On January 10, 2005, Regina Ltd. acquired 60% of the shares of Dakota Ltd. by issuing common

Question:

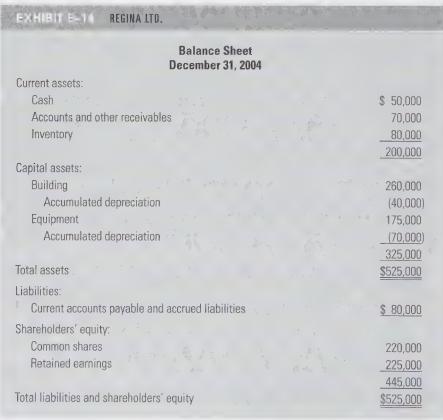

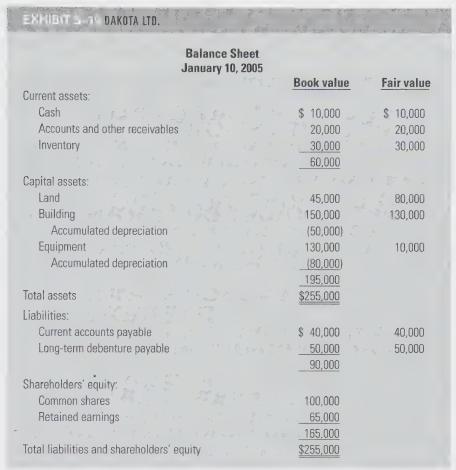

On January 10, 2005, Regina Ltd. acquired 60% of the shares of Dakota Ltd. by issuing common shares valued at $150,000. Prior to the acquisition of Dakota, Regina's balance sheet appeared as shown in Exhibit 5-14. The balance sheet of Dakota Ltd. at the date of acquisition is shown in Exhibit 5-15.

Required:

Prepare a consolidated balance sheet for Regina Ltd., as it would appear immediately following the acquisition of Dakota.

Transcribed Image Text:

EXHIBIT E-14 REGINA LTD. Current assets: Cash Accounts and other receivables Inventory Capital assets: Building Accumulated depreciation Equipment Balance Sheet December 31, 2004 Accumulated depreciation Total assets Liabilities: Current accounts payable and accrued liabilities Shareholders' equity: Common shares Retained earnings Total liabilities and shareholders' equity $ 50,000 70,000 80,000 200,000 260,000 (40,000) 175,000 (70,000) 325,000 $525,000 $ 80,000 220,000 225,000 445,000 $525,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

To prepare a consolidated balance sheet immediately following the acquisition of Dakota Ltd by Regina Ltd we will need to combine the assets liabilities and equity of both companies and make several a...View the full answer

Answered By

Jinah Patricia Padilla

Had an experience as an external auditor in Ernst & Young Philippines and currently a Corporate Accountant in a consultancy company providing manpower to a 5-star hotel in Makati, Philippines, Makati Diamond Residences

5.00+

120+ Reviews

150+ Question Solved

Related Book For

Question Posted:

Students also viewed these Accounting Theory questions

-

Regina Ltd. owns 60% of the common shares of Dakota Ltd., acquired on January 10, 2005. The details of the purchase are given in SSP 5-1, and the trial balances for December 31, 2005, and selected...

-

During 2005, the following transactions occurred between Regina Ltd. and Dakota Ltd. (see SSP51): a. Regina lent $50,000 at 10% interest to Dakota Ltd. on July 1, 2005, for one year. The interest was...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Sally has a spinner game. Here are the rules of the game: The player pays $2 and spins the spinner. If the spinner lands on purple, the player wins $0.50. If the spinner lands on yellow, the player...

-

Liquid nitrogen is a relatively inexpensive material that is often used to perform entertaining low-temperature physics demonstrations. Nitrogen gas liquefies at a temperature of - 346F. Convert this...

-

Where should you point the cork of a champagne bottle when opening it?

-

Calculate the MHR for Machine A from the following data: Electric power: 75 paise per hour Repairs: Rs 530 per annum Steam: 10 paise per hour Rent: Rs 270 per annum Water: 2 paise per hour Running...

-

1. What are some key differences between the JetBlue and West Jet software implementations? 2. What are the advantages and disadvantages of communicating a major project in advance? 3. What are the...

-

Kelley Business Machines provided the following manufacturing costs for the month of March. From the above information, calculate Kelley's total variable costs

-

The balance sheet for Subco Ltd. at July 1, 2007, is shown in Exhibit 5-24 On that date, Parco Ltd. purchased 6,000 common shares of Subco for $312,500 and thereby attained significant influence over...

-

One of your instructors has complied with your urgent request for a letter of recommendation and has given you an enthusiastic endorsement. Regardless of the outcome of your application, you owe...

-

Comparative data on three companies in the same service industry are given below: Required: 1. What advantages are there to breaking down the ROI computation into two separate elements, margin and...

-

The combined weight of the load and the platform is 200 lb, with the center of gravity located at G. If a couple moment of M = 900 lb ft is applied to link AB, determine the angular velocity of links...

-

Due In: 06:48:23 Questions Question 1 (4) O Question 2 (8) Question 2 of 2 A company sold $150,000 bonds and set up a sinking fund that was earning 8.5% compounded semi-annually to retire the bonds...

-

Find the point on the graph of f(x) = x which is closest to the point (6, 27). How close is the closest point?

-

Due to a crash at a railroad crossing, an overpass is to be constructed on an existing level highway. the existing highway has a design speed of 50 mi/h. The overpass structure is to be level,...

-

Finding Bone Density Scores. In Exercises 37-40 assume that a randomly selected subject is given a bone density test. Bone density test scores are normally distributed with a mean of 0 and a standard...

-

From an article on the ages of humans: The claim is = 73.4, and the sample statistics include n = 35, = 69.5, and s = 8.7. Find the value of the test statistic z.

-

A condenser (heat exchanger) brings 1 kg/s water flow at 10 kPa quality 95% to saturated liquid at 10 kPa, as shown in Fig. P4.91. The cooling is done by lake water at 20C that returns to the lake at...

-

What types of investments in common stock normally are accounted for using (a) The equity method and (b) The cost method?

-

How is the ability to significantly influence the operating and financial policies of a company normally demonstrated?

-

When is equity-method reporting considered inappropriate even though sufficient common shares are owned to allow the exercise of significant influence?

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App