A farmer and his family, known locally as the Oonchies, had for a number of years carried

Question:

A farmer and his family, known locally as the ‘Oonchies’, had for a number of years carried out a contracted service for many owners of local and surrounding farming properties. For an agreed or contracted price they would sow seeds over many hectares and harvest the resulting crops on behalf of the other farmer. This contract work was included as part of the Oonchies’ family farm revenue and expense, and was part of the total profit or loss of the whole family farming business.

It has been decided to separate and formalise this service business from 1 July 2022 by creating a separate new business: Oonchies Contract Seeding & Harvesting, under the ownership and control of Julie, the daughter. The accounts are to be prepared using the accrual method of accounting.

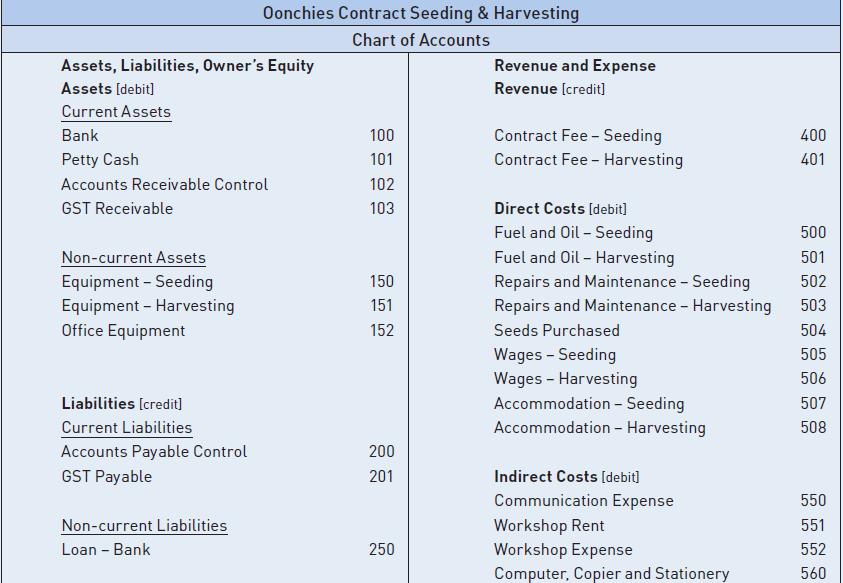

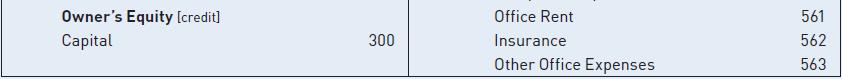

Using the chart of accounts for account allocation (see figure 5.78), you are required to prepare the general journal and specialised journals as required, post to the general ledger and extract a trial balance as at 31 July 2022.

An initial service chart of accounts was prepared with the expectation that it would be expanded over time as the business developed and hopefully grew.

On 1 July the service business commenced with bank $60 000; seeding equipment $50 000; harvesting equipment $80 000 and office equipment $5000. A loan from the bank had been established $30 000.

Transactions for July were:

3 Purchased various stationery supplies from Theodore Newsagency paying with debit card $495 ($450 +

$45 GST).

5 Relevant insurance policies for the year from Contractors Insurance were entered into and remitted funds electronically $3080 ($2800 + $280 GST).

10 Remitted monthly rent for office area $110 ($100 + $10 GST) and workshop area $220 ($200 + $20 GST) to landlord.

10 Emailed tax invoice to Ray Peak for seeding completed today as per contract $22 000 ($20 000 +

$2000 GST).

15 Received direct into bank account from Ray Peak $18 260.

15 Accommodation account settled electronically for contract seeding work $550 ($500 + $50 GST).

15 Received tax invoice from Emerald Fuel Supplies $4455 ($4050 + $405 GST) for diesel and oils received on credit during seeding contract.

16 Tax invoice received on account for parts from Capella Machinery Suppliers required for equipment during recent seeding operations $1837 ($1670 + $167 GST).

20 Tax invoices received on accounts for repair, maintenance and cleaning of all harvesting equipment;

parts from Capella Machinery Suppliers $5137 ($4670 + $467 GST); fuel, oils and lubricants from Emerald Fuel Supplies $2937 ($2670 + $267 GST).

31 Paid by direct transfer the amounts owing to Emerald Fuel Supplies and Capella Machinery Suppliers.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson