On 1 February 19_8 Mr and Mrs Shah bought an existing eating house to convert it to

Question:

On 1 February 19_8 Mr and Mrs Shah bought an existing eating house to convert

it to an Indian restaurant. The initial capital of £50 000 banked on 1 February

was used the next day to make the following payments: £40 000 for purchase of

premises, £4 000 for furniture and fittings and £6 000 for conversion costs.

Customers were required to settle bills by cash or cheque after the meal, and

weekly credit accounts were opened for two nearby offices who entertained their

guests at the restaurant on a regular basis. A 3 per cent cash discount was

offered for payment within one week. All cash and cheques were banked daily.

All payments, except petty cash expenditures, were made by cheque. Mr Shah

paid his suppliers a week following delivery, thereby obtaining a 2 per cent cash

discount from each.

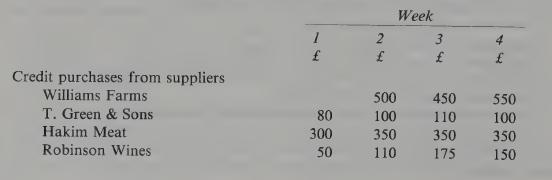

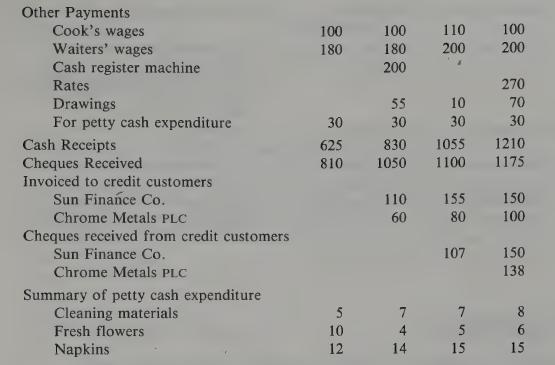

The following is a week-by-week summary of the first month’s trading:

The owners employ you to maintain a full double-entry bookkeeping system.

Write up the books for the first month’s trading.

(1) Since the information given is on a week-by-week basis it is best to write up

the books also on a weekly basis.

(2) Classify the £6 000 conversion costs as premises, the £200 cash register as

fixtures and fittings.

(3) The petty cash expenditures for cleaning materials, fresh flowers, and napkins

should be grouped into one account called general expenses.

(4) In your discount calculations round off to the nearest whole £.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir