On June 1, 2009, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with

Question:

On June 1, 2009, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and the straight-line cost recovery method was used. The property was sold on June 21, 2013, for $385,000.

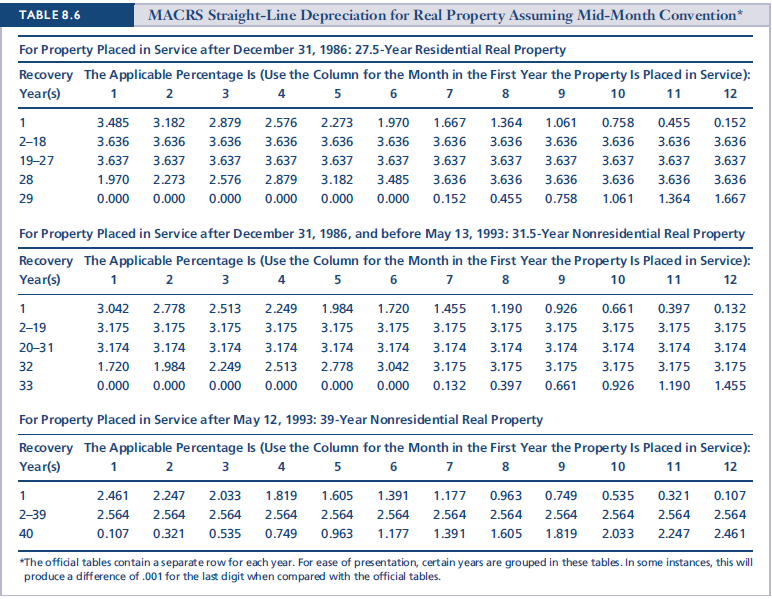

a. Compute the cost recovery and adjusted basis for the building using Table 8.6 from Chapter 8.

b. What are the amount and nature of Skylark's gain or loss from disposition of the building? What amount, if any, of the gain is unrecaptured § 1250 gain?

Transcribed Image Text:

MACRS Straight-Line Depreciation for Real Property Assuming Mid-Month Convention* TABLE 8.6 For Property Placed in Service after December 31, 1986: 27.5-Year Residential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): Year(s) 5 6 1 2 3 4 10 11 12 2.576 2.273 1.970 1.364 0.758 3.485 3.182 2.879 1.667 1.061 0.455 0.152 3.636 3.636 3.636 3.636 3.636 2-18 3.636 3.636 3.636 3.636 3.636 3.636 3.636 19-27 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 2.273 2.576 3.485 3.636 28 1.970 2.879 3.182 3.636 3.636 3.636 3.636 3.636 0.000 0.000 0.000 0.455 1.364 1.667 29 0.000 0.000 0.000 0.152 0.758 1.061 For Property Placed in Service after December 31, 1986, and before May 13, 1993: 31.5-Year Nonresidential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): 1 Year(s) 2 3 4 5 6 10 11 12 1.720 1.190 0.132 3.042 2.778 2.513 2.249 1.984 1.455 0.926 0.661 0.397 3.175 3.175 2-19 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 20-31 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 1.720 1.984 2.249 2.778 3.042 3.175 3.175 32 2.513 3.175 3.175 3.175 3.175 0.000 0.000 0.000 0.000 0.397 0.661 0.926 1.190 1.455 33 0.000 0.000 0.132 For Property Placed in Service after May 12, 1993: 39-Year Nonresidential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): Year(s) 1 5 6 7 8 2 3 10 11 12 2.461 2.033 1.605 1.391 0.963 0.749 0.535 2.247 1.819 1.177 0.321 0.107 2-39 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 0.535 0.749 1.391 1.605 2.033 40 0.107 0.321 0.963 1.177 1.819 2.247 2.461 *The official tables contain a separate row for each year. For ease of presentation, certain years are grouped in these tables. In some instances, this will produce a difference of .001 for the last digit when compared with the official tables.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

a Store cost 400000 2009 cost recovery rate 01391 2010 cost recovery rate 02564 2011 cost recover...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2014 Comprehensive Volume

ISBN: 9781285180922

37th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business Law questions

-

On June 1, 2010, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and...

-

On June 1, 2012, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and...

-

On June 1, 2011, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and...

-

In the game of roulette, a gambler who wins the bet receives $36 for every dollar she or he bet. A gambler who does not win receives nothing. If the gambler bets $1, what is the expected value of the...

-

How does a company account for the disposal of an asset? How does it report gains and losses on its financial statements?

-

Calculating Project Cash Flow from Assets In the previous problem, suppose the project requires an initial investment in net working capital of 2,000 and the investment will have a market value of...

-

Assume that the contemporary apparel company rag & bone has embarked on a new IMC strategy. It has chosen to advertise on TV during NBC Nightly News and in print in Time magazine. The message is...

-

Early in 2010, Inez Marcus, the chief financial officer for Suarez Manufacturing, was given the task of assessing the impact of a proposed risky investment on the firm's stock value. To perform the...

-

Substantive procedures and audit evidence Background You are about to complete the planning stage of the audit of Seymour Print Ltd and you are considering your approach to several events that have...

-

Richard chooses technique 0 and 2 requiring 10+10-20 efforts and provising 10+11=21 benefits. Hence, 21 is returned as the output Example 2: input1: 3 input2: (10,10,10,10) input3: (10,11,12,15)...

-

On December 1, 2011, Lavender Manufacturing Company (a corporation) purchased another company's assets, including a patent. The patent was used in Lavender's manufacturing operations; $49,500 was...

-

On May 2, 1986, Hannah acquired residential real estate for $450,000. Of the cost, $100,000 was allocated to the land and $350,000 to the building. On January 20, 2013, the building, which then had...

-

Yorgi purchases qualified small business stock in Gnu Company, Inc., on September 15, 2008, for $50,000. She sells the shares for $400,000 on December 30, 2016. The stock retains its qualified small...

-

How do global power dynamics shape international relations, and what impact do these dynamics have on the balance of power among nation-states ?

-

(paragraph form each question) how do you formulate a strategy?, how do you implement a strategy? how do you evaluate a strategy?

-

Discuss the Now What Do I Do With Brad and Kerry case study. In doing so, please address the following areas: Identify the problem: Define the problem in human resource terms. Diagnose the cause(s):...

-

1. What role do traits, behaviors, and the situation (contingency theories) play in leadership effectiveness? Summarize what we know about these theories. 2. Describe 3 different situations in which...

-

How do you think learning report writing help you in your future work? Learning report writing now will help me in future as I am going to likely have to write lots of reports. While I know how to...

-

Two lenses, of focal lengths +6.0 cm and -10 cm, are spaced 1.5 cm apart. Locate and describe the image of an object 30 cm in front of the +6.0-cm lens.

-

According to a recent survey, 40% of millennials (those born in the 1980s or 1990s) view themselves more as spenders than savers. The survey also reveals that 75% of millennials view social...

-

In 2016, Muhammad purchased a new computer for $16,000. The computer is used 100% for business. Muhammad did not make a 179 election with respect to the computer. He does not claim any available...

-

In 2016, Muhammad purchased a new computer for $16,000. The computer is used 100% for business. Muhammad did not make a 179 election with respect to the computer. He does not claim any available...

-

Tabitha sells real estate on March 2 for $260,000. The buyer, Ramona, pays the real estate taxes of $5,200 for the calendar year, which is the real estate property tax year. Assume that this is not a...

-

Arnold inc. is considering a proposal to manufacture high end protein bars used as food supplements by body builders. The project requires an upfront investment into equipment of $1.4 million. This...

-

Billy Bob bank has three assets. It has $83 million invested in consumer loans with a 3-year duration, $46 million invested in T-Bonds with a 12-year duration, and $69 million in 6-month (0.5 years)...

-

Ventaz Corp manufactures small windows for back yard sheds. Historically, its demand has ranged from 30 to 50 windows per day with an average of 4646. Alex is one of the production workers and he...

Study smarter with the SolutionInn App