Frangipani Fragrances currently reimburses its 40 salespeople for the use of their personal cars for the business.

Question:

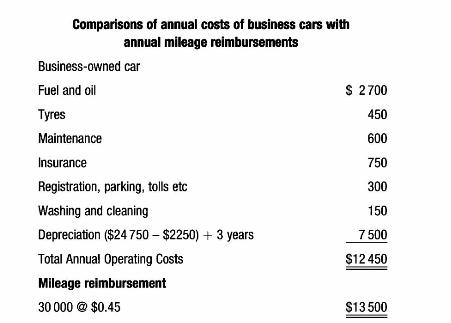

Frangipani Fragrances currently reimburses its 40 salespeople for the use of their personal cars for the business. Cassandra, business sales manager, has been trying without success to persuade the business to buy a number of cars to be used by her sales staff in the future. Cassandra's assistant has estimated the costs of operating business-owned cars at an expected 30000 kilometres per year on the basis of accounting records for cars used by business executives. The cost estimates in comparison with average mileage reimbursements are below.

The business is currently paying \(\$ 0.45\) per kilometre on an average of 30000 kilometres driven by each salesperson, and the sales manager believes that considerable savings are possible if the business buys cars to be used by sales personnel. She was recently questioned by Kelvin Lawry, the business' chief financial officer, about high costs in her department. She responded that the business could save \(\$ 42000\) per year by buying cars for the sales staff instead of paying that high mileage rate. She had the annual cost comparison to show him if he challenged her on her statement.

At previous meetings, Cassandra had emphasised that a fleet of clean new cars with the business name on them would improve the business image and increase brand-name recognition, both factors leading to increased future sales. She emphasised that this would be especially so given that many sales routes would be lengthened next year to an average of 36000 kilometres per year and would include areas where the business' products had not previously been sold. Cassandra had repeatedly been told that it would be too expensive for the business to buy cars for the sales staff to use, which is why she had instructed her assistant to prepare the cost comparison shown above.

Required:

a Assume that Frangipani Fragrances has a cost of capital of 10 per cent and that you are the business' financial manager. Write the sales manager a brief memo explaining why it would not be desirable for the business to buy cars for her staff in spite of the annual costs estimated by her assistant. Ignore the lengthening of sales routes and the possibility that sales might be increased.

b Now assume that you are the sales manager. Write the CFO a memo describing how the analysis in

(a) would be affected by: (i) longer sales routes, and (ii) possible sales increases due to an improved business image and name recognition.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons