Regina Ltd. owns 60% of the common shares of Dakota Ltd., acquired on January 10, 2005. The

Question:

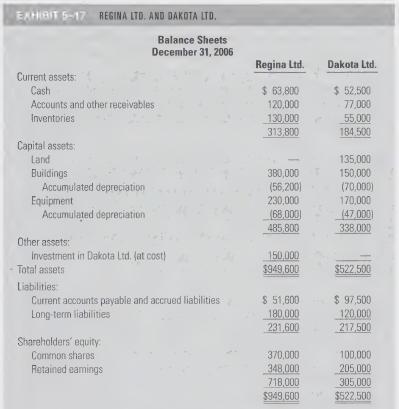

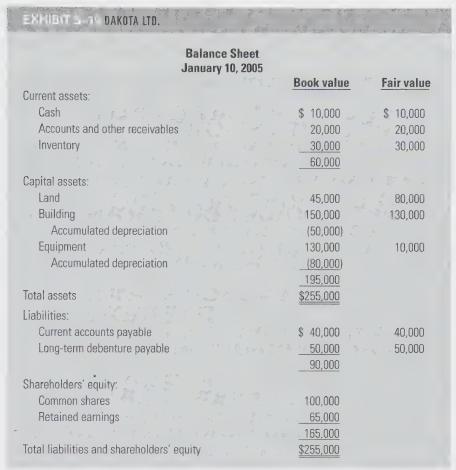

Regina Ltd. owns 60% of the common shares of Dakota Ltd., acquired on January 10, 2005. The details of the purchase are given in SSP 5-1, and the trial balances for December 31, 2005, and selected transactions for 2005 are shown in SSP 5-2. The financial statements of both companies (unconsolidated) at December 31, 2006, are shown in Exhibit 5-17.

Additional Information:

1. At the beginning of 2006, unrealized upstream profits in inventory amounted to $40,000 held in Regina’s inventory (i.e., from upstream sales) and $20,000 in Dakota’s inventory (i.e., downstream).

2. During 2006, Dakota sold inventory to Regina for $160,000 at the normal gross margin. One-half of that amount is still in Regina's inventory at yearend.

3. Late in 2006, Regina sold inventory to Dakota at a special price of $40,000.

All of these goods are still in Dakota’s inventory on December 31, 2006. The cost to Regina of the goods sold to Dakota was $20,000, a 50% gross margin on the selling price.

4. The one-year, $50,000 loan that Regina extended to Dakota on July 1, 2005, was extended for two more years (to July 1, 2008). Simple interest (at 10%)

has been accrued by both companies, but no interest will be paid until the principal is repaid.

Required:

Calculate the following amounts for the year ended December 31, 2006:

a. Non-controlling interest in earnings (i.e., on Regina's consolidated income statement).

b. Non-controlling interest (on Regina’s consolidated balance sheet), December 31, 2006.

c. Regina’s year-end consolidated retained earnings.

Data from SSP1

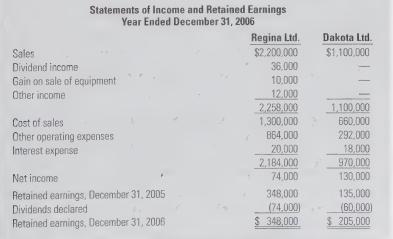

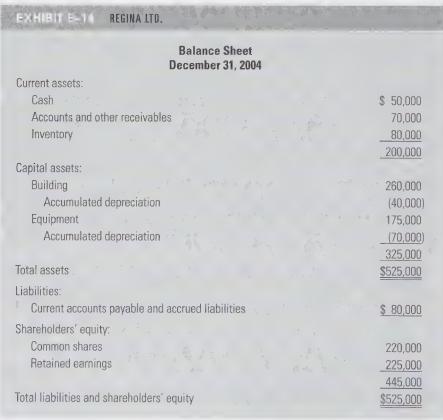

On January 10, 2005, Regina Ltd. acquired 60% of the shares of Dakota Ltd. by issuing common shares valued at $150,000. Prior to the acquisition of Dakota, Regina's balance sheet appeared as shown in Exhibit 5-14. The balance sheet of Dakota Ltd. at the date of acquisition is shown in Exhibit 5-15.

Step by Step Answer: