R Lachlan closes her accounts on 30 June. In 2021, the July rent received in June is

Question:

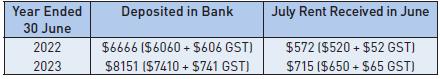

R Lachlan closes her accounts on 30 June. In 2021, the July rent received in June is $490 (see figure 10.106).

Transcribed Image Text:

Year Ended 30 June 2022 2023 Deposited in Bank $6666 1$6060+ $606 GST) $8151 ($7410 + $741 GST) July Rent Received in June $572 ($520 + $52 GST) $715 ($650 + $65 GST)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson

Question Posted:

Students also viewed these Business questions

-

22 A client, a 29-year-old father, has a 3-year-old daughter and wants to buy enough life insurance to provide her father purchases can be invested to produce an annual return of 6%, how much life...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

plash House Equipment is a small store in St. Catharines, Florida, that sells water sport equipment to families and sporting groups in the neighborhood. The business was registered over two years...

-

A small, 2-ha, mostly impervious urban catchment has an average slope of 1.5% and the following average. Horton infiltration parameters: f0 = 4 mm/hr, fc = 1 mm/hr, k = 2.2 hr-1. (Infiltration occurs...

-

Describe the general and task environments and the dimensions of each

-

Lakeside Inc. is considering replacing old production equipment with state-of-the-art technology that will allow production cost savings of $7,500 per month. The new equipment will have a five-year...

-

Calculating Interest Using the Simple Interest Formula. Rebecca wants to buy a new saddle for her horse. The one she wants usually costs $500, but this week it is on sale for $400. She does not have...

-

A firm implementing a diversification strategy has just acquired what it claims is a strategically related target firm but announces that it is not going to change this recently acquired firm in any...

-

Viking Corp. uses a standard cost system to account for the costs of its one products. Material standards are 13 pounds of material at $1.30 per pound and 3 hours of labor at a standard wage rate of...

-

Annual insurance of $5940 ($5400 + $540 GST) was paid at the end of February 2022 for the period March February. Monthly accounts are prepared and standing journals are used; balance date is 30 June....

-

On 2 April 2021, D Cotter invested $125 000 in 4% state government bonds for five years. Interest is paid on 1 April and 1 October. The accounting year ended on 30 June. You are required to prepare...

-

D. D. Ronnelley Co. is a conglomerate firm with operations in publishing and computer software. It is considering whether to accept a new project in computer software. Noting that publishing is a...

-

What is the logical ending point of a sequential game that starts at position (2,8) with player 1 moving first? Show your work. Player 1 Strategy B Strategy A Strategy A Player 2 Strategy B (3,4)...

-

Problem A-6 Income and Retained Earnings Statements Peanut Corporation is a private corporation using ASPE. At December 31, 2017, an analysis of the accounts and discussions with company officials...

-

8.5 Area Between Curves (dy) Calculus-Calculator Allowed Mastery Check #2 Name: Date: Period: For 1-2, find the area of the region bounded by the following curves. Show the integral set up with...

-

Your company has a travel policy that reimburses employees for the "ordinary and necessary" costs of business travel. Employees often mix a business trip with pleasure by either extending the time at...

-

Simulation A: 1 Diameter 600 mm 2 Focal Length 1800 mm 3 F/D Ratio 3 4 Eyepieces 30 m 5 Barlow? N 6 Celestial Sights M42 - M31 - M51 Simulation B: 1 Diameter 150 mm 2 Focal Length 1800 mm 3 F/D Ratio...

-

What sort of information is critical to the global firm that is not often necessary for a firm operating in the home market only? Detail the sorts of information critical to the global firm.

-

Cable Corporation is 60% owned by Anna and 40% owned by Jim, who are unrelated. It has noncash assets, which it sells to an unrelated purchaser for $100,000 in cash and $900,000 in installment...

-

Cash sales of $2079 have caused the worksheet to be out of balance because a mistake was made when the figures were put into the worksheet. The bookkeeper accidentally increased the cash account by...

-

Advantage Tennis Coaching, a business owned by sole trader Nicholas Cash, had the following assets and liabilities as at the financial years ended 30 June 2016 and 30 June 2017 as shown. Required a....

-

The following business transactions and business events relate to Danielle Chans Business Consultancy Pty Ltd. Required a. Prepare a worksheet for the business transactions for June. b. Enter these...

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App