Have a go at preparing the trade payables budget for Vierra Popova Ltd for the six months

Question:

Have a go at preparing the trade payables budget for Vierra Popova Ltd for the six months from July to December (see Activity 9.8).

Data from Activity 9.8

Have a go at preparing the trade receivables budget for Vierra Popova Ltd for the six months from July to December (see Activity 9.7 and Example 9.2).

Data from Example 9.2

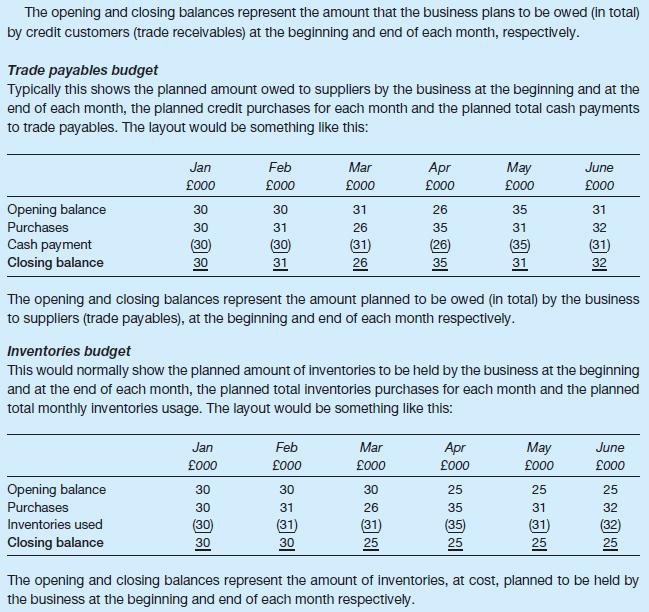

To illustrate some of the other budgets, we shall continue to use the example of Vierra Popova Ltd that we considered in Example9.1. To the information given there, we need to add the fact that the inventories balance at 1 January was £30,000.

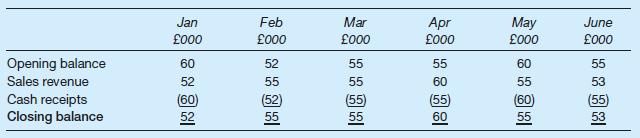

Trade receivables budget

This would normally show the planned amount owed to the business by credit customers at the beginning and at the end of each month, the planned total credit sales revenue for each month and the planned total cash receipts from credit customers (trade receivables). The layout would be something like this:

Data from Activity 9.7

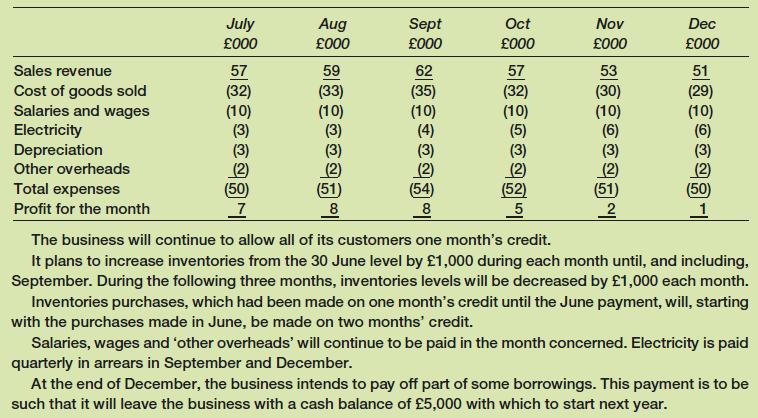

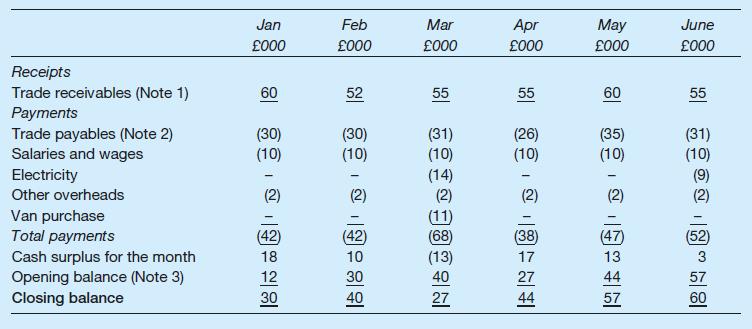

Vierra Popova Ltd (Example 9.1) now wishes to prepare its cash budget for the second six months of the year. The budgeted income statements for each month of the second half of the year are as follows:

Prepare the cash budget for the six months ending in December. (Remember that any information you need that relates to the first six months of the year, including the cash balance that is expected to be brought forward on 1 July, is given in Example 9.1.)

Data from Example 9.1

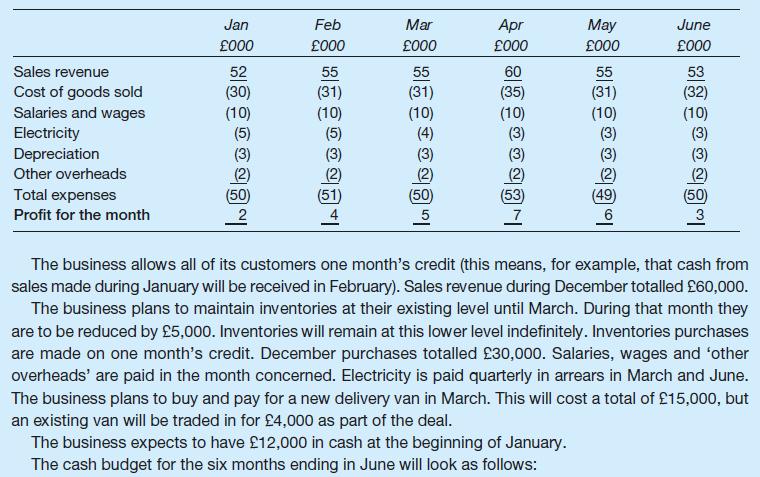

Vierra Popova Ltd is a wholesale business. The budgeted income statements for each of the next six months are as follows:

Notes:

1. The cash receipts from trade receivables lag a month behind sales because customers are given a month in which to pay for their purchases. So, December sales will be paid for in January and so on.

2. For inventories to remain constant at the end of each month, the business must replace exactly the amount that has been used. In most months, the purchases of inventories will, therefore, equal the cost of goods sold. During March, however, the business plans to reduce its inventories by £5,000. This means that inventories purchases will be lower than inventories usage in that month. The payments for inventories purchases lag a month behind purchases because the business expects to be allowed a month to pay for what it buys.

3. Each month’s cash balance is the previous month’s figure plus the cash surplus (or minus the cash deficit) for the current month. The balance at the start of January is £12,000 according to the information provided just before the cash budget (above).

4. Depreciation does not give rise to a cash payment. In the context of profit measurement (in the income statement), depreciation is a very important aspect. Here, however, we are interested only in cash.

Step by Step Answer:

Accounting And Finance For Non Specialists

ISBN: 9781292334691

12th Edition

Authors: Peter Atrill, Eddie McLaney