Stanmore Stationery is preparing a quarterly budget covering the 3 months ending 30 June 2020. The information

Question:

Stanmore Stationery is preparing a quarterly budget covering the 3 months ending 30 June 2020.

The information available for the budget is as follows:

1. Cash sales represent 30% of all monthly sales; 50% of all credit sales are collected in the month of sale and the remainder are collected in the month following the sale.

2. Inventory purchases that are made on account equal 60% of the sales forecast for that month;

40% of the purchases are paid for in the month of purchase, and 60% are paid for in the following month.

3. Ending inventory on 30 June 2020 is projected to be $34 600.

4. Equipment purchases at the end of June are budgeted at $57 000.

5. Other quarterly expenses are budgeted as follows: electricity, $8800; rent, $33 000; salaries,

$92 000. These expenses are paid when incurred.

6. Depreciation for the quarter is $8400.

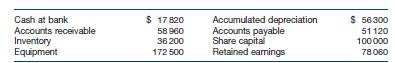

7. The balance sheet as at 1 April 2020 will have the following account balances.

8. Budgeted sales are: April, $142 000; May, $136 000; June, $132 000.

Required

(a) Prepare a budgeted income statement and balance sheet for the quarter ending 30 June 2020.

Ignore income tax.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie