D. D. Ronnelley Co. is a conglomerate firm with operations in publishing and computer software. It is

Question:

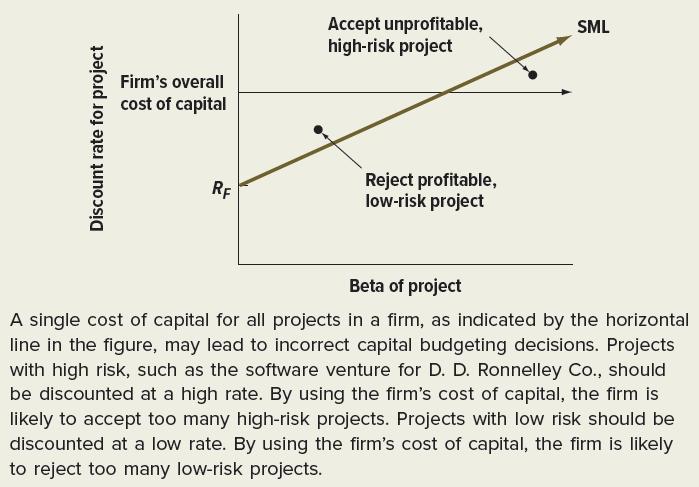

D. D. Ronnelley Co. is a conglomerate firm with operations in publishing and computer software. It is considering whether to accept a new project in computer software. Noting that publishing is a low-beta business while computer software is a high-beta business, the conglomerate firm realizes it should discount the project at a rate commensurate with the risk of computer software. Instead, if all projects in D. D. Ronnelley Co. were discounted at the same rate, a bias would result. The firm would accept too many high-risk projects (software ventures) and reject too many low-risk projects (books and magazines). This point is illustrated in Figure 13.5. Figure 13.5 Relationship between the Firm’s Cost of Capital and the Security Market Line (SML)

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe