Suppose you are the money manager of a $4 million investment fund. The fund consists of four

Question:

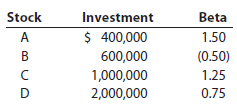

Suppose you are the money manager of a $4 million investment fund. The fund consists of four stocks with the following investments and betas:

If the market’s required rate of return is 14% and the risk-free rate is 6%, what is the fund’s required rate of return?

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: