9.1 Project Analysis. Assume that you are evaluating the following three mutually exclusive projects: A. Complete the

Question:

9.1 Project Analysis. Assume that you are evaluating the following three mutually exclusive projects:

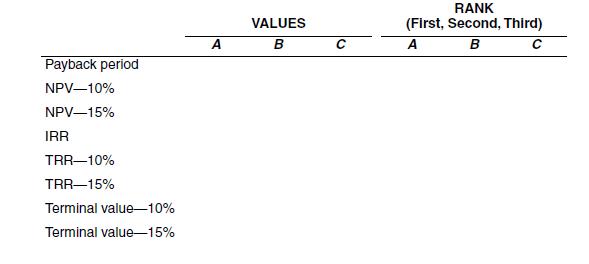

A. Complete the following analyses. (For the last two lines, Terminal Value, please write in the dollar amount of the terminal value.):

B. Compare and explain the conflicting rankings of the NPVs and TRRs versus the IRRs.

C. Using different discount rates, is it possible to get different rankings within the NPV calculation? Why or why not?

D. If 10 percent is the required return, which project is preferred?

E. Which is the fairer representation of these two projects, TRR or IRR? Why?

A B C Cost $3,400 $3,400 $3,400 Year 1 0 1,870 1,020 Year 2 0 1,870 1,700 Year 3 6,460 1,870 3,284 B. Compare and explain the conflicting rankings of the NPVs and TRRs versus the IRRs.

A B C Cost $3,400 $3,400 $3,400 Year 1 0 1,870 1,020 Year 2 0 1,870 1,700 Year 3 6,460 1,870 3,284 B. Compare and explain the conflicting rankings of the NPVs and TRRs versus the IRRs.

C. Using different discount rates, is it possible to get different rankings within the NPV calculation? Why or why not?

D. If 10 percent is the required return, which project is preferred?

E. Which is the fairer representation of these two projects, TRR or IRR? Why?

Step by Step Answer:

Finance And Accounting For Nonfinancial Managers

ISBN: 978-0071364331

1st Edition

Authors: Samuel C Weaver ,J Fred Weston