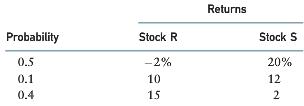

Stocks R and S have the following probability distributions of returns: a. Calculate the expected return for

Question:

Stocks R and S have the following probability distributions of returns:

a. Calculate the expected return for each stock.

b. Calculate the expected return of a portfolio consisting of 50 percent of each stock.

c. Calculate the standard deviation of returns for each stock and for the portfolio. Which stock is considered riskier with respect to total risk?

d. Compute the coefficient of variation for each stock. According to the coefficient of variation, which stock is considered riskier?

e. If you added more stocks at random to the portfolio, which of the following statements most accurately describes what would happen to σp2?

(1) σp would remain constant.

(2) σp would decline to somewhere in the vicinity of 15 percent.

(3) σp would decline to zero if enough stocks were included.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Expected Return

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: