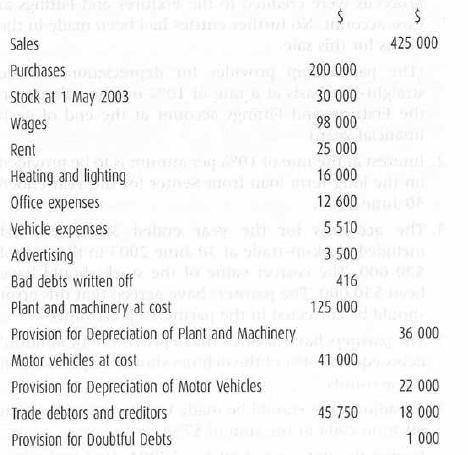

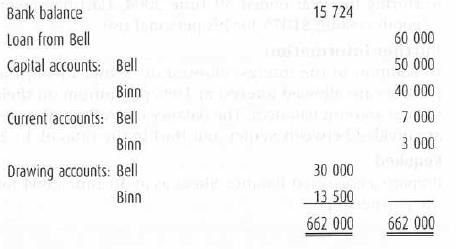

The following trial balance has been extracted from the books of Bell and Binn at 30 April

Question:

The following trial balance has been extracted from the books of Bell and Binn at 30 April 2004.

Further information

1. Stock at 30 April 2004 is valued at $27 000.

2. Bell is to be credited with interest on the loan at a rate of 10% per annum.

3. The bank reconciliation shows that bank interest of $314 and bank charges of $860 have been debited in the bank statements. These amounts have not been entered in the cash book.

4. At 30 April 2004, rent of $1500 and advertising of $2000 have been paid in advance.

5. Depreciation is to be provided as follows.

(i) Plant and machinery: 10% per annum on cost

(ii) Motor vehicles: 20% per annum on their written down values

6. The partners are to be charged interest on drawings and allowed interest on capitals at a rate of 10% per annum.

7. Partnership salaries are to be allowed as follows: Bell $10 000 per annum; Binn $8000 per annum.

8. The balance of profits and losses is to be shared as follows: Bell 3/5; Binn 2/5.

Required

(a) Prepare the partnership Trading, Profit and Loss and Appropriation Accounts for the year ended 30 April 2004

(b) Prepare the partners Current accounts for the year ended 30 April 2004.

(c) Prepare the Balance Sheet at 30 April 2004.

Step by Step Answer: