded at fair value except for plant, whose fair value was $5,000 greater than carrying amount. This plant has an expected future life of five years, the benefits being received evenly over this period. Dividend revenue is recognized when dividends are declared. The tax rate is 30%. The results of Demster for the next three years were:

Required

(a) Calculate the share of profit or loss from Demster for each of the years ending December 31, 2011, 2012, and 2013.

(b) Calculate the balance in the Investment in Demster account for each of the years ending December 31, 2011, 2012, and 2013.

Step by Step Answer: