Stocks X and Y have the following probability distributions of expected future returns: a. Calculate the expected

Question:

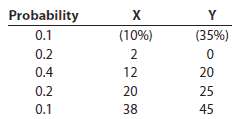

Stocks X and Y have the following probability distributions of expected future returns:

a. Calculate the expected rate of return, rY, for Stock Y (rX = 12%).b. Calculate the standard deviation of expected returns, ??X, for Stock X (??Y = 20.35%). Now calculate the coefficient of variation for Stock Y. Is it possible that most investors will regard Stock Y as being less risky than Stock X?Explain.

Transcribed Image Text:

Probability 0.1 0.2 (10%) (35%) 2 0.4 12 20 0.2 20 25 0.1 38 45

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

a b s X 1220 versus 2035 for Y CV Y 203514 1...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted:

Students also viewed these Accounting questions

-

Stocks A and B have the following probability distributions of expected future returns: Probability A B 0.4 (12%) (25%) 0.2 2 0 0.2 12 19 0.1 22 28 0.1 30 50 Calculate the expected rate of return, ,...

-

Stocks A and B have the following probability distributions of expected future returns: a. Calculate the expected rate of return, r ' B , for Stock B (r ' A = 12%). b. Calculate the standard...

-

Stocks R and S have the following probability distributions of returns: a. Calculate the expected return for each stock. b. Calculate the expected return of a portfolio consisting of 50 percent of...

-

Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail Mar. 1...

-

What are the documentation retention requirements of AS 1215?

-

Refer to Googles statement of cash flows in Appendix A. What are its cash flows from financing activities for the year ended December 31, 2018? List the items and amounts.

-

What Can We All Do to Support Change? (pp. 246249)

-

Please complete the Express Catering, Inc.s 2014 tax return based upon the information provided below. If required information is missing, use reasonable assumptions to fill in the gaps. Ignore any...

-

Dave Krug contributed $2,200 cash along with inventory and land to a new partnership. The inventory had a book value of $2,000 and a market value of $4,400. The land had a book value of $2,600 and a...

-

Bob Hibberd, CGA, was hired by Edgemont Entertainment Installations to prepare its financial statements for April 2014. Using all the ledger balances in the owner's records, Bob put together the...

-

A stock has a required return of 11%, the risk-free rate is 7%, and the market risk premium is 4%. a. What is the stocks beta? b. If the market risk premium increased to 6%, what would happen to the...

-

Suppose you are the money manager of a $4 million investment fund. The fund consists of four stocks with the following investments and betas: If the markets required rate of return is 14% and the...

-

Could this be seen as an innovation? HealthT, a midsize for-profit hospital company, was seeking ways to improve its bottom line. Charlie, its chief operating officer, noted the huge company expense...

-

Year 5% 6% 4 3.546 3.465 5 7% 3.387 3.312 4.329 4.212 4.100 8% 3.993 5.076 4.917 4.767 4.623 Present Value of an Annuity of $1 at Compound Interest 9% 10% 11% 12% 13% 14% 15% 3.240 3.170 3.102 3.037...

-

2. Determine the overturning stability of the cantilever retaining wall shown. The equivalent fluid density is 5.5 kN/m, soil density is 18 kN/m, and the concrete weighs 23.5 kN/m. (5 pts) 2 m 2 m 2...

-

A. For a certain two-dimensional, incompressible flow field the velocity component in the y direction is given by v = 3xy + xy 1. (05 pts) Short answer, what is the condition for this flow field to...

-

Cho0se a hazardous material to cr3ate a pr3sentation on (i.e. sulfuric acid, explosives, used needles, there are many types of hazardous materials) Cr3ate a presentation (P0werPoint, Open0ffice...

-

If det [a b] = c d 2 -2 0 a. det c+1 -1 2a d-2 2 2b -2 calculate:

-

Truck drivers for a hauling company, while loading a desk, found a $100 bill that had fallen out of the desk. They agreed to get it exchanged for small bills and divide the proceeds. En route to the...

-

Controls can be identified based on their function. The functions are preventive, detective, and corrective. A. True B. False

-

A structural formula for cholesterol is shown below. How many chiral carbon atoms are there in the cholesterol molecule? What is the configuration, R or S, of the carbon atom bonded to the OH group?...

-

Complete the table for unit sales, sales price, total revenues, and operating costs excluding depreciation.

-

Complete the depreciation data.

-

Fill in the blanks under Year 4 for the terminal cash flows, and complete the project cash flow line. Discuss working capital. What would have happened if the machinery were sold for less than its...

-

A zero-coupon bond bears a higher interest rate risk than a coupon-paying bond, given other bond characteristics are equal. True False

-

Company management decided to restructure its balance sheet. Current long term debt of 8 mio euros will be increased to 20 mio euros. Interest for the debt is 4%. Borrowed 12 mio euros will used to...

-

Susan loans 10000 to Jim. Jim repays the loan with yearly instalments at the end of each year. Interest is expected to be 5% the first five years, and 10% the last five years. Calculate the...

Study smarter with the SolutionInn App