Strategic analysis of operating income (continuation of 13-3D) Refer to Problem 13-30. Assume that in 2009, Dransfield

Question:

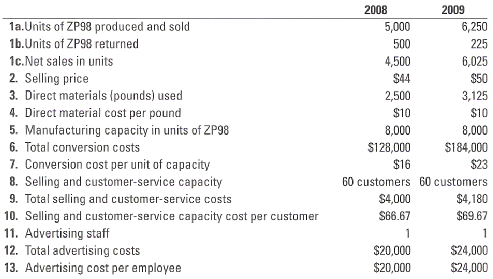

Strategic analysis of operating income (continuation of 13-3D) Refer to Problem 13-30. Assume that in 2009, Dransfield has changed its processes and trained workers to recognize quality problems and fix them before products are finished and shipped to customers. Quality is now at an acceptable level. Cost per pound at materials is about the same as before, but conversion costs are higher, and Dransfield has raised its selling price in line with the market. Sales have increased and returns have decreased. Dransfield’s managers attribute this to higher quality and a price that is still less than Yorunt’s. Information about the current period (2009) and last period (2008) follows.

Conversion costs in each year depend on production capacity defined in terms of ZP98 units that be produced, not the actual units produced. Selling and customer-service costs depend on the number of customers that Dransfield can support, not the actual number of customers it serves. Dransfield has 50 customers in 2008 and 60 customers in 2009. At the start of each year, management uses its discretion to determine the number of advertising staff for the year. Advertising staff and its costs have no direct relationship with the quantity of ZP98 units produced and sold or the number of customers who buy ZP98.

1. Calculate operating income of Dransfield Company for 2008 and 2009.

2. Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2008 to 2009.

3. Comment on your answer in requirement 2. What do these components indicate?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav