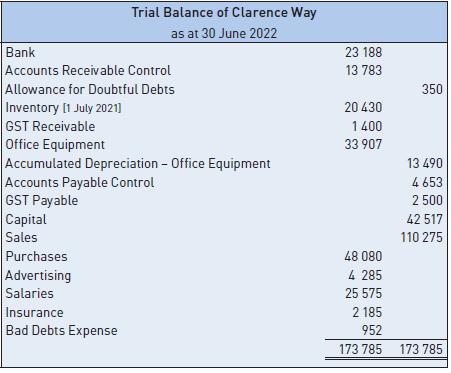

From the following pre-adjustment trial balance of Clarence Way as at 30 June 2022 (figure 11.18) and

Question:

From the following pre-adjustment trial balance of Clarence Way as at 30 June 2022 (figure 11.18) and the balance day adjustment listing, prepare an 8-column worksheet.

Adjustments required as at 30 June 2022 are listed below.

a Closing inventory was $14 685.

b A further $495 ($450 + $45 GST) was written off as a bad debt.

c The allowance for doubtful debts was increased to $850.

d Depreciation of office equipment is 15% p.a.

e Advertising was prepaid $750.

f Salaries have accrued $895.

g Goods $380 were received and included in closing inventory value, but the supplier’s tax invoice has not yet been processed.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson

Question Posted: