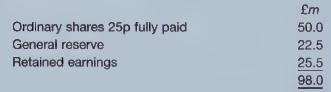

Devonian plc is expected to have the following equity as at 31 December this year: During this

Question:

Devonian plc is expected to have the following equity as at 31 December this year:

During this year, the operating profit (profit before interest and taxation) is estimated at £40 million and it is expected that this will increase by 25 per cent during the forthcoming year. The business is listed on the London Stock Exchange and the share price as at 31 December this year is expected to be £2.10.

The business wishes to raise £72 million to enable it to re-equip one of its factories and is considering two possible financing options. The first option is to make a one for-

five rights issue at a discount price of £1.80 per share on 31 December this year.

The second option is to borrow long-term at an interest rate of 10 per cent a year on 31 December this year. If the first option is taken, it is expected that the price/earnings (P/E) ratio will remain the same for the forthcoming year. If the second option is taken, it is estimated that the P/E ratio will fall by 10 per cent of its value by the end of next year.

Assume a tax rate of 30 per cent.

Required:

(a) Assuming a rights issue of shares is made, calculate:

(i) the theoretical ex-rights price of an ordinary share in Devonian plc; and (ii) the value of the rights for each original ordinary share.

(b) Calculate the price of an ordinary share in Devonian plc in one year’s time assuming:

(i) a rights issue is made; and (ii) the required funds are borrowed.

Comment on your findings.

(c) Explain why rights issues are usually made at a discount.

(d) From the business’s viewpoint, how critical is the pricing of a rights issue likely to be?

Step by Step Answer: