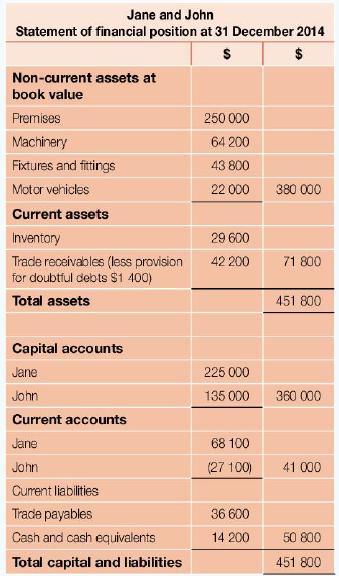

Jane and John are in partnership, sharing profits and losses in the ratio 5:3, respectively. They decided

Question:

Jane and John are in partnership, sharing profits and losses in the ratio 5:3, respectively.

They decided to dissolve the partnership on 31 December 2014.

Additional information:

• At dissolution the premises were sold for $256,000, the machinery for $59,200, the fixtures and fittings for $38,400. The motor vehicles were taken over by the partners: Jane $9000 and John $11,000.

• The inventory was sold for $26,400.

• The trade receivables paid $39,800 and the trade payables are paid on $32,600.

• The cost of dissolution was $8000.

Required

Prepare the ledger accounts to record the dissolution.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone

Question Posted: