Dons business buys three motor vehicles for the business and pays by debit card between 1 July

Question:

Don’s business buys three motor vehicles for the business and pays by debit card between 1 July 2021 and 30 June 2022. As a result of the nature of the business, each motor vehicle is put to a special use.

Motor vehicle 1 was purchased on 1 August 2021 for $47 619 ($43 290 + $4329 GST) with a residual value of $5280 ($4800 + $480 GST). It is depreciated using the straight line method of depreciation at 15% p.a.

Motor vehicle 2 was purchased on 30 November 2021 for $43 780 ($39 800 + $3980 GST) with a residual value of $9790 ($8900 + $890 GST). It is depreciated using the diminishing balance method at 28% p.a.

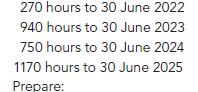

Motor vehicle 3 was purchased on 1 February 2022 for $49 060 ($44 600 + $4460 GST) with a residual value of $2860 ($2600 + $260 GST). It is depreciated using the units of use method based on 8000 hours of usage. (Depreciation cost per hour of use is calculated to two decimal places.) Usage has been:

a a time line for each of the three motor vehicles to 30 June 2023 b depreciation worksheets to 30 June 2025 c an extract income statement for the year ended 30 June 2023, and d an extract balance sheet as at 30 June 2024.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson