Also, prepare the adjusting entry as of December 31 to record the accrued vacation pay as of

Question:

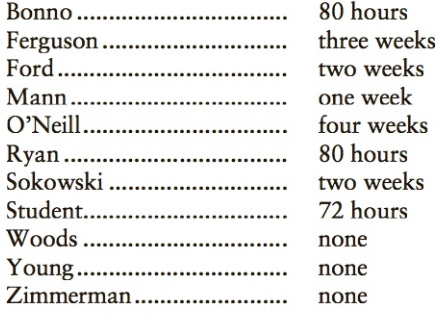

As of December 31, the vacation time earned but not used by each em- ployee is listed here.

Transcribed Image Text:

Bonno... Ferguson. Ford.. Mann.. 80 hours three weeks two weeks one week four weeks O'Neill. Ryan.. Sokowski 80 hours two weeks 72 hours Student... Woods .. none Young... Zimmerman. none none JOURNAL POST. DATE DESCRIPTION DEBIT CREDIT REF.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (16 reviews)

Bonno 140800 Ferguson 337500 Ford 128000 Mann 67500 ONeill 46153...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

1. The total payroll tax expense incurred by the employer on salaries and wages paid during the quarter ended December 31 was.....................$ 2. The total payroll tax expense incurred by the...

-

Guitar Universe, Inc., is a popular source of musical instruments for professional and amateur musicians. The companys accountants make necessary adjusting entire monthly, and they make all closing...

-

Read ALL instructions before getting started! ABC Corporation is a new company that buys and sells office supplies. Business began on January 1, 2012. Given on the first two tabs are ABC's 12/31/12...

-

Medallion and RIEF (Renaissance Institutional Equity Fund) are both managed by Renaissance Technologies. How do they differ in terms of asset classes, dollar capacity, average holding period of each...

-

In 2015, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? a) Her AMT base is $100,000, all...

-

Indicate whether the employer or employee or both incur each of following (a) FICA taxes; (b) FUTA taxes; (c) SUTA taxes; and (d) withheld income taxes.

-

Give an example of a case in which project management could be important in your personal life. Explain why, as well as how and why you might organize such a project. LO6

-

Western Wood Products Company prepared the following factory overhead cost budget for the Press Department for February 2010, during which it expected to require 10,000 hours of productive capacity...

-

Rogers Company signs a five-year capital lease with Packer Company for office equipment. The annual year-end lease payment is $10,000, and the interest rate is 8%. (Table B.1, Table B.2, Table B.3,...

-

Enter a lookup function in cell E5 that returns the tax deduction amount for the number of dependents listed in the cell C5. Use the table in range H13:I17 to complete the function. The maximum...

-

The form on page 6-69 shows the amounts that appear in the Earnings to Date column of the employees earnings records for 10 full-time and part-time workers in Ranger Company. These amounts represent...

-

State briefly the rules of debit and credit as applied to asset accounts and as applied to liability and owners equity accounts.

-

Kettle Snacks just received an order to produce 16,000 single- serving bags of gourmet, fancy- cut, low- fat potato chips. The order will require 16 preparation hours and 30 cooking and draining...

-

As shown on the attached chart, what is the approximate current 7-year spread premium for Kellogg Bonds? 25 Basis Points 75 Basis Points 200 Basis Points AUS Treasury Actives Curve X-ads Tenor...

-

A pharmaceutical company claims to have invented a new pill to aid weight loss. They claim that people taking these pills will lose more weight than people not taking them. A total of twenty people...

-

Let U = {a, b, c, d, e, f} be the universal set and let A = {a, b, c, d, e, f}. Write the set A. Remember to use correct set notation. Provide your answer below: A=

-

Produce a poster series of three (3) A3 sized posters on creativity in the early years. As a collective the poster series must articulate the importance of aesthetics and creativity for young...

-

Find the second derivative of the function. g(x) = ex In(x) g"(x) = Need Help? Read It

-

Show that the given signal is a solution of the difference equation. Then find the general solution of that difference equation. Yk = k; yk +2 +4yk+1-5yk = 8 + 12k

-

Juanita owns a home in Richardson, TX. She purchases a Homeowners Policy (HO-3) from Farm State Ins. Co. The policy provides $100,000 in liability coverage (coverage E) and $5,000 in Med Pay coverage...

-

Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee. Payroll Period W=Weekly No....

-

Ernesto Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee. Payroll Period W=Weekly...

-

Which of the following types of payments are taxable under FUTA? a. Commissions as compensation for covered employment. b. Christmas gifts of nominal value. c. Courtesy discounts to employees. d....

-

Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account...

-

Your company is considering the purchase of a fleet of cars for $195,000. It can borrow at 6%. The cars will be used for four years. At the end of four years they will be worthless. You call a...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

Study smarter with the SolutionInn App