During 2005, the following transactions occurred between Regina Ltd. and Dakota Ltd. (see SSP51): a. Regina lent

Question:

During 2005, the following transactions occurred between Regina Ltd. and Dakota Ltd. (see SSP5—1):

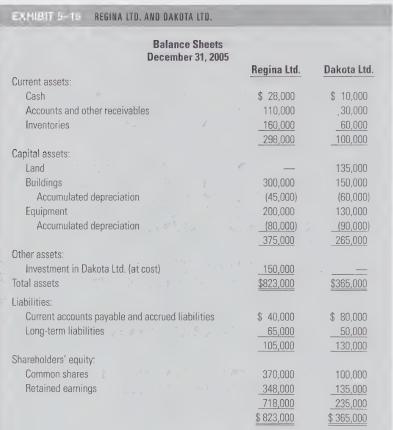

a. Regina lent $50,000 at 10% interest to Dakota Ltd. on July 1, 2005, for one year. The interest was unpaid at December 31, 2005.

b. During 2005, Regina purchased inventory from Dakota at a cost of $400,000; $100,000 oft hat amount was still in Regina’s inventory at the end of 2005.

c. During 2005, Dakota purchased inventory of $200,000 from Regina; $40,000 of that amount was still in Dakota’s inventory at the end of 2005.

Other Information:

d. Dakota’s building and equipment were estimated to have remaining useful lives from January 10, 2005, of 10 and 5 years, respectively. Straight-line depreciation is being used.

e. There has been no impairment of goodwill.

f. No fixed assets were sold or written off during 2005.

The December 31, 2005, separate-entity financial statements for both companies are shown in Exhibit 5-16.

Required:

Prepare the consolidated statement of income and retained earnings and the consolidated balance sheet for Regina Ltd. for the year ended December 31, 2005.

Data from SSP1

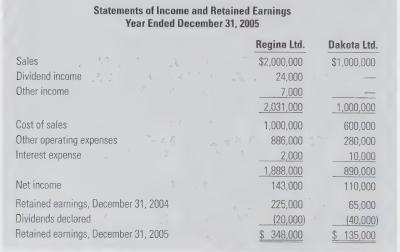

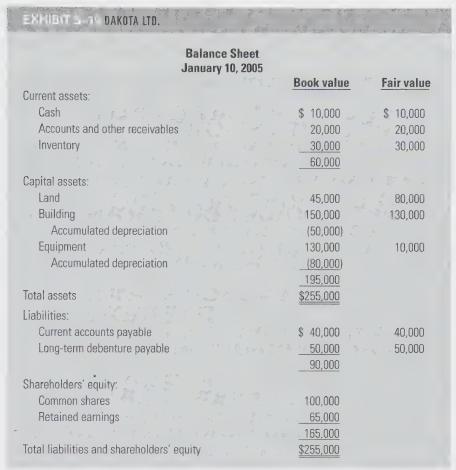

On January 10, 2005, Regina Ltd. acquired 60% of the shares of Dakota Ltd. by issuing common shares valued at $150,000. Prior to the acquisition of Dakota, Regina's balance sheet appeared as shown in Exhibit 5-14. The balance sheet of Dakota Ltd. at the date of acquisition is shown in Exhibit 5-15.

Step by Step Answer: