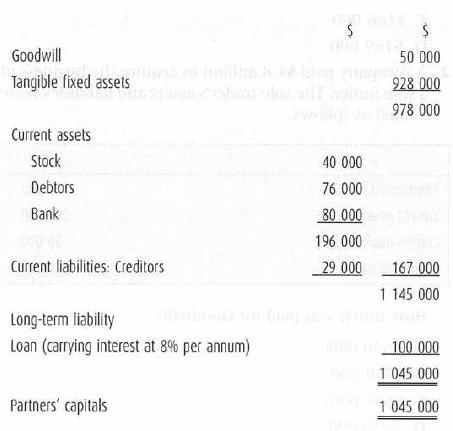

The following is the Balance Sheet of the Erchetai partnership at 30 April 2002. On 30 April

Question:

The following is the Balance Sheet of the Erchetai partnership at 30 April 2002.

On 30 April 2002, Istaimy plc acquired the business of the Erchetai partnership. The following matters were taken into consideration in fixing the terms of the acquisition.

1. No depreciation had been provided on freehold buildings. It was agreed that a provision of $128 000 should have been made.

2. On 1 April 2002 Erchetai had purchased a machine. The cost was $60 000. $20 000 was paid immediately. The balance is payable by four equal instalments on 1 May, 1 June, 1 July and 1 August, together with interest at the rate of 12% per annum. Only the initial payment of $20 000 had been recorded in the partnership's books. It was Erchetai's policy to depreciate machinery at the rate of 15% per annum on cost, and to provide for a full year's depreciation in the year of purchase.

3. A debtor owing $5000 at 30 April 2002 has since become bankrupt. Erchetai has been advised that a dividend of 20 per cent will be paid.

4. Stock has been valued at cost. Investigation shows that if stock had been valued at net realisable value it would have been valued at $28 000. If separate valuation at the lower of cost and net realisable value had been applied to each item of stock it would have been valued at $30 000.

The purchase consideration was satisfied as follows:

- The long-term loan was satisfied by the issue of $80 of 10% debenture stock 2008/10 for every $100 of the loan.

- The partners were issued, for every $50.00 of capital, with:

3 x 8 percent preference shares at $1.20 per share, and 3 ordinary shares of $10.00 each at $12.50.

Required

Prepare the journal entry to record the purchase of the partnership business in the books of Istaimy plc. Your answer should include cash transactions.

Step by Step Answer: