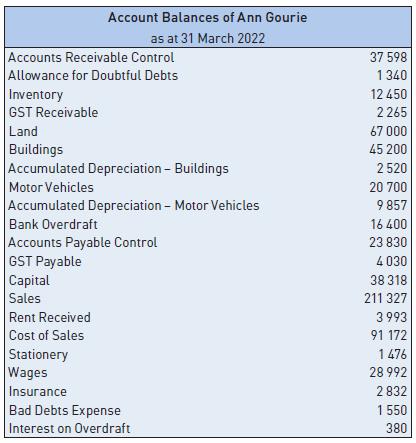

From the pre-adjustment account listing of Ann Gourie, shown in figure 11.20, and the relevant balance day

Question:

From the pre-adjustment account listing of Ann Gourie, shown in figure 11.20, and the relevant balance day adjustments, prepare an 8-column worksheet for the year ended 31 March 2022.

The following adjustments are required.

a A stocktake values inventory at $12 160, indicating it is overstated $290; $319 ($290 + $29 GST).

b Depreciation of buildings at 2.5% p.a.

c Depreciation of motor vehicle at 15% p.a.

d Rent received in advance $750.

e Wages accrued $480.

f Insurance paid in advance $1610.

g Tax invoice for $265 stationery received but tax invoice not yet processed.

h Interest on overdraft accrued $1050.

i Additional bad debt write-off $242 ($220 + $22 GST).

j Allowance for doubtful debts is adjusted to 5% of (adjusted) accounts receivable, rounded to the nearest dollar.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson