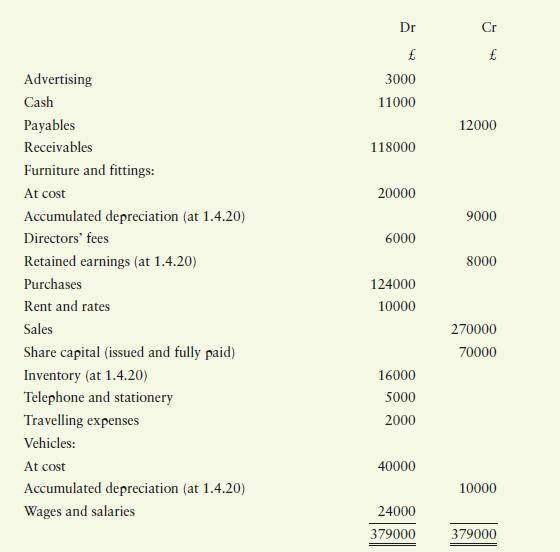

The following balances have been extracted from the books of Jim Ltd as at 31 March 2020:

Question:

The following balances have been extracted from the books of Jim Ltd as at 31 March 2020:

Additional information

1. Inventory at 31 March 2020 was valued at £14,000.

2. Furniture and fittings and vehicles are depreciated at a rate of 15 percent and 25 percent, respectively, on cost.

3. Corporation tax owing at 31 March 2020 is estimated to be £25,000.

4. A dividend of 40p per share is proposed.

5. The company’s authorised share capital is £100,000 of £1 ordinary shares.

Required

1. Prepare Jim Ltd’s trading and statement of profit or loss and statement of retained earnings for the year to 31 March 2020 and a statement of financial position as at that date.

2. Why would the business not necessarily be worth its net assets value as at 31 March 2020?

Step by Step Answer: