Cue and Rest are partners sharing profits and losses in the ratio of 2:1. They are allowed

Question:

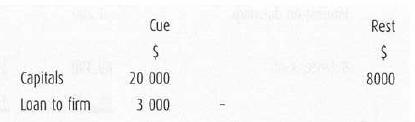

Cue and Rest are partners sharing profits and losses in the ratio of 2:1. They are allowed interest at 10% per annum on capitals and loans to the partnership.

Other information is as follows.

The partnership has made a net profit for the year of $40 000.

How much is Cue's total share of the profit?

A. $24 800

B. $25 100

C. $26 800

D. $27 100

Transcribed Image Text:

Capitals Loan to firm Cue $ 20 000 3 000 Rest $ 8000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

To calculate Cues total share of the profit we need to consider the following components Interest on ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Develop an External Factor Evaluation (EFE) Matrix for DSG (Worth 3 points) The EFE Matrix should replicate the sample provided. Be sure to have at least 6 Opportunities and 6 Threats. Ensure that...

-

Overview The Snack Shop, a student-run convenience store was located in the academic building housing the Business Department of a small US College campus. The store ran under the umbrella of a...

-

A, B and C are in partnership sharing profits and losses in the ratio of 50 : 25 : 25 per cent. Each partner receives a salary of 40,000 and interest on opening capital balance of 15 per cent per...

-

Complete the attached SWOT Worksheet using information from the Cotopaxi case. Use your SWOT Worksheet to help you answer the question: What should Davis Smith/Cotopaxi do (for company...

-

Copperhead, Inc., has the following stockholders equity: That company has passed its preferred dividends for three years including the current year. Compute the book value per share of the companys...

-

What are the major advantages and disadvantages of a standard cost system?

-

How do high-learning and low-learning products differ?

-

1. What steps should U.S.-based franchisors take when establishing outlets in foreign countries? 2. Describe the opportunities and the challenges franchisors face when entering emerging markets such...

-

Question 4 [27] FINANCIAL STATEMENTS, INCORPORATING ADJUSTMENTS Mr Byte is the owner of Transcend Traders, a computer shop that has been trading for the past 5 years. Transcend Traders uses the...

-

The facts are as in exercise 1, but Tee and Leaf have a partnership agreement which includes the following terms. 1. Leef is to be credited with interest on his loan to the partnership at the rate of...

-

The following trial balance has been extracted from the books of Bell and Binn at 30 April 2004. Further information 1. Stock at 30 April 2004 is valued at $27 000. 2. Bell is to be credited with...

-

Describe the management process and how it operates.

-

Questions for scen ario one Why do you think you feel uncomfortable about this new situation? Could you have avoided this situation in the first place? What is the best course of action you can take?...

-

Draw a current state map of Ford Manufacturing (One family/ product/service flow). Give a brief explanation of the current state and the related issues with it. create your own action plan to show...

-

THE SHRM Learning system provides several motivation theories that increase engagement. Which of the motivation theories most aligns your real world experience as personally motivating you and why?...

-

Leadership and management are two distinct yet complementary concepts within organizations. Leadership is about inspiring and influencing others towards a shared vision or goal, often focusing on...

-

Analyse the need and want(s) that led you to research products or services that would address the state of your imbalance. 2. Examine the internal and external sources of information by including...

-

Calculate the force of gravity that Earth and the Sun exert on each other (Sun's mass is 2.0 10 30 kg; average Earth-Sun distance is 1.5 10 11 m).

-

Calculate the change in entropy when 100 kJ of energy is transferred reversibly and isothermally as heat to a large block of copper at (i) 0 C, (ii) 50 C.

-

Describe three kinds of decisions that can be supported using Predix . What is the value to the firm of each of those decisions? Explain.

-

To what extent is GE becoming a software company? Explain your answer.

-

Do you think GE will become one of the top 10 U.S. software companies? Why or why not?

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App