C. George (Controls) Ltd manufactures a thermostat that can be used in a range of kitchen appliances.

Question:

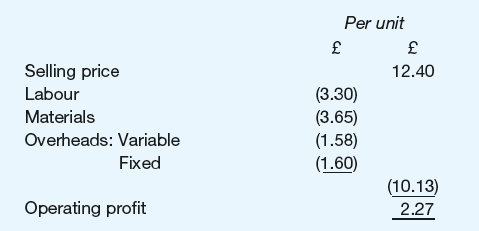

The following data, based on the current level of output, have been prepared in respect of the product:

Although the existing equipment is expected to last for a further four years before it is sold for an estimated £40,000, the business has recently been considering purchasing new equipment that would completely automate much of the production process. The new equipment would cost £670,000 and would have an expected life of four years, at the end of which it would be sold for an estimated £70,000. If the new equipment is purchased, the old equipment could be sold for £150,000 immediately.

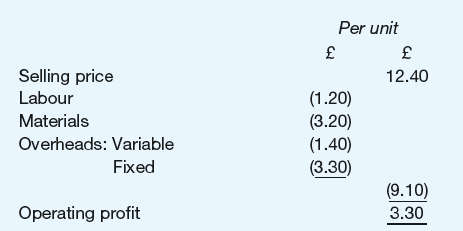

The assistant to the business€™s accountant has prepared a report to help assess the viability of the proposed change, which includes the following data:

Depreciation charges will increase by £85,000 a year as a result of purchasing the new machinery; however, other fixed costs are not expected to change. In the report the assistant wrote:

The figures shown above that relate to the proposed change are based on the current level of output and take account of a depreciation charge of £150,000 a year in respect of the new equipment. The effect of purchasing the new equipment will be to increase the operating profit to sales revenue ratio from 18.3 per cent to 26.6 per cent. In addition, the purchase of the new equipment will enable us to reduce our inventories level immediately by £130,000.

In view of these facts, I recommend purchase of the new equipment.

The business has a cost of capital of 12 per cent. Ignore taxation.

Required:

(a) Prepare a statement of the incremental cash flows arising from the purchase of the new equipment.

(b) Calculate the net present value of the proposed purchase of new equipment.

(c) State, with reasons, whether the business should purchase the new equipment.

(d) Explain why cash flow, rather than profit, projections are used to assess the viability of proposed capital expenditure projects.

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Accounting and Finance An Introduction

ISBN: 978-1292088297

8th edition

Authors: Peter Atrill, Eddie McLaney